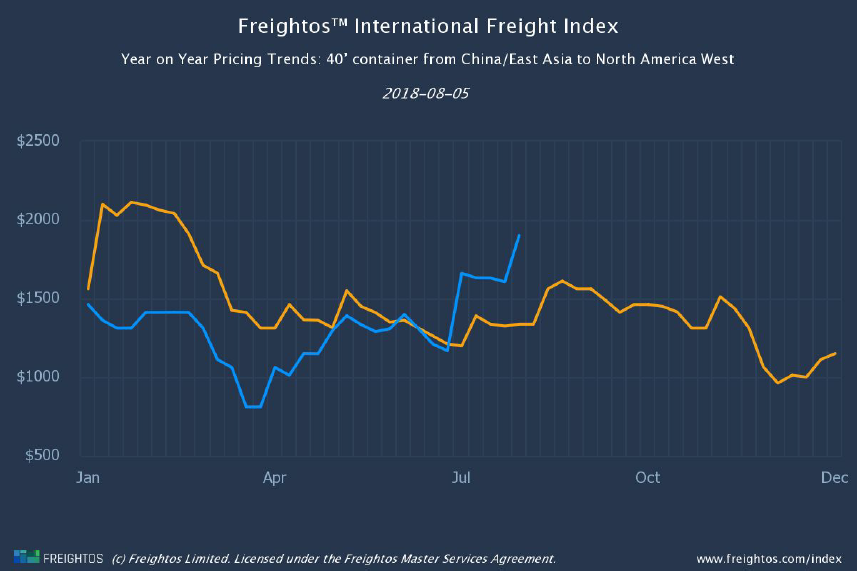

For transpacific rates, July was hot, and August will be hotter. China-US West Coast rates ($1,901/FEU) are already 18% higher than the peak of last year’s peak season ($1612/FEU on August 20).

China-East Coast rates have already broken the $3,000/FEU barrier, for the first time since March 5, 2017.

Insight from Freightos CEO, Zvi Schreiber

“In ramping up capacity over the past three years, carriers lost their control of the market and prices tumbled. Attempts to raise rates regularly failed, as one or more carriers dropped their rates to win sales. This was a game in which all carriers lost.

But recently, they seem to have emerged from this ‘carriers’ dilemma’ and we are seeing signs of more price discipline. Under this changed game plan all carriers are winning now. Shippers might not approve, but at this level pricing discipline has to be good for the industry.”

Ocean Freight Rates

Freightos Baltic Indexes For Ocean Containerised Freight | |||||

Lane |

Global |

China - |

China - US East Coast |

China - North Europe |

North Europe - US East Coast |

This Week |

$1,585 |

$1,901 |

$3,073 |

$1,765 |

$1,441 |

Last Week |

6% |

18% |

15% |

-3% |

-2% |

Last Year* |

17% |

42% |

31% |

-2% |

20% |

Since July 1, Emergency Bunker and Peak Season surcharges and three rounds of GRI have all largely stuck. Carriers have already announced GRIs for August 15 and September 1.

Prices are rising, because:

- There have been several service withdrawals since June, with this month seeing THE Alliance taking out one string,

- Carriers are standing firm, resisting the temptation to undercut competitor pricing to win business, US demand for Chinese imports rose from May. Yes, that was in part spurred by US importers arranging shipments in advance of punitive trade tariffs kicking in.

- The weather even pitched in late last week, with Typhoon Jongdari closing East Asian ports, leading to rolled bookings which temporarily tightened capacity further.

August began with another round of GRIs. By August 5, rates were standing at:

- $1,90/FEU for China-West Coast rates, up $294 increase from the previous week.

- $3,073/FEU for China-East Coast rates, up $409 from the previous week.

Meanwhile, with factories in Europe closing down, China-North Europe rates dropped back slightly last week, from $1,811 FEU to $1765/FEU.

Air Freight Rates

Average General & Express Rates On Key Air Freight Routes | |||||

As of |

China-US |

China-Europe |

Europe-US | ||

29 Mar |

$2.90-5.00/KG |

$2.80-4.50/KG |

$1.80-2.70/KG | ||

2 Aug |

$2.90-6.00/KG |

$2.80-6.00/KG |

$1.60-3.00/KG | ||

Meanwhile, air freight rates have stayed very stable. How stable? China-US and China-Europe general rates haven’t really changed since March 29. Europe-US rates dipped when larger airplanes moved to Europe to cater for the seasonal increase in passenger flights. In effect prices have dropped more than the 20c difference between $1.80/KG and $1.60/KG when this year’s promotional pricing season started three weeks ago.