Many of you may be familiar with the quote, attributed to the 19th century American author Mark Twain: when an American newspaper had (wrongly) carried his obituary, he apparently reacted by saying “The reports of my death are greatly exaggerated.” Unfortunately, something similar can be said about recent reports on the resurrection of air cargo: worldwide, the trend may be positive, but in many markets, the reality is different.

February showed a worldwide year-on-year (YoY) weight increase of 1.1%, accompanied by a yield/rate increase in USD of 84%. After a strong volume drop in the middle of the month, the end of the month showed a strong recovery.

Due to the annually changing dates of Chinese New Year (CNY), we traditionally look at the months of January and February together. Though counting one day less than in the leap year 2020, the YoY figures for these two months are + 0.9% in weight and +79% in yield/rate (in USD). Within the two months’ period, yields/rates increased by 4% MoM and the load factors went up by 3.2 percentage points MoM.

However, as always, worldwide averages need to be broken down in order to get the real state-of-affairs. Volumes are the best indicator of where things stand over a longer period: we compared the period Jan/Feb 2021 with the corresponding periods in the past three years.

Asia Pacific, one of the six main regions charted by WorldACD, is in a class of its own, emphasizing the increasing importance of the region in world trade. Except from the sub-region Australasia & the Pacific (-26% YoY), air cargo exports kept growing, particularly from the sub-regions China and North East Asia, showing YoY growth figures of 46% and 24% respectively. The entire region’s air cargo output grew by 19% YoY, by 14% vs 2019, and by 6% vs the bumper year 2018. In imports, Asia Pacific was 7% above 2020, 2% above 2019, but 4% below 2018. It is noteworthy that the business intra-Asia Pacific grows much less than the exports to other regions.

For the other 19 “sub-regions”, the picture is drastically different. Apart from 3 small sub-regions (Central Africa, Mexico and Central Asia), all sub-regions showed a decrease in outgoing business in 2021 compared to each of the three foregoing years. Hardest hit are South Asia, with a decrease of around 24% vs each of the three earlier years, North Africa (-23% YoY), Southern Africa (-20% YoY), the Gulf Area (-17% YoY) and Canada (-16% YoY).

Digging a few levels deeper, we are reminded that air cargo is not only about business from Shanghai and Hong Kong, important though these markets may be: of the larger 15 city-to-city markets growing by more than 100% YoY in Jan/Feb, only two had Shanghai as their origin, and one Hong Kong. The 12 other markets had diverse origin cities, including Paris, Liege, Nairobi, Beirut, Los Angeles and New York. The highest MoM growth was recorded in the market from Japan to USA Midwest, in kilograms, but also in yields/rates…

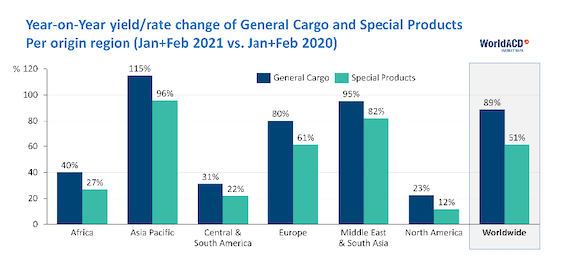

All six regions (Africa, Asia Pacific, Central & South America, Europe, MESA and North America) behave in the same way when it comes to increases in yields/rates: in all regions the yield/rate growth YoY continues to be stronger in general cargo than in special cargo. That is not the case when it comes to volumes: with a YoY growth of 29% YoY, Vulnerable cargo & High Tech very clearly outpace not only the market as a whole, but also score much better than all other large special cargo categories, including Pharma/Temp, which were all negative YoY. From Asia Pacific, the high tech segment increased by more 25% YoY in each regional direction, fueled by the worldwide demand for work-from-home devices.

The highest rates in air cargo at the moment are paid for business originating in South Korea, both eastbound and westbound: demand for COVID-19 diagnostic kits and a sea/air transfer play an important role here.