Moscow - PAO Sovcomflot (SCF Group), one of the world leaders in energy shipping and marine services for offshore oil and gas upstream projects, has today reported its results for the full year to 31 December 2018.

2018 Full Year Financial Highlights

(IFRS audited accounts – year to 31 December 2018)

USD Millions |

2017 |

% ∆ | |

Gross revenue |

1,519.9 |

1,435.4 |

+5.9 |

Time charter equivalent revenue* |

1,074.7 |

1,058.0 |

+1.6 |

EBITDA** |

580.7 |

545.4 |

+6.5 |

Adjusted profit/(loss)*** |

6.9 |

(5.3) |

n/a |

Net profit/(loss) |

(45.6) |

(113.0) |

n/a |

Q4 2018 Financial Highlights

USD Millions |

Q4 2017 |

% ∆ | |

Gross revenue |

413.4 |

374.7 |

10.4 |

Time charter equivalent revenue* |

300.7 |

272.0 |

10.6 |

EBITDA** |

166.1 |

137.1 |

21.2 |

Adjusted profit/(loss)*** |

13.9 |

(30.8) |

n/a |

Net profit/(loss) |

11.9 |

(106.2) |

n/a |

*Time charter equivalent (TCE) represents shipping revenues less voyage expenses and is commonly used in the shipping industry to measure financial performance and to compare revenue generated from a voyage charter to revenue generated from a time charter

**Earnings before interest, tax, depreciation and amortisation calculated on an adjusted basis

*** Net loss adjusted on fleet and other assets impairment and non-operating income/expenses

2018 Market сondition and SCF Group performance

2018 proved to be a second consecutive challenging year for the tanker industry, with trading conditions remaining extremely difficult and the spot rates well below their historical averages. There was, however, a visible rebound in freight rates in the Q4, reflecting a balancing between tanker supply and demand, following a sustained period of tanker fleet removals and an increase in crude oil demand from Asian refiners in particular. In Q4 the Group has managed to increase its revenue base and achieved a profit of USD 11.9 million against a USD 106.2 million loss in 2017. The annual results reflected a strong contribution from the industrial shipping business (comprising offshore services and LNG transportation). These activities now account for 57.2 per cent of the Group’s TCE revenues (up from a 50.9 per cent share in 2017).

Taking into account the challenging conditions in the conventional tanker markets, and in accordance with IFRS accounting standards, the Group undertook an impairment review of vessel values for the year ended 31 December 2018. This resulted in an impairment charge of USD 49.3 million (2017: USD 29.0 million). Adjusting for this charge and other non-operating costs, amounting to USD 3.2 million in total (2017: USD 78.7 million), the Group achieved an adjusted profit of USD 6.9 million for the year (2017: USD (5.3) million loss).

2018 Operating Highlights

- Yevgeny Primakov (Icebreaker Ice-15) joined the fleet, the final vessel in a series of four new generation IBSV’s, engaged under a long-term time-charter agreement with Sakhalin Energy, which makes a total fleet of 10 supply and standby vessels servicing SEIC and ENL at Sakhalin island (Sea of Okhotsk).

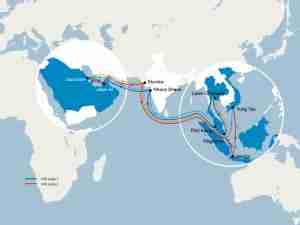

- The world’s first Aframax tanker to use LNG as her primary fuel Gagarin Prospect (114,000 DWT) entered service (July) on long-term time charter to Shell. In October, Gagarin Prospect completed her first commercial voyage using LNG fuel, from Primorsk to Rotterdam as part of Sovcomflot’s commitment to drive down tanker industry emissions.

- During the year Sovcomflot ordered a further two new generation ‘Green Funnel’ Aframax tankers as well as three LNG-fuelled MR product carriers from Zvezda shipyard (Primorsky Krai). Vessels using LNG fuel release 100 per cent less Sulphur Oxide (SOx), 76 per cent less Nitrogen Oxide (NOx), 27 per cent less Carbon Dioxide (CO2) and 100 per cent fewer particulate matters into the atmosphere than those with engines burning standard marine fuels. They exceed rather than merely comply existing and anticipated emissions regulations, including the IMO’s new global limit for sulphur in marine fuel oil that applies from 1 January 2020

- The Group’s LNGC Pskov loaded the first cargo of LNG from Yamal LNG’s second train (August) and in November completed the first open water ship-to-ship transfer of cargo for Yamal LNG

- Christophe de Margerie, the Group’s pioneering icebreaking LNGC loaded the first cargo (December) from Yamal LNG’s third train.

- Sovcomflot was successful in international LNG tenders and new long-term contracts with Total and Shell, to add to the Group’s LNG portfolio - fully in line with the chosen strategy of growing its fixed rate/fixed term liquefied gas transportation business with core clients

- Time-charters for four ice-class shuttle tankers for the Sakhalin 2 and Varandey projects were extended or renewed, thereby adding new fixed-rate follow-on business with core clients and further strengthening Sovcomflot’s global leadership in the provision of shuttle tanker services to upstream projects in the Arctic and Sub-Arctic regions.

Sergey Frank, President and CEO of Sovcomflot commented:

“During the reporting period, SCF Group achieved solid operating and financial results despite another difficult year for the conventional tanker market. A strong performance from the Group’s gas and offshore divisions offset continued weakness in the conventional tanker fleet over 2018 and helped drive the Group’s operating profit to USD 187.3 million. Looking forward, we remain firmly committed to growing our industrial businesses and this will be central to SCF Group strategy through to 2025. Whilst our conventional tanker fleet swung into profit in Q4 2018, it was insufficient to offset the impact of the dire tanker markets experienced by the industry as a whole in the first half of the year. The outlook for 2019 remains positive and our performance in Q1 2019 has exceeded expectations.

There is industry optimism that 2H 2019 and 2020 in particular will provide better times for the tanker markets with increased demand for oil and oil products, restrained newbuilding supply and the potential for favourable disruption resulting from the introduction of Marpol 2020 towards the end of the year. The Company is well positioned to take advantage of continued improvement in the conventional tanker markets”

Evgeniy Ambrosov, Senior Executive Vice-President, Business development, commented:

“Over 2018, we have implemented a series of projects in close cooperation with our esteemed partners. The start of commercial operations of our Green Aframax tanker series, with the flagship Gagarin Prospect, was the most conspicuous amongst them. This project was implemented with our partners Shell - together we are leading the industry towards the adoption of LNG fuel. A powerful fleet of icebreaking supply and standby vessels, servicing the offshore oil & gas projects on Sakhalin island, was reinforced with another vessel of the series Evgeny Primakov, which has started its work under the 20-year time-charter agreement with Sakhalin Energy. The cooperation with Novatek has seen its further success, when the icebreaking LNGC Christophe de Margerie loaded the first LNG cargo from Yamal LNG’s third train. Our LNGCs and SCF Melampus started the open water “ship-to-ship” transfers of export cargo from Yamal LNG. We are grateful to our clients for their loyalty and the responsibility entrusted to us for the safe transportation of their cargoes - however strong the winds are and thick the ice is.”

Igor Tonkovidov, Executive Vice-President and Chief Operating & Chief Technical Officer of Sovcomflot noted:

“In 2018 the Group delivered on our promise to introduce cleaner-burning LNG as a primary fuel for our large-capacity tankers. We consider our pioneering Green Funnel initiative represents a major milestone for the tanker industry. Sovcomflot places the highest importance on safety and our philosophy that ‘Safety Comes First’ underpins all our activities. In this context, we established our Marine Operations Centre in St. Petersburg during 2018. This state-of-the-art facility represents a major breakthrough and is the first of its kind in Russia, providing heightened levels of safety and efficiency for our fleet operations, especially in regions with challenging operating conditions.”

Nikolay Kolesnikov, Executive Vice-President, Chief Financial Officer of Sovcomflot, commented:

“The Group has successfully met all its financing and refinancing needs having raised almost USD 900 million of debt capital in 2018 from domestic and international financial institutions. Our ability to access the debt capital markets reflects the robustness of SCF’s business model, underpinned by strong future contracted revenues, which stood at USD 8.4 billion at the 2018 year end. The funds raised in 2018 have addressed the Group’s mid-term financing requirements and provide an additional liquidity cushion.”

2018 additional financial Information

For the year ended 31 December 2018, dividends of RUB 0.86 per share, totalling RUB 1,696.0 million (equivalent to USD 26.8 million) were declared on 29 June 2018 and paid on 10 July 2018 (Year ended 31 December 2017: dividend of RUB 3.12 paid per share, totalling RUB 6,141.0 million – equivalent to USD 106.9 million).

The Group raised some USD 900 million of new debt capital in 2018, which included: a USD 106.0 million long-term credit facility with Sberbank; a USD 252.0 facility with six international banks (ABN AMRO Bank; BNP Paribas; Citibank; ING Bank; KfW IPEX-Bank, and Société Générale) and a new USD 264 million six-year revolving credit facility with a consortium of five leading international banks (Citibank; DVB Bank; ING Bank; Société Générale, with UniCredit acting as mandated lead arrangers and bookrunners and ING Bank acting as the facility agent).

The Group’s credit ratings remained unchanged during the reporting period and up to date: BB+/stable (S&P), Fitch, Ba1/stable (Moody's), BB/positive (Fitch).

A full version of the consolidated financial statements of PAO Sovcomflot, for the year ended 31 December 2018, is available in the Investor section of Sovcomflot’s website.

Industry Recognition

During the year, the quality of the Group’s operations and activities received external recognition from a number of different domestic and international publications/organisations:

- Marine Money - – Project Financing Deal of the Year – West (USD 260 million loan agreement with VTB Bank)

- Royal Institution of Naval Architects – Significant Ships of 2017 (Christophe de Margerie)

- LNG World Shipping – Carrier of the Year (Christophe de Margerie)

- Lloyd’s List Global Awards – Environment Award – Individual Company (Gagarin Prospect).

- 2018 Award for Scientific, Technical and Innovative Projects in Development of the Arctic, under the Russian Ministry of Energy – First prize for reliable and safe year-round navigation in the Gulf of Ob.

Fleet Management

As at 31 December 2018, Sovcomflot’s fleet comprised 144 owned and chartered vessels (including vessels in joint ownership with third parties) amounting to 12.5 million tonnes DWT in total.