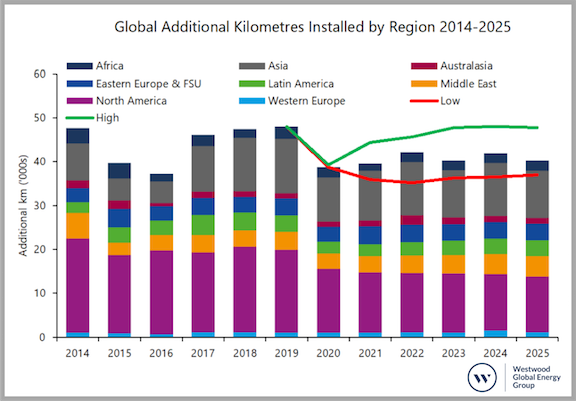

Pipeline installations to fall 19% in 2020, however, demand in Asia and Middle East to support long-term forecast.

Even before the Covid-19 pandemic and subsequent collapse in oil prices, Westwood expected global pipeline installations to fall from recent highs, due to a combination of economic and permitting issues. However, the market collapse has trickled down to all sectors of the oil and gas industry, even the historically well shielded pipelines sector, and has exacerbated the expected contraction in pipeline installations and capital expenditure in 2020 and into 2021.

Westwood foresees that pipeline installations will decline by 19% in 2020, from a high point of 48,000km in 2019. Capital expenditure is expected to fall by a greater amount, being 34% lower in 2020 compared to 2019, predominantly due to several large diameter pipelines with high associated Capex per km being completed in 2019. Operational Expenditure should be more insulated, dropping by an estimated 5% on 2019, as operators halt non-essential operations to both comply with local restrictions related to the Covid-19 panic as well as tighten budgets in the lower price environment. Longer term, with an expected improvement in the market, a number of large km pipelines in Asia and the Middle East are expected to be sanctioned, helping to bolster kilometres installed and capital expenditure, as governments look to expand production capacities and improve infrastructure to take exports to market.

In this report, Westwood reviews global onshore pipeline installation activity through to 2025, providing a regional overview of pipeline installations, as well as capital and operational expenditure. To reflect the current uncertainty in the industry, this edition includes the potential impact of different oil price scenarios on the pipelines sector could have on both new installation activity and Opex.