Russia’s seaborne crude shipments rebounded strongly from two weeks of disruptions, with record-equaling flows from the country’s main export terminals. Eleven tankers completed loading of the country’s ESPO crude at the Pacific port of Kozmino, recovering after a storm halved exports the week before and matching previous highs. Volumes from the Baltic port of Ust-Luga also gained in the week to Feb. 4, after maintenance work cut flows late last month, while shipments from Primorsk equaled the previous week's record.

The bounce back saw weekly average shipments surge by about 880,000 barrels a day to the highest this year. That put flows 400,000 barrels a day above the level Moscow has pledged to its OPEC+ partners for the first quarter on a weekly basis, though 100,000 barrels a day below that target on a four-week measure, which helps to smooth out short-term factors.

Russian exporters are having to rely more heavily on the country’s own tankers and the shadow fleet of aging vessels, with Greek owners disengaging from the Russian crude trade after a ramp-up in US sanctions. The number of Greek-owned tankers hauling Moscow’s crude fell in January to just a fifth of the levels seen last May, vessel tracking-data compiled by Bloomberg show.

Russia has said it will cut oil exports by 500,000 barrels a day below the May-June average during the first quarter, after several other members of the OPEC+ group agreed to make further output curbs. The Russian cut will be shared between crude shipments, which will be reduced by 300,000 barrels a day, and refined products.

Russian crude cargoes continue to run the gauntlet of the southern Red Sea, despite attacks on merchant vessels from Yemen-based Houthi rebels. The Houthis assured Russia and China that the group is “ready to ensure the safe passage of their ships in the Red Sea.” However, the only two tankers reported to have been struck off Yemen were both carrying Russian cargoes. The Sai Baba, hauling Urals crude, was hit by a drone off Yemen on Dec. 23, while the Marlin Luanda, struck by a missile and set on fire last month, was carrying Russian naphtha.

Russia is still struggling to sell its Sokol crude. Sixteen cargoes, totaling about 11 million barrels, are sitting on tankers that appear to be going nowhere. Another three 700,000 barrel cargoes are awaiting transfer from the shuttle tankers that haul them from Sakhalin Island. Two ships have headed back to India, while four have gone to China.

Russia has now lost all its European markets for seaborne crude since its invasion of Ukraine almost two years ago. Bulgaria — Moscow’s last customer in the region — has taken nothing since the end of 2023.

The gross value of Russia’s crude exports jumped to $1.79 billion in the seven days to Feb. 4 from $1.32 billion the previous week. That’s the highest in more than three months. Meanwhile four-week average income rose by $86 million to $1.49 billion a week.

Flows by Destination

Russia’s seaborne crude flows in the four weeks to Feb. 4 rose to 3.19 million barrels a day. That was up from 3.09 million barrels a day in the period to Jan. 28. Shipments were about 400,000 barrels a day below the average seen in May and June, or about 100,000 barrels a day below Russia’s first quarter target. Weekly shipments reached a five-week high of 3.68 million barrels a day.

The four-week average continues to be affected by the storm that closed Kozmino for five days in the week to Jan. 28 and disruptions to shipments from Ust-Luga caused by a drone strike on a neighboring condensate refinery, followed by several days of maintenance.

About 1.8 million barrels of Russian crude is heading to the Caribbean on a VLCC and is due to arrive at its unspecified destination in the region on Feb. 18, according to navigation signals from the ship.

A fourth cargo is heading to Tema in Ghana, where a new refinery built by Chinese investors has begun refining crude. The plant will initially process 40,000 barrels a day, rising to 100,000 barrels with completion of a second phase, due by the end of 2025.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and the Baltic port of Ust-Luga and are not subject to European Union sanctions or a price cap.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

-

Asia

Observed shipments to Russia’s Asian customers, including those showing no final destination, rose to 2.86 million barrels a day in the four weeks to Feb. 4, up from 2.76 million in the previous four-week period.

About 1.1 million barrels a day of crude was loaded onto tankers heading to China. The Asian nation’s seaborne imports are boosted by about 800,000 barrels a day of crude delivered from Russia by pipeline, either directly, or via Kazakhstan.

Flows on ships signaling destinations in India averaged about 840,000 barrels a day.

Both the Chinese and Indian figures will rise as the discharge ports become clear for vessels that are not currently showing final destinations.

The equivalent of about 615,000 barrels a day was on vessels signaling Port Said or Suez in Egypt, or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India or China and show up in the chart below as “Unknown Asia” until a final destination becomes apparent. This figure includes more than 12.5 million barrels of Sokol crude originally destined for India that has been stuck on ships since late November.

Several subsequent cargoes of Sokol have been delivered to ports in China. The country typically takes one or two cargoes a month, out of the nine usually loaded. So far, it has taken four of the cargoes loaded in January, while two more await transfer from the shuttle tankers used to haul shipments from the export terminal at De Kastri.

The “Other Unknown” volumes, running at about 270,000 barrels a day in the four weeks to Feb. 4, are those on tankers showing no clear destination. Most of those cargoes originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others could be moved from one vessel to another, with most such transfers now taking place in the Mediterranean, off the coast of Greece.

Ship-to-ship transfers of crude in the Laconian Gulf off Greece have picked up after several months of inactivity. The VLCC Ligera, holding about 1.8 million barrels, is heading for the Caribbean after taking on cargoes from two smaller tankers. A second supertanker, Achelous, is taking on cargoes at the time of writing.

Europe and Turkey

Russia’s seaborne crude exports to European countries have collapsed since Moscow’s troops invaded Ukraine in February 2022. A market that consumed about 1.5 million barrels a day of short-haul seaborne crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

Flows to Bulgaria appear to have halted at the end of last year, even sooner than the March deadline to end imports approved by Bulgaria’s parliament. That leaves Turkey as the only short-haul market for shipments from Russia’s western ports.

Exports to Turkey were steady at about 260,000 barrels a day in the four weeks to Feb. 4. The recent surge in flows, which took them to more than 440,000 barrels a day in the four weeks to Dec. 12, appears to have waned.

Flows to Bulgaria remained at zero in the most recent four-week period. No cargoes of Russian crude have been delivered to the port of Burgas since the end of 2023.

No Russian crude was shipped to northern European countries, or those in the Mediterranean in the four weeks to Feb. 4.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.

Export Value

Following the abolition of export duty on Russian crude, we have begun to track the gross value of seaborne crude exports, using Argus Media price data and our own tanker tracking.

The gross value of Russia’s crude exports jumped to $1.79 billion in the seven days to Feb. 4 from $1.32 billion the previous week. That’s the highest in more than three months. Meanwhile four-week average income rose by $86 million to $1.49 billion a week. The four-week average peaked at $2.17 billion a week in the period to June 19, 2022. The highest it reached last year was $2 billion a week in the period to Oct. 22.

During the first four weeks after the Group of Seven nations’ price cap on Russian crude exports came into effect in early December 2022, the value of seaborne flows fell to a low of $930 million a week, but soon recovered.

The chart above shows a gross value of Russia’s seaborne oil exports on a weekly and four-week average basis. The value is calculated by multiplying the average weekly crude price from Argus Media Group by the weekly export flow from each port. For shipments from the Baltic and Arctic ports we use the Urals FOB Primorsk dated, London close, midpoint price. For shipments from the Black Sea we use the Urals Med Aframax FOB Novorossiysk dated, London close, midpoint price. For Pacific shipments we use the ESPO blend FOB Kozmino prompt, Singapore close, midpoint price.

Export duty was abolished at the end of 2023 as part of Russia’s long-running tax reform plans.

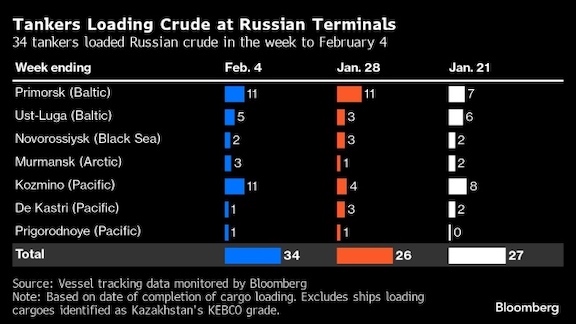

Ships Leaving Russian Ports

The following table shows the number of ships leaving each export terminal.

A total of 34 tankers loaded 25.8 million barrels of Russian crude in the week to Feb. 4, vessel-tracking data and port agent reports show. That was up by about 6.2 million barrels from the previous week.

A record-equaling 11 tankers completed loading ESPO crude at the Pacific port of Kozmino, rebounding after a storm halved exports the previous week.

Exports from the Baltic port of Ust-Luga also rebounded in the week to Feb. 4, after maintenance work cut flows the previous week. A record-equaling 11 tankers also loaded at Primorsk during the week.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Three cargoes of KEBCO were loaded at Ust-Luga during the week.