Delta Air Lines Inc. sees profit in the final months of the year outpacing Wall Street’s expectations, buoyed by a resurgence in international travel and the strongest recovery rates for corporate sales since the pandemic began.

Adjusted earnings in the fourth quarter will be $1 to $1.25 a share, the Atlanta-based carrier said Thursday in a statement. Even at the low end of the range, that would easily beat the 80-cent average of analyst estimates compiled by Bloomberg. Revenue in the period will climb as much as 9% from the same quarter in 2019, Delta said.

The outlook suggests the carrier -- and the broader airline industry -- is gaining momentum in its recovery from a pandemic-driven slump. While demand from leisure passengers has largely come back, lucrative international travel by large corporations is the last segment to bounce back. That’s particularly notable for Delta, where one-third of passenger revenue last year was from premium products.

Despite persistently high fares, domestic demand is “at historic levels,” Chief Executive Officer Ed Bastian said in an interview.

“We’ve been 90% full as an airline every day since the first of April,” he said. “We expect to see that through the end of the year and into the spring.”

Delta’s shares rose 3.8% as of 7:27 a.m. before regular trading in New York. Other US carriers, including rivals United Airlines Holdings Inc. and American Airlines Group Inc., climbed as well.

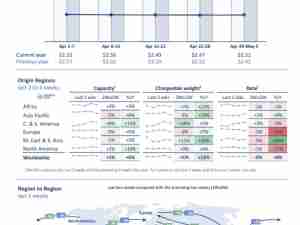

Corporate sales have recovered to 80% of pre-pandemic levels, with a particular jump after Labor Day, Delta said. Revenue in the third quarter from international passengers rebounded to 97% of the level from the same period in 2019, fueled by trans-Atlantic trips.

Delta is the first major US airline to report third-quarter results, with United and American set for next week. A group of 11 US carriers should report combined operating revenue of $54.5 billion and a net profit of $2.8 billion for the three months that ended Sept. 30, according to Michael Linenberg, a Deutsche Bank analyst.

Delta’s adjusted earnings were $1.51 a share in the past quarter, including a 3-cent impact from Hurricane Ian. That narrowly missed the $1.54 estimate from analysts. Revenue was $12.8 billion, matching analysts’ predictions.

Delta hasn’t yet fully restored service in all the cities affected by the storm, including hard hit Fort Myers, Florida. It reduced revenue $35 million in September at the carrier and will have a similar impact this month.

“We had to shut down operations one to two days per station,” Bastian said. “We’re still having to fly a reduced schedule.”

The airline has trimmed flights and worked to rein in costs as the industry continues to grapple with challenges that have disrupted operations. Costs for each seat flown a mile, excluding fuel, will be as much as 13% higher in the fourth quarter compared with 2019, Delta said. The company expects its operating margin to be 9% to 11%.

Flying capacity in the period will be 8% to 9% below 2019. Delta anticipates returning to 2019 capacity levels by the middle of 2023.