British Airways parent IAG SA said it couldn’t provide an earnings forecast this year, because weakened demand in Asia has now rippled across to Europe, and companies across the globe are cutting back on business travel as the coronavirus outbreak spreads.

The shares fell as much as 9% after the airline group, which also includes Spain’s Iberia and Aer Lingus of Ireland, said it will reduce capacity by 1% to 2% this year, according to a statement Friday.

With industry events being canceled and companies imposing restrictions, airlines outside of Asia are coming to grips with a fast-emerging threat to business. EasyJet Plc, the U.K.-based discounter, said Friday that it will cancel some flights as it sees slower demand across Italy and other European markets. Amadeus IT Group SA, which operates the industry’s largest booking network, added to the gloom by reporting ticket sales are decelerating globally.

The stark warnings mark an emerging recognition that the contagion’s impact won’t be confined to Asia. Just last week, the International Air Transport Association forecast that the industry would see its first annual decline in global passenger demand in over a decade in 2020, primarily weighed down by the impact of the virus in China. But since then, fears about the spread to other markets have triggered a global market sell-off.

IAG shares were down 6.9% as of 8:04 a.m. in London, bringing this week’s drop to 25%. The Stoxx Europe 600 Travel & Leisure index fell 4.3%.

Outgoing Chief Executive Officer Willie Walsh said that IAG’s assumption of a stabilizing situation in Asia unraveled over the weekend, forcing the company to hold off on giving guidance.

“On Monday, we had the decision in Italy to lock down some of those towns clearly brought Europe into the spotlight,” Walsh said on a conference call. “It’s a rapidly changing situation,” with weaker airlines in Europe in danger of failing.

Outbreaks in Italy and other European countries have led to restrictions on flights far from China, while firms including JP Morgan Chase & Co. are clamping down on non-essential travel. The outbreak will shave about $30 billion from industry revenue, IATA estimated last week, with the impact most severe on Chinese airlines.

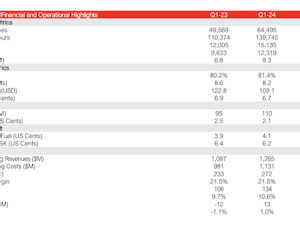

IAG reported adjusted operating profit of 3.29 billion euros ($3.6 billion) for 2019, according to a statement Friday, down 5.7% from 2018 on a pro forma basis. Analysts had predicted 3.2 billion euros.

British Airways scrapped flights to China through the middle of April, and pared frequencies through March to Northern Italy and South Korea due to lower demand. Spanish unit Iberia has scrapped flights to Shanghai to the end of April, and is allowing customers to postpone flights to Italy and Japan.

The novel coronavirus has the potential to become a pandemic and is at a decisive stage, the head of the World Health Organization said Thursday. Its rapid spread has led equity strategists at Goldman Sachs Group Inc. to slash their outlook for U.S. companies’ profit growth to zero this year, as the epidemic erodes revenue and slows global economic growth.

IAG and Ryanair are best placed among European airlines to weather a drop in traffic stemming from the coronavirus spreading to the region, Bernstein analyst Daniel Roeska wrote in a note Thursday, before the carrier reported earnings. Air France-KLM would be most vulnerable, Bernstein said.

The warning comes as Walsh gets ready to hand over the reins to Luis Gallego, the head of IAG’s Spanish unit, on March 26. Walsh, 58, took the helm at British Airways in 2005 and built it into a European airline giant.