The energy world is changing, and quicker than most experts predicted only a year ago. The adaptation of renewable energy technologies is accelerating, even during the pandemic, and three contenders – carbon capture and storage (CCS), battery storage and hydrogen – have begun a competitive race to reduce emissions and assist the increasing number of countries, industries and companies that are setting net zero targets.

To address the energy transition and identify the latest trends, Rystad Energy is proudly initiating a monthly Energy Transition Report, which will showcase and analyze the latest developments across key transition variables, societies and technologies.

Asia – the mother of batteries

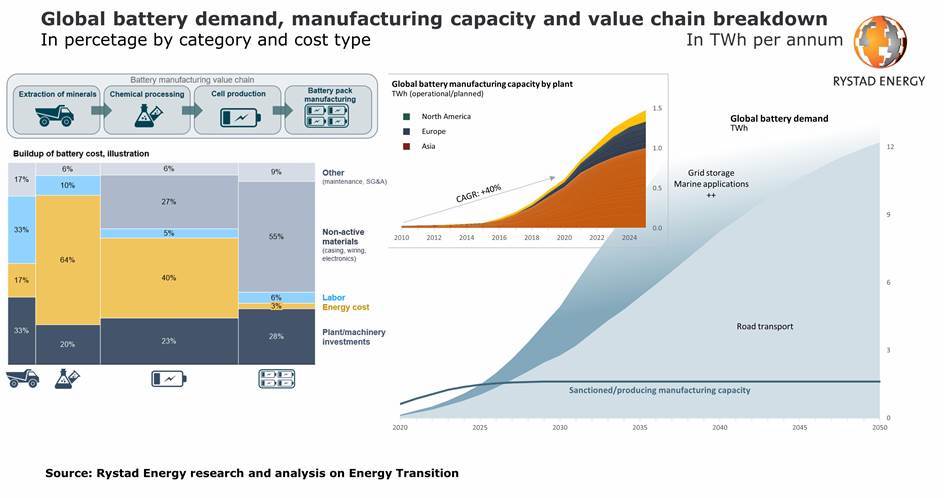

The world’s current total battery cell production capacity is about to exit 2020 at around 617 gigawatt hours (GWh) per year. Most of this capacity, 516 GWh, comes from producing facilities in Asia. Europe follows with 61 GWh and North America with 40 GWh of production capacity.

Existing sanctioning is set to create a boom in capacity for Europe and North America towards 2025, while Asia’s capacity is also set to expand, dwarfing other continents, and securing its place as the ‘mother of batteries’.

In 2025, Asia’s producing capacity is set to double to around 1 terawatt hour (TWh) per annum. Europe will follow with around 0.33 TWh and North America with around 0.14 TWh.

Battery cells risk supply deficit

Currently, the world’s battery cell producing capacity by far exceeds global demand, which is limited to around 140 GWh per year.

However, as the electrification of road transport accelerates and with added battery demand from grid storage projects and marine applications, the world is now ahead of a ground-breaking demand boom, which will already create a battery cell supply shortfall from 2026, unless more production projects are sanctioned globally.

Rystad Energy forecasts a balanced battery cell market in 2025, with both supply and demand at just under 1.5 TWh per year. Demand however, will continue to grow going forward and is forecast to reach nearly 2 TWh in 2026, adding even more in following years. Unless more battery cell production projects are sanctioned globally, the world is in for a deficit and buyers will have to compete for limited supply.

Road transport demand for battery cells alone will reach nearly 12 TWh per year by 2050, Rystad Energy’s forecast reveals.

How much cheaper can batteries get?

Given the trajectory of battery prices over the past decade, it would be easy to assume that this decline will eventually flatten out. This is further substantiated by the fact that the cost of raw materials represents an increasing share of the total cost for battery cell manufacturers, and currently stands at 50-60% of the cost of goods sold (depending on chemistry and form factor). One might think this leaves limited room to further improve economics. But if we expand the analysis to look at the various cost components of the entire value chain for batteries, we might arrive at a different conclusion.

For example, looking across the entire value chain, we see that 34% of the cost of battery production is tied to energy consumption. And most of this involves electricity used for drying operations in the chemical processing and cell production phases. With new and improved techniques, these costs could be vastly reduced – a potential that will likely soon be realized in cell manufacturing. Additionally, we see a shift towards more vertical integration in the battery industry, with battery producers moving upstream in order to better optimize the mining and processing part of the value chain.

As both battery cell and battery pack designs become more specialized and optimized for their intended applications, there is also the potential to reduce expenses related to non-active materials, to cut labor costs through automated manufacturing processes, and to reduce up-front investments through enhanced production facility design.

CCS could address 42% of global emissions

Rystad Energy has analyzed the full scope of global CO2 emissions and has concluded that CCS solutions could address about 42% of the world’s total dirty footprint. It is not likely, however, to reach its full potential as competing hydrogen and battery societies will also target their fair share of the global pie.

The core applications for CCS are within natural gas processing, power generation, hydrogen production (steam methane reforming or SMR), and industrial processes. Today, the vast majority is related to natural gas processing and hydrogen production for use in refining and fertilizer production.

“Not surprisingly, we find the largest CCS potential in China, India and the US, where power and combustion outweigh process emissions. The power sector, although significant, is less likely to utilize CCS than industry, as renewable energy – given the fast decline in costs – outcompetes some CCS projects in the power sector,“ says Marius Foss, senior vice president and head of global energy systems at Rystad Energy.

Net zero targets are booming

Country-level net zero targets, non-existent just a few years ago, have become the new energy trend and are booming globally. A Rystad Energy tally shows that countries with announced net zero targets doubled within one year, reaching a total of 16 in 2020, from 8 in 2019.

Some energy producers, industrial groups and big tech companies also joined the net zero race and have set their own such targets. A Rystad Energy analysis shows that the targets Big 5 tech firms, Apple, Amazon, Google, Facebook and Microsoft have set, will potentially reduce their combined emissions by a cumulative 108.3 million tonnes of CO2 equivalent (MtCO2e).

_-_28de80_-_58820516bd428ab3fd376933932d068c43db9a4a_lqip.jpg)