Iran’s tight gas market is reverberating across the Middle East, as a drop in its exports forces key customers Iraq and Turkey to seek alternative supplies and curb electricity output.

Iraq has some 6 gigawatts of power capacity—around a third of its total, according to the International Energy Agency—sitting idle after Iran cut gas exports due to cold weather, Electricity Minister Adel Kareem said on Tuesday.

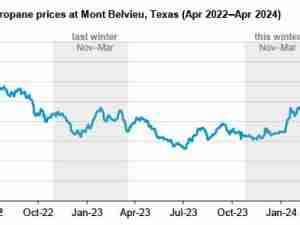

Reduced flows have also hit Turkey, causing the country’s worst energy crunch in decades and prompting it to slash power supplies to industrial users. That’s happening as Europe is still dealing with an energy crunch that sent prices rallying since last year to a record. Iran has cited technical failures as the reason for recently cutting exports to Turkey.

In response, Turkey has sought to tap the spot market for liquefied natural gas and the government has asked for more piped imports from Azerbaijan. Iraq doesn’t have the infrastructure to support such imports, so the electricity minister said he’d look to LNG giant Qatar for supplies to help cover futures shortfalls.

Iran’s Oil Ministry didn’t immediately respond to a request for comment.

The crunch should ease if milder weather limits heating demand in the region. But for future winters, Iran will need to boost domestic gas production to sustain exports, which dropped to 11.5 billion cubic meters in 2020 from 12.9 billion cubic meters in 2017, according to the Gas Exporting Countries Forum.

That’s likely to require investment in the South Pars field that accounts for more than 70% of Iran’s gas needs. Development of its remaining phases would cost around $7.8 billion, the Iranian oil ministry’s news agency recently reported.

France’s TotalEnergies SE and China National Petroleum Corp. quit South Pars after the U.S. reimposed sanctions on Iran in 2018. Negotiations to revive a 2015 deal that lifted sanctions in exchange for curbs on Iran’s nuclear program are entering their final stage, European negotiators have said.