High Level Freight Update

1 Growing import demand enabled a rare third consecutive GRI to push China-US ocean rates up again, even as capacity gets closer to normal.

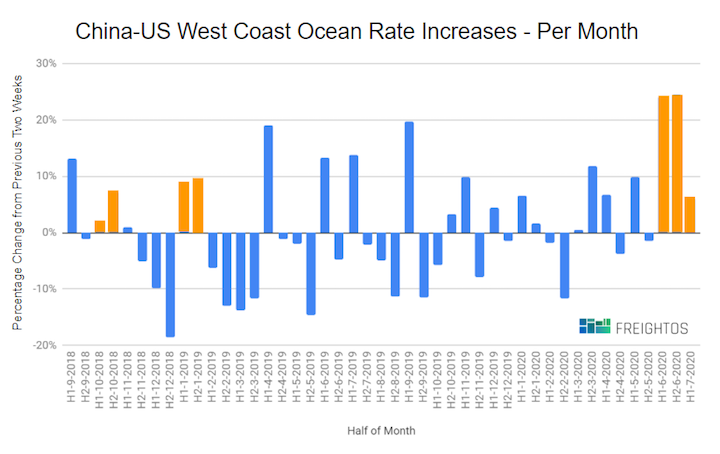

2 Even the trade war lead-up in late 2018 didn’t have three significant GRIs in a one-month span (see graphic).

3 Air volumes are increasing even as PPE demand stabilizes, showing commercial cargo has returned to the market.

China-US rates:

• China-US West Coast prices (FBX01 Daily) climbed 7% since last week to $2796/FEU. This rate is 76% higher than the same time last year.

• China-US East Coast prices (FBX03 Daily) rose 3% since last week, reaching $3458/FEU, and are 23% higher than rates for this week last year.

Unpacking the data

As the June uptick in US importer demand for Chinese goods continues into July, carriers introduced a third-consecutive General Rate Increase (GRI) to start the month, with some even trying to apply Peak Season Surcharges on top of the increase.

This third significant increase follows GRIs at the start and middle of June – a rarity in ocean rates that didn’t even happen in the lead up to the trade war in late 2018.

Even more remarkable is that this July increase is happening as carriers have largely returned capacity to near normal levels, while tightly restricted capacity had helped boost June rates.

This demand surge is likely driven by many US businesses adding inventory that’s finally run down since their last orders in March or April as restrictions in some areas are reduced, businesses are reopening and even US manufacturing is recovering somewhat.

Some of this demand in what may be an early peak season could be motivated by the August expiration of certain tariff exemptions for hundreds of products from coffee filters to skateboards.

Whatever the cause, the ships that have arrived in US ports recently have been very full, leading to some delays in unloading ships with such high utilization.

But a welcomed knock-on effect of the improved volumes in June has been some recovery in trucking employment that lost more than 80,000 jobs during the shutdown.

Air cargo volumes are increasing even as the PPE demand that sent rates soaring has stabilized.

As air rates fall – Freightos.com marketplace data has China-US rates down 60% since early May – commercial cargo pushed volumes 12% higher at the end of June compared to the end of May. Extreme ocean rates are also contributing to air volumes, as some shippers are opting for air over expensive ocean.