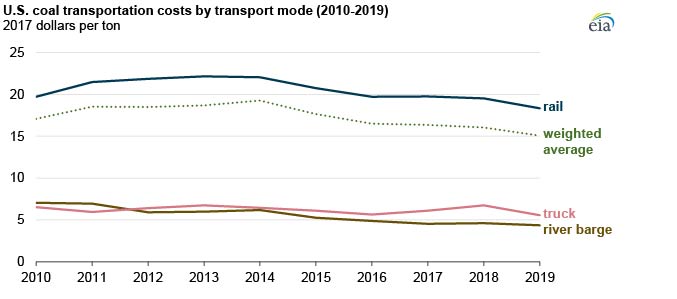

U.S. delivered coal costs, which reflect commodity and transportation costs, have declined steadily since 2010 (in constant 2017 dollars per ton). In 2019, the average transportation cost of coal was $15.03 per ton, down from $16.07 per ton in 2018. Transportation costs accounted for about 40% of the total delivered cost of coal in 2019, down 1% compared with the previous year. In the past 10 years, coal commodity costs have fallen faster than transportation costs. As a result, transportation’s share of the total delivered cost of coal has increased since 2008, when transportation accounted for about one-third of the total cost.

U.S. Energy Information Administration (EIA) surveys also capture coal transportation costs by mode. Rail transport costs decreased for the second consecutive year, while river barge costs remained relatively flat. Truck costs decreased by 17% in 2019 after two consecutive years of increase. In addition to costs specific to each mode of transport, transportation costs are affected by factors such as route length, availability of transport mode and of supply source options, and the competition between coal and other commodities for transport. Although single-mode shipping is more common, individual coal shipments are sometimes transported by more than one mode.

Plant location and rail system accessibility largely determine the primary way a power plant receives its coal. River barge (waterway) is often the most cost-effective method of transporting large quantities of coal over long distances, but its use is limited to the relatively few plants located on suitable rivers. Shipping by truck is only cost effective over short-haul distances, and most coal mines are located far away from power plants and consumers.

Although more expensive on a per-tonnage basis than truck or river barge, transporting coal by rail through the extensive U.S. rail network is the dominant mode of transportation for coal delivery. Rail shipping is a cost-effective way to move large volumes of coal from the relatively few remote coal-producing regions to coal-fired power units located near electric customers. Almost all U.S. coal comes from four regions: the Powder River Basin (Wyoming and Montana), the Illinois Basin (Illinois, Indiana, and Kentucky), Central Appalachia (Kentucky and West Virginia), and Northern Appalachia (Ohio, Pennsylvania, and West Virginia).

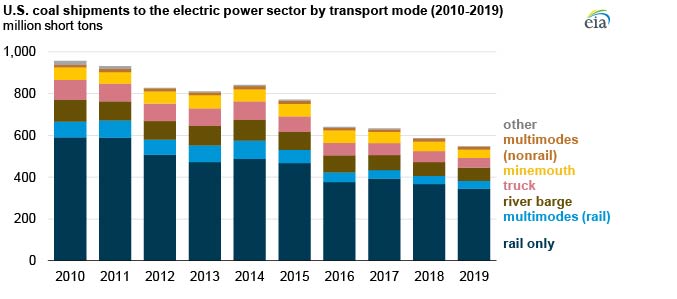

The U.S. electric power sector received 547 million short tons (MMst) of coal in 2019, 38 MMst less than in 2018. In 2019, coal shipments declined for their fifth consecutive year, down to the lowest value recorded since EIA began publishing the series in 2007. More than two-thirds (69%) of the coal delivered to the U.S. power sector last year was shipped either completely or in part by rail; the remainder was shipped by river barge, truck, and other methods.

Coal shipments by truck and coal shipments to minemouth plants (power plants built near coal mines) declined more substantially than other transport modes, falling by 13% and 12% from 2018, respectively. Rail shipments in all forms, including multimode, decreased 6%, while coal shipped by waterways fell 2% from 2018 levels.

_-_28de80_-_58820516bd428ab3fd376933932d068c43db9a4a_lqip.jpg)