Here is Rystad Energy’s daily market comment from our Senior Oil Markets Analyst Louise Dickson:

Although prices fell sharply on Wednesday after surprisingly high crude stock builds in the US, today the dust settled and the market sentiment turned bullish ahead of the OPEC+ meeting, as traders expect the group to stand firm on its policy for a gradual modest production increase.

Prices are rising as the market expects a moderate supply increase instead of an acquiescence to calls by the US and other oil producers to bring on more supply sooner.

However, while OPEC+ top producers Saudi Arabia, Russia, Iraq, Kuwait, and UAE all remain unified in sticking to the supply tapering plan of 400,000 bpd, repeated calls from the US, Japan, India, and other oil importers add an element of external pressure that could tip the scale.

Market participants are largely expecting OPEC+ to stick to its supply program, so any increase above 400,000 bpd would come as a surprise and have an exaggerated negative effect on oil prices, despite the amount actually being quite marginal.

The current demand-supply mismatch has pushed oil prices above $80 per barrel Brent for more than a month, which has been a short-term boon for OPEC+ producers but pain for consumers, in particular countries worried about inflation and post-pandemic economic growth.

China has already responded to high commodity prices by releasing volumes of strategic petroleum reserves, and the US is discussing a similar maneuver, so if OPEC+ stays conservative, the market could expect some reactionary releases from the US and China.

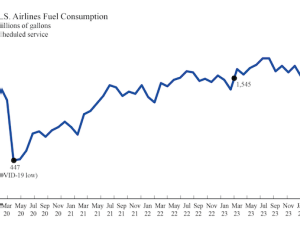

The resurgence of Covid-19 cases, in particular in China, is another reason to remain cautious on the supply side. In Beijing, nearly 50% of flights have been grounded to halt the spread of a local outbreak.

When China reacted to a Covid-19 case resurgence in the summer of 2021, domestic aviation fuel demand fell by nearly 60% in just a matter of weeks as domestic flights were grounded.

The market expects OPEC+ to remain cautious, instead preferring to take a wait and see approach towards oil demand instead of jumping the gun.

And despite the current market tightness, supply is slowly returning, and markets could be rebalanced already by 2022, especially if Iran comes back into the picture.

Rystad Energy estimates Iran's crude oil production to reach around 3.5 million bpd by the end of 2022 in the case sanctions are removed late 2021 or early 2022.

All eyes will be on OPEC+ today and any leaks ahead of the meeting’s conclusion could move prices in either direction.

Although conservatism is the word, OPEC+ has surprised in the past, so if the buy-side pressure has too strongly metastasized, a change of course is not completely out of the question.