Japan’s exports pick up pace, give economy momentum in rough markets

posted by AJOT | Jun 18 2013 at 08:00 PM | International Trade

Japan's exports rose in May at the fastest annual rate in more than two years with the help of a weak yen and a moderate pick-up in global demand, boding well for the government's efforts to steer the economy through market turbulence.

The faster-than-expected rise is welcome news for Prime Minister Shinzo Abe after recent a sell-off in stocks, volatility in bonds and a spike in the yen raised concerns about the outlook for his economic recipe of radical monetary easing, fiscal stimulus and pro-growth policies.

Calculated in yen, exports rose 10.1 percent in the year to May, compared with analysts' 6.5 percent forecast in a Reuters poll, rising for a third straight month and at the fastest pace since December 2010, finance ministry data showed.

The weaker yen also boosted the energy-heavy import bill, which rose 10 percent from a year earlier, leaving Japan with a 994 billion yen ($10.4 billion) trade deficit, but economists said the net effect of the yen's retreat remained positive.

They argue that higher export revenues translate into higher exporter earnings and consequently more investment and workers' bonuses, with indirect benefits for the broader economy even if costlier imports also affect businesses and consumers.

Given the blue-chip index in Japan's stock market is heavy on exporters, Abe's government also hopes that the export windfall will shore up general business and consumer confidence.

Keeping general sentiment buoyant is seen as crucial to spurring consumption and investment as policymakers aim to pull Japan out of its liquidity trap and end nearly two decades of economic stagnation and deflation.

"It is obvious (Abe's) policy mix played a big role in weakening the yen, which helped export value, earnings and the

stock market," said Takeshi Minami, chief economist at Norinchukin Research Institute.

Export Momentum to Pick Up

That is why analysts are not too concerned about the modest pace of recovery in export volumes, which remained 4.8 percent below year-ago levels, though the gap continued to narrow from a 5.3 percent drop in April and a 15.8 percent slump in February.

The yen lost over a fifth of its value against the dollar in the 12 months to the end of May and even after recent gains remains about 17 percent below year-ago rates at around 95 to the dollar, a level many Japanese companies say they feel comfortable with.

That and improved demand from Japan's top export markets make analysts optimistic that exports will continue to recover and the trade gap will narrow.

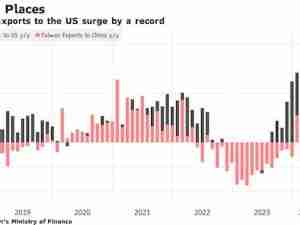

Exports to the United States rose 16.3 percent from a year earlier, the fastest pace since May 2012, while shipments to China rose 8.3 percent, the quickest pace since February 2011.

"We can certainly say that exports are headed in the right direction," said Shuji Tonouchi, senior fixed income strategist at Mitsubishi UFJ Morgan Stanley Securities.

"The breakdown shows that export volumes are still a little weak. Demand from the United States is doing well and Japan's trade deficit should eventually shrink."

The yen's retreat, combined with high costs of fuel Japan must import while its nuclear reactors remain idle since the

Fukushima disaster in March 2011, has kept Japan's trade in deficit for 11 straight months now.

At the same time, it has helped bolster Japan's hefty surplus on its overseas investment income, bringing its current account - the broad measure of trade flows and other transfers - back into the black.

Japanese financial markets have seen extreme volatility over the past few weeks on worries about reduced stimulus from the U.S. Federal Reserve, which caused the yen to bounce from a 4-1/2-year low against the dollar.

An underwhelming package of structural reforms unveiled by the Japanese government recently and concerns about slowing growth in China have also contributed to the tumult in markets.

With the heavy artillery of fiscal