Maersk Line, part of Danish oil and shipping group A.P. Moller-Maersk, is sometimes seen as a barometer of world trade. Last week it announced unusually high peak season surcharges on freight rates from Asia to Europe.

"The present market situation is unique," Lars Reno Jakobsen, head of Network and Product and a member of Maersk Line's management board, said in a statement.

Jakobsen told Reuters that Maersk expects the seasonal third-quarter demand increase to be "very strong" this year.

He said that demand for shipping from Asia remained high after the Chinese New Year instead of the usual slackening.

"The (vessel) utilisation rates have been much higher in the second quarter than they have normally been," he said. "It is a very exceptional year ... That means there's a shortage of space on the vessels and for containers for the period."

"We are experiencing a demand surge in most trades, which is a development that is both unprecedented and unexpected by us and our customers," Jakobsen said in the statement.

Asia-Europe trade is growing by 23 percent year-on-year, outpacing the market's 3-6 percent forecast from six months ago, he said.

"We expect an even more pronounced and serious shortage of containers in the coming months as we enter the peak season," he added.

After a plunge in the market from late 2008 through last year, the global shipping industry is recovering with world trade.

CONTAINER SCARCITY

"Maersk Line expects the equipment (container) shortage to last through the third quarter of this year and will continue to work closely together with all stakeholders, not least our customers, to further reduce equipment turnaround times," it said.

Jakobsen told Reuters that Maersk Line had obtained 50,000 extra 40-foot units to help overcome the shortage -- adding to its existing 1.3 million units.

During the slump of 2008-2009, many container shipping and container leasing companies stopped sourcing and producing containers, Maersk said.

"As carriers and shippers did not expect the current demand surge, the necessary equipment has not been ordered in 2010, ultimately resulting in the global shortage in equipment," it said.

In response to the equipment shortage, Maersk Line has begun producing new containers and leasing containers, it said.

It has also re-activated laid-up vessels to help reposition containers as fast as possible from, for instance, the east coast of North America and Latin America to Asia, it said.

Jakobsen said all major vessels were employed, and only minor tonnage was still laid up.

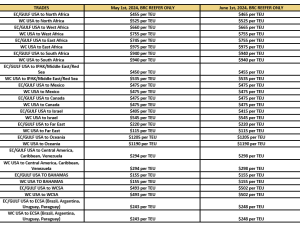

Last week, Maersk Line announced a peak season surcharge (PSS) for the Far East-Europe trade applicable from July 2010, Maersk said.

The surcharge will help Maersk recover the higher costs caused by the increased volumes and equipment shortages, such as port costs and costs of extraordinary vessels deployed to reposition containers, Maersk said.

Maersk said it would apply only one peak season surcharge so it would not announce separate surcharges or rate increases in connection with the peak season. (Reuters)