By the Numbers

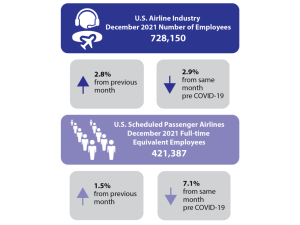

U.S. cargo and passenger airlines add 20,049 jobs in December 2021

AJOT | February 09, 2022 | Air Cargo | Airlines | By The Numbers

Reaching COVID-19 pandemic high however employment remains 2.9% below pre-pandemic December 2019

Rail Traffic for the Week Ending February 5, 2022

AJOT | February 09, 2022 | Intermodal | Rail | By The Numbers

For this week, total U.S. weekly rail traffic was 458,152 carloads and intermodal units, down 7.6 percent compared with the same week last year.

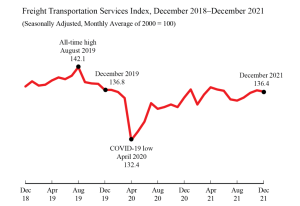

BTS December 2021 Freight Transportation Services Index (TSI)

AJOT | February 09, 2022 | International Trade | By The Numbers

The Freight Transportation Services Index (TSI), which is based on the amount of freight carried by the for-hire transportation industry, fell 0.2% in December from November, falling for the first month after three consecutive months of growth, according to the U.S. Department of Transportation’s Bureau of Transportation Statistics’ (BTS).

GPA handles 479,000 TEUs in January

AJOT | February 09, 2022 | Ports & Terminals | Ports | By The Numbers

The Port of Savannah handled a record 479,700 twenty-foot equivalent container units of cargo in January, an increase of 4 percent over the same month a year ago, a month in which cargo volumes had expanded by 22 percent.

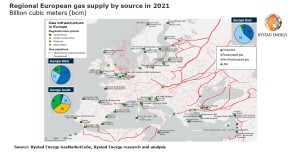

Russia-Ukraine tensions could jeopardize 30% of European gas demand

AJOT | February 09, 2022 | Energy | Conventional | By The Numbers

An escalation of military tensions between Russia and Ukraine could put up to 155 billion cubic meters per year of natural gas imports to Europe at risk, if the conflict causes Russia to halt deliveries, Rystad Energy research estimates. The figure corresponds to 30% of Western Europe’s annual gas demand.

OCBC Bank extends sustainability-linked loan to U-Ming Marine

AJOT | February 09, 2022 | Maritime | Bulk | By The Numbers

The loan demonstrates U Ming’s strong commitment to decarbonising its fleet to meet the International Maritime Organisation’s (IMO) target of achieving a 70% reduction in carbon intensity of international shipping by 2050, compared to 2008.

South Carolina Ports has record January for containers

AJOT | February 09, 2022 | Ports & Terminals | Ports | By The Numbers

South Carolina Ports had a record January for containers handled at the Port of Charleston, following an unprecedented amount of cargo handled in 2021.

XPO reports highest revenue of any quarter in company history

AJOT | February 09, 2022 | Logistics | By The Numbers

Expects 2022 adjusted operating ratio in North American LTL to inflect to year-over-year improvement mid-year

Oil prices falling on hopes of progress in Iran negotiations and cooling Eastern Europe tensions – Rystad Energy

AJOT | February 08, 2022 | Energy | Conventional | By The Numbers

Oil markets are falling this morning on hopes that Iranian crude will reenter the market in the coming months, and Russia-Ukraine tensions are cooling.

DAT to integrate PIERS import-export data

AJOT | February 08, 2022 | Intermodal | By The Numbers

DAT Freight & Analytics announced an agreement with IHS Market PIERS to add import and export data into DAT iQ’s RateView and Benchmark Analytics reporting.

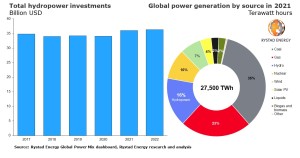

Rystad: Hydropower floodgates opening

AJOT | February 07, 2022 | Energy | Alternative | By The Numbers

2022 investments set to soar and drive global capacity to above 1,200 GW

The hydropower market will continue its upward trajectory in 2022 as global capacity exceeds 1,200 gigawatts (GW) for the first time and investments climb to $36.3 billion, Rystad Energy research shows. As the energy transition gathers pace and countries search for reliable, large-scale infrastructure projects to meet future demand, hydropower is solidifying its position as the most popular renewable energy source.

Hydropower accounts for almost one-sixth of the world’s power generation, trailing only coal and natural gas. The industry’s contribution to power generation is nearly 60% higher than nuclear energy and greater than all other renewables combined, including wind, solar PV, bioenergy and geothermal. Power generated through hydropower rose slightly in 2021 to 4,414 terawatt-hours (TWh), up from 4,360 TWh in 2020, while capacity of nearly 17 GW was added in 2020, followed by another 14 GW in 2021.

Investments in the sector slowed somewhat before 2020 as other renewable sources such as wind and solar PV gained momentum, a situation exacerbated by delays to several major hydropower projects and some regions’ lack of policy changes, which also stunted growth. The industry is, however, experiencing a renaissance as countries are increasingly motivated to find suitable renewable options to decarbonize their energy supply.

“Hydropower is the backbone of low-carbon electricity generation and has been rising since the 1970s. Over the last two decades, the installed global capacity of hydropower has grown from 680 GW in 2000 to nearly 1,200 GW in 2021, a surge of more than 75%,” says Rystad Energy analyst Karan Satwani.

LNG supply and demand creates continued volatility

AJOT | February 07, 2022 | Energy | Conventional | By The Numbers

As European gas prices continue to make headlines across the world, SSY LNG analyst Thanos Felios looks at what’s behind the rise of LNG prices and the impact this has on the LNG Shipping market.

Oil markets in wait-and-see mode as prices drop slightly from multi-year highs – Rystad Energy

AJOT | February 07, 2022 | Energy | Conventional | By The Numbers

Oil markets are mixed this morning, buoyed by positive US-Iran discussions but dampened by continuing supply issues and Covid-19 concerns, especially in Asia.

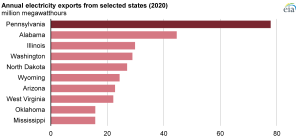

Pennsylvania sent more electricity to neighboring states than any other state in 2020

AJOT | February 07, 2022 | Energy | Conventional | By The Numbers

More than 230 million MWh of electricity was generated in Pennsylvania during 2020, exceeding electricity generation in all states except for Texas and Florida.

Port congestions may have severe ramifications for the US trade deficit in 2022

AJOT | February 07, 2022 | Maritime | Liner Shipping | By The Numbers

While the focus has been on the continued port congestion leading to berthing delays, there is a new concern - decreasing port volumes that could negatively affect global trade.

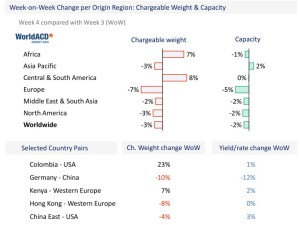

WorldACD: Trends for the past 5 weeks (wk 4)

AJOT | February 07, 2022 | Air Cargo | Freighters | By The Numbers

WorldACD's latest views on air cargo market developments, covering each of the last 5 weeks up till Sunday 30 January.

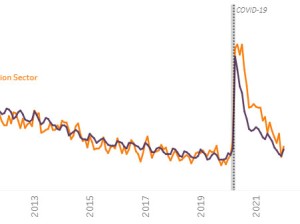

U.S. transportation sector unemployment rate up to 4.7% in January

AJOT | February 07, 2022 | Logistics | By The Numbers

Remains above pre-pandemic level of 3.4% in January 2020

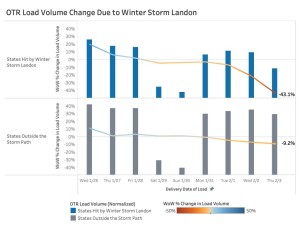

Fourkites Winter Story Landon analysis

AJOT | February 07, 2022 | Logistics | By The Numbers

Landon has impacted the Rockies, Midwest, Plains and South since Tuesday night, and moved to the Northeast on Friday.

Fertilizer prices jump in North America on race for supplies

Bloomberg | February 04, 2022 | International Trade | Commodity | By The Numbers

North American fertilizer prices rose the most in almost five months this week as a global competition for supplies means farmers could still have a ways to go before seeing relief from high nutrient costs.

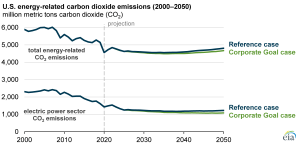

Utilities’ carbon-reduction goals will have little impact on U.S. CO2 emissions

AJOT | February 04, 2022 | Energy | Alternative | By The Numbers

Executing several plans announced by U.S. power utilities to reduce carbon dioxide (CO2) emissions would have a minor effect on U.S. energy-related CO2 reductions, according to the analysis we published earlier this week.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved