Growth in seaborne perishable cargo slowed in 2019 but is forecast to better weather the COVID-19 induced economic storm than the dry cargo trade given the broader resilience of the food supply chain. Meanwhile, availability of refrigerated container equipment is forecast to tighten as buoyant trade and continued modal shift boost expansion in reefer cargo carried by containerships, according to Drewry’s latest Reefer Shipping Annual Review and Forecast 2020/21 report.

Worldwide seaborne reefer trade recorded growth of just 1.7% in 2019 to 130.5 million tonnes, its weakest rate of growth since 2015. Traffic growth was held back due to lower shipments of both deciduous and citrus fruits on the back of extreme weather conditions in Europe and drought in South Africa and Chile, though aided by soaring pork traffic into China following the outbreak of African swine fever.

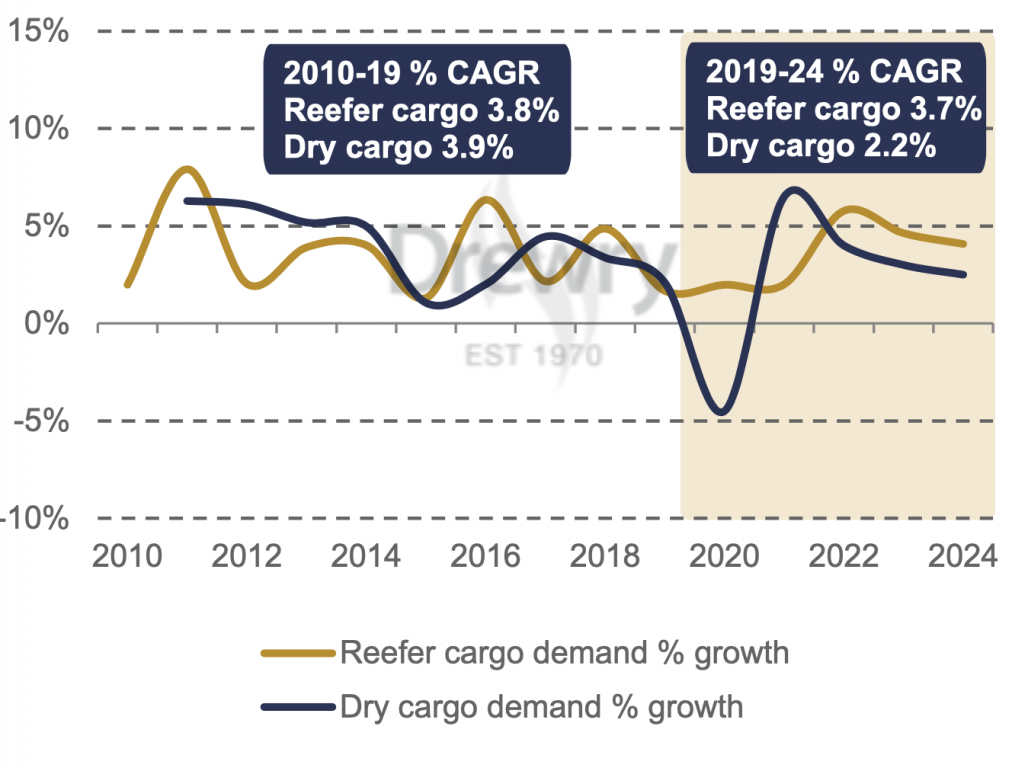

Drewry forecasts that seaborne reefer traffic will reach 156 tonnes by 2024, representing average annual expansion of 3.7% which is faster than the anticipated growth in the wider dry cargo trade (see chart).

“Drewry expects the reefer trade to be more recession proof against the economic impacts of COVID-19,” said Drewry’s head of reefer shipping research Philip Gray. “And near term, it will continue to benefit from African swine fever induced protein demand into Asia. The continuing trade standoff between the US and China remains a threat to transpacific trade, but could provide opportunities on other routes through trade substitution, such as East Coast South America to Asia.”