Will Trump back down on trade war?

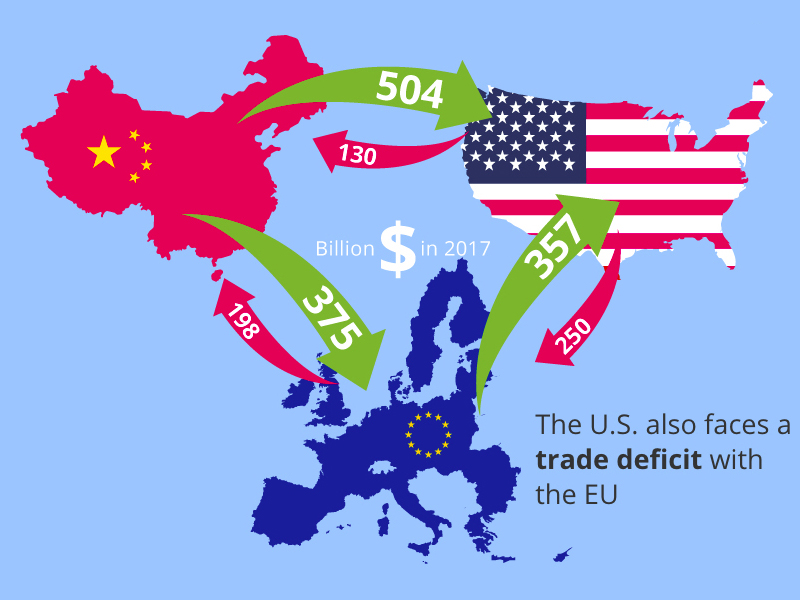

Nov 09, 2018With the mid-term elections last Tuesday seeing the Democrats take back the House of Representatives, many are questioning what this means in terms of Trump’s tough policies on trade with China - will he be forced to back down?

According to reports, this is unlikely. Strategists doubt that the Democrats will challenge Trump on his trade agenda, as they are believed to also support one of the key reasons for this trade war: a tougher stance on Chinese trade and intellectual property practices.

If you’ve been a little lost up until this point, you’re not alone. Trade Wars by nature, are convoluted and comprised of many political and economic factors, making the outcomes difficult to predict. If you need to quickly catch up on exactly what a trade war is and why we are having one - check out this visual summary to get up to speed.

Generally speaking, many economists have agreed that adding tariffs (import and export taxes) will deter international trade and won’t be super beneficial for the US economy. Whilst it may ‘protect’ some American jobs and industries that are being undercut by foreign competition, it will hamper the many more companies and industries who rely on international trade and globalization to survive.

But what does it mean for the shipping and transport industry, an industry which is so reliant on globalization and trade?

At this point, the additional cost of the tariffs have just been passed down to the consumer. This is only not a concern for as long as the consumer is willing to pay more for their goods. However, as more and higher tariffs are added, the effects for the shipping industry are expected to only worsen over time, with many fearing that a large-scale trade war could hurt shipping volume, demand, and profits.

We’ve already started to see the damage. Bloomberg reported back in July that shipping company A.P. Moeller-Maersk A/S had already lost almost a third of its market value, and may struggle to make a profit this year as a result of rising uncertainties surrounding the Trade Wars.

His recent round of tariffs by Trump (10% on $200 bn of Chinese imports, many of them consumer goods) is still set to jump to 25% on January 1st, 2019, putting even further strain on the multitude of industries affected.

So, what can be done? Up until now, China has had capacity and large scale exports to meet the business needs of many shippers. Focusing on just one trade route however, will leave transport companies susceptible to fluctuations and disputes between markets. Diversifying distribution channels into other emerging trade routes outside of China could be seen as one solution to avoid, or at least ease the impact of tariffs for the time being.

Trump and Chinese President Xi are expected to meet and have a discussion on a potential trade deal between US and China later this month at the G20 summit. Reports are optimistic that Trump and China are willing to bring the Trade War to a meaningful conclusion, and avoid further tariffs economic fallout for both countries.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved