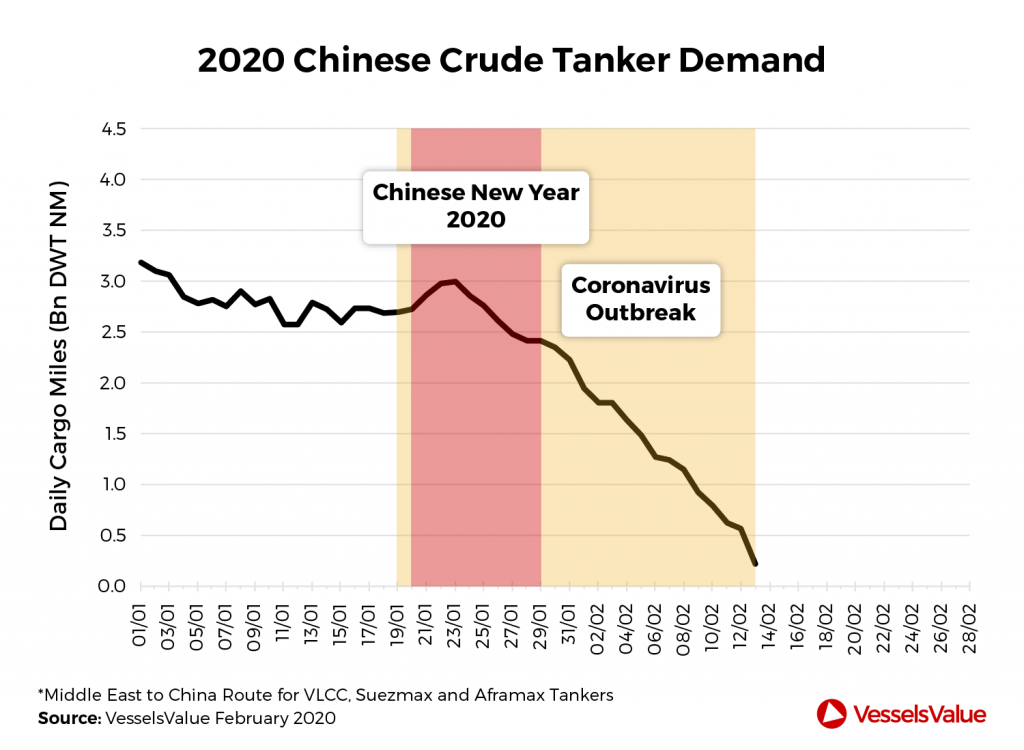

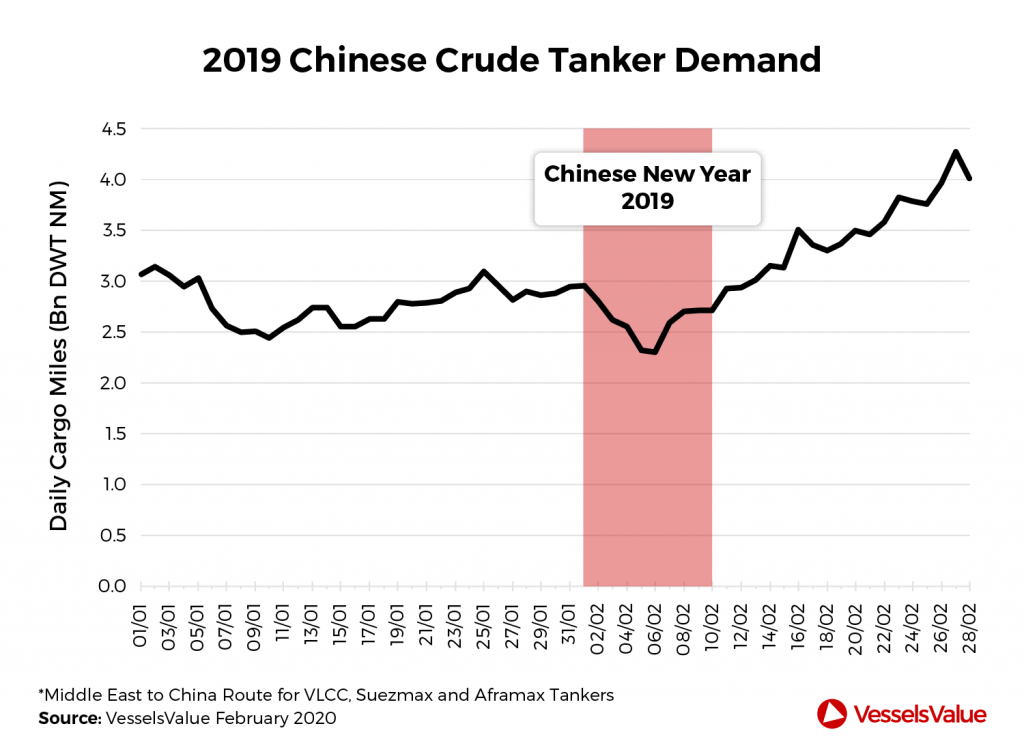

Using satellite tracking technology, VesselsValue (VV) has compared China's real time demand for seaborne crude oil from the Middle East in recent weeks against the same period last year.

The coronavirus has coincided with Chinese New Year, so they compared data from 2019 alongside this year.

The data essentially shows the demand for crude tankers. The metric is in billion ton miles where a ton mile is a ton of cargo that's travelled one nautical mile by sea.

In recent weeks, it can be seen to have fallen almost to zero from a 2019 average of 3.42 billion ton miles per day.

Most years, there is a mild slowdown of activity in Chinese ports surrounding the Chinese New Year, but this time the effects have been significantly compounded.

Across wider shipping markets, sale and purchase of vessels has almost stopped completely, newbuildings (which mostly happen in Asia) are being delayed due to the inactive workforce, and charter rates (vessel earnings) are down.

Based on VV Charter Rate assessment the cost per day of hiring a Very Large Crude Carrier (VLCC) for 12 months has fallen by over 20% in last 1 month or by USD 4 million over the period. From USD 53,460 per day on 14th January 2020 to today USD 42,250 per day. Spot earnings have fallen by over 70% during the same period.

An event like coronavirus really does show the gravitas of China on global shipping markets.