This week’s international freight update:

Key insights:

- With the Suez cleared, delayed ships will start arriving soon. Though congestion and delays are expected to put pressure on rates when that happens, ocean prices from Asia to Europe have not increased yet.

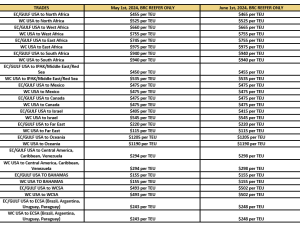

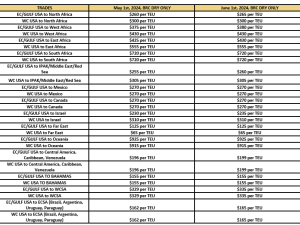

- That said, strong demand and increasingly scarce capacity – possibly an impact of the Suez disruption – sent Europe-US ocean rates spiking nearly $700 and 30% to a multi-year high of $2,851/FEU, a 55% increase since the start of the year.

- Shifts from ocean freight to air, made worse by Suez delays, are increasing demand for air cargo. Freightos.com marketplace data shows rates from Asia have already increased 60%-80% to the US and 15%-25% to Europe in the last four weeks.

- China-US rates:

- Asia-US West Coast prices (FBX01 Daily) increased 4% to $5,375/FEU. This rate is 251% higher than the same time last year.

- Asia-US East Coast prices (FBX03 Daily) climbed 2% to $5,868/FEU, and are 108% higher than rates for this week last year.

Analysis

With the Ever Given freed last Monday, and another five days needed to clear the backlog of waiting ships (though nearly double the typical number of ships are still waiting to pass), Asia-Europe ocean shipping resumed this week, and the industry is starting to feel the effects.

Delayed vessels will start arriving in Europe and to the US East Coast soon. Carriers are scrambling to optimize when and where ships arrive to minimize delays and congestion and some European port calls will get skipped.

This move will mean delays for cargo at skipped ports, and longer dwell times at larger ports, though, as Europe’s imports are spread among several major ports, extreme backlogs like the one at LA/Long Beach are not likely.

Asia to Europe and Mediterranean container rates have not increased yet – prices fell 2% and 1% respectively this week – but the delays of the coming weeks and the resulting shortage of capacity and equipment are expected to put pressure on rates. Maersk, as well as MSC and Hapag-Lloyd have already announced a suspension of bookings on some services for lack of space.

Asia-US prices have also not shown a significant impact, though East Coast capacity could be affected somewhat by delays, and the West Coast could feel the equipment crunch. But demand for Asia-US freight is still showing no sign of slowing down as rates increased slightly this week, pushing Asia-US West Coast rates to a new high.

But continued strong demand and scarce capacity sent rates spiking on transatlantic lanes this week. Europe to North America prices increased nearly $700 and 30% to a multi-year high of $2,851/FEU, a 55% increase since the start of the year. And the disruption in the Suez may have contributed to the announcement of more cancelled sailings for the coming weeks, removing about 9% of all scheduled ships. Rates from Europe to South America likewise spiked by nearly 25%.

The Suez incident is also increasing demand for air cargo, where capacity is still limited by the absence of passenger travel and existing ocean delays were already pushing some volume to planes instead of ships. Freightos.com marketplace data shows rates from Asia have already increased 60%-80% to the US and 15%-25% to Europe in the last four weeks.