Iran’s efforts to remove U.S.-led sanctions from its economy could allow Africa’s largest mobile-phone provider to repatriate about 2.8 billion rand ($204 million) from the country, according to people familiar with the matter.

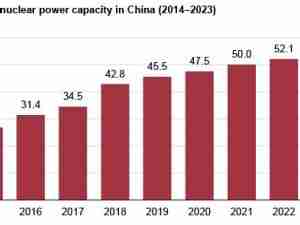

MTN Group Ltd. has been prevented from taking cash out of Iran since 2018, when former U.S. President Donald Trump withdrew from the nuclear accord signed by his predecessor, Barack Obama. The administration of Joe Biden is more in favor of the deal, and diplomats are hoping to have the landmark 2015 deal restored within the next few months.

The 2.8 billion rand stuck in the country is owed to MTN in loan repayments and dividends, the Johannesburg-based firm said in its last annual results. The company owns 49% of MTN IranCell Telecommunication Co. Services., one of the nation’s largest wireless carriers, and e-commerce business Snapp.

Should MTN be able to withdraw some or all of the funds, the company could look to further pay down debt, said the people, who asked not to be identified as dealings with Iran is a sensitive issue. An Iran exit isn’t on the cards at present, they said, even as the South African company looks to sell operations elsewhere in the Middle East, namely in Syria and Afghanistan.

“MTN Irancell has started the year on a very strong operational performance and we are pleased with the results delivered,” MTN said in emailed comments, without elaborating any further on the talks to lift sanctions or the company’s chances to repatriate funds.

MTN’s shares have gained 70% this year, the second-best performance on the FTSE/JSE Top 40 Index, and are trading at their highest level since September, 2019. Investors are backing an asset-disposal and debt-repayment plan, alongside efforts to monetize fintech services such as mobile money.

After Iran’s previous sanctions were lifted in 2015, MTN repatriated about $1 billion. The restrictions, which center around Iran’s nuclear activity, cover the country’s financial-services sector, making large transfers of capital and foreign currency extremely difficult.