Russia’s state oil tanker company PJSC Sovcomflot said that US sanctions are putting pressure on its operations, the latest sign that the measures are complicating the delivery of the nation’s petroleum.

Last month, the US Treasury’s Office of Foreign Assets Control designated Sovcomflot and identified 14 crude oil tankers in which the state-controlled firm has an interest. That came on top of wider measures already imposed on non-Sovcomflot ships and Russia-friendly companies since October for violations of a Group of Seven cap on the price of Russian oil.

“New sanctions are creating additional operational difficulties for doing business,” Sovcomflot said in a statement. “The company is working to overcome current challenges and continues to operate the fleet as usual.”

The measures imposed late last year began a period of sanctions tightening aimed at squeezing the Kremlin’s access to petrodollars to fund the war in Ukraine. Prior to that, Moscow had started to find workarounds by amassing a vast so-called shadow fleet of tankers to deliver its oil. There is nevertheless a caution from western regulators about steps that could drive up global fuel prices and add to inflationary pressures.

Most of the individually sanctioned tankers since October all but halted trading or faced notable disruption after the measures were imposed. Traders in Asia, by far the largest recipients of Russian crude, said the measures are making it harder and more expensive to find suitable ships for the trade.

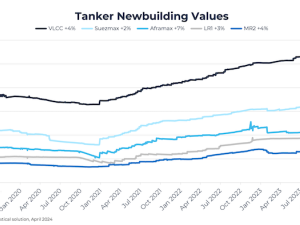

Traders at Chinese oil teapot refiners said freight rates for vessels handling sensitive crude like Russia’s have remained resilient — despite a weakening in the wider shipping market — as more tankers get sanctioned or singled out by the US.

As such, the sellers of Russian grades have been asking for too-high prices for Urals and ESPO grades — especially given a limited pool of buyers willing to deal with Moscow, the traders said.

Separately, shipowners who handle sensitive crudes said they are increasingly wary of any kind of dealings with sanctioned vessels.

The implied cost of delivering Russia’s flagship Urals oil to India is about 20% of the export price of cargoes as they leave Russia, according to data from Argus Media compiled by Bloomberg. It’s hard to know how much of that cost is truly being borne by Russia.

_-_28de80_-_58820516bd428ab3fd376933932d068c43db9a4a_lqip.jpg)