The shipping and oil group beat 2010 forecasts on the back of a container shipping recovery and higher oil prices, swinging from its worst result in 2009, when the global economic crisis hit trade and shipping, to its best result ever.

"Growth in emerging markets positively influenced world trade and, accordingly, the Group's profit," said Maersk, which is seen as a barometer of global trade as its ships carry around 15 percent of all seaborne containers.

Investors welcomed the bumper profit and a tripling of Maersk's dividend to 1,000 Danish crowns per share.

Maersk posted a net profit of 28.2 billion Danish crowns ($5.18 billion) for 2010 against a loss of 5.49 billion in 2009.

The profit beat a forecast of 27.7 billion crowns in a Reuters poll and was on the high side of its own November guidance for profit "in the order of $5 billion".

"Things look better going into 2011 than a year ago, but our share of oil production will be lower and we still see some uncertainty about the oil price and where container rates will end up," Chief Executive Nils Smedegaard Andersen told Reuters.

Chief Financial Officer Trond Westlie said the higher dividend reflected the "solidity of the group" and the way it sees the business progressing. Maersk does not have a stated dividend policy.

The results came two days after Maersk said it would order 10 huge container ships from Korea's Daewoo Shipbuilding & Marine Engineering for $1.9 billion and take options on 20 more vessels of a similar size to capitalise on expected growth on Asia-Europe routes.

They also followed improved results from container shipping rivals including Singapore's Neptune Orient Lines and Korea's Hanjin Shipping.

More than 40 percent of Maersk's turnover comes from emerging markets, and Andersen said the group would look in 2011 to expand its presence in those markets and continue a "transformation" of Maersk Oil by adding oil and gas resources.

Uncertain 2011

"The company issued a cautious outlook for 2011, which was expected, and which is in line with former patterns of a usually conservative guidance," ING shipping analyst Axel Funhoff said. "The market has factored in this cautious guidance already."

The container shipping business -- where Maersk Line's 570-vessel fleet is the world market leader -- rebounded but missed analysts' average estimate for its operating profit, while the oil and gas business beat expectations.

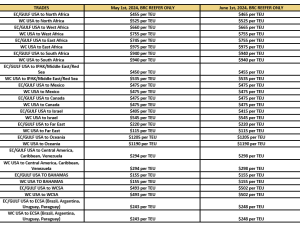

Average freight rates and volumes for Maersk's container ships recovered to near pre-crisis 2008 levels after a steep plunge in 2009.

"The Group's container activities expect a satisfactory result (in 2011), but below the 2010 result," Maersk said.

Analysts took "satisfactory" to mean cautiously optimistic. "We interpret (that) as a result above market consensus," Jyske bank trader Martin Munk said.

Tanker shipping lost money with rates depressed throughout 2010, and Andersen said they would remain low this year.

Assets, not M&A

Andersen said Maersk had the financial strength to invest, but would not embark on an M&A spree.

"We can't invest in everything at once but we do in fact have the strength to take some decisive steps by investing in the right assets -- not acquisitions (of companies) -- and the right ships," he told Reuters.

Cash flow used for capital expenditure this year will be significantly higher than in 2010, said Maersk, which used $5.5 billion to reduce debt last year.

Maersk said it expected global demand for seaborne containers to grow by 6-8 percent in 2011 and the global supply of new tonnage to match or grow more than freight volumes, especially on the Asia to Europe routes.

The group's oil and gas activities benefited from a 29 percent rise in oil prices to an average of $80 per barrel, but were hit by a lower share of output from its big Qa