Wheat surged as mounting tensions over Ukraine stoked concern about the outlook for grain shipments from Eastern Europe.

Futures in Chicago climbed as much as 4.4% while contracts tied to corn and soybeans also rose in Chicago as the U.S. said intelligence indicates Russia may attack Ukraine before the Olympics end on Feb. 20. Moscow has said it has no intention of invading.

Ukraine and Russia together are heavyweights in wheat, supplying more than a quarter of the world’s shipments of the grain. They also play a big role in global corn and sunflower oil. A protracted discord in the region could keep prices of such commodities elevated and add to food costs that are already the highest in a decade.

While a direct conflict might initially see a liquidation in positions to take risk off, the “ultimate issue for wheat would be bullish for prices,” said Rich Nelson, chief strategist at U.S.-based Allendale Inc.

In wheat options, implied volatility on March contracts jumped from 32% to 48% on Friday, with overall volume up about 60%. Benchmark futures in Chicago for May delivery climbed the most in more than four months, before pulling back to end the day up 3.2% at $8.04 a bushel.

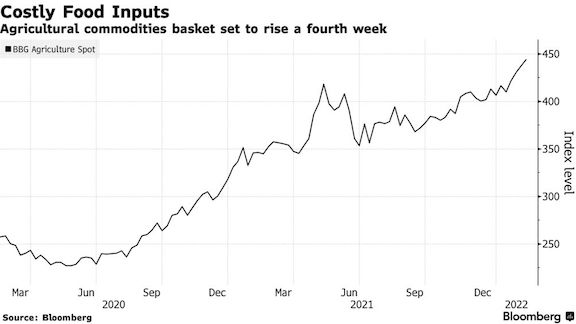

Bloomberg Agriculture Spot Subindex neared an all-time high earlier this week as the outlook for soybean and corn crops in South America continue to dim. Prices across grains, oilseed and softs markets have all rallied recently as supply shortfalls abound, a signal that food inflation already hitting consumers worldwide probably will continue.

More bullish signs for soybeans emerged Friday with a new South American forecast. Soil moisture in Brazil’s south is likely to keep falling in the next 10 days amid dry conditions and high temperatures, worsening conditions for still-developing crops, says Celso Oliveira, Climatempo meteorologist.