Stirrings of a recovery in global travel are bringing airlines back from the brink, but the rebound may come too late for several carriers still facing a heightened risk of bankruptcy, a Bloomberg News analysis shows.

Covid-19 paralyzed international aviation as nations locked their borders and imposed other restrictions that are only now being dismantled in some parts of the world. Asia is lagging, with China and Hong Kong almost completely walled off, and the financial positions of some airlines in the region have deteriorated since Bloomberg did the same analysis in March and November 2020.

And while governments in Europe and the U.S. injected billions of dollars in aid into carriers, state help wasn’t as forthcoming elsewhere, leaving cash-strapped airlines to work out restructures in court or directly with creditors.

“These airlines were already in a bad financial state” before Covid-19, said Mark Martin, founder of Dubai-based Martin Consulting LLC. Most of those still stuck in the quagmire are there because the markets they usually cater to came to a standstill due to the pandemic, and they had no other way of attracting flyers, he said.

Using the Z-score method developed in the 1960s by American finance professor Edward Altman to predict bankruptcies, Bloomberg studied publicly-listed major commercial airlines to identify those most under threat. Scores of 1.8 or below indicate bankruptcy risk, while above 3 suggests sound footing. This doesn’t take into account sources of potential additional funding.

The Z-score uses five variables: liquidity, solvency, profitability, leverage and recent performance. The model initially had accuracy rates of more than 95% in predicting bankruptcies, but that has come down to between 80% and 90% for forecasts made within a year of insolvency, Altman said in a 2018 interview.

Bloomberg’s analysis didn’t cover non-operational and chartered airlines, and removed carriers with the smallest fleets. Of the lowest scorers, six are in Asia, where inter-regional air passenger traffic is still 61% below pre-pandemic levels, versus about 25% for Europe and only 0.5% in the U.S., according to aviation analytics firm Cirium. Beijing’s Covid-Zero strategy has severely limited international travel by Chinese tourists, clouding the outlook.

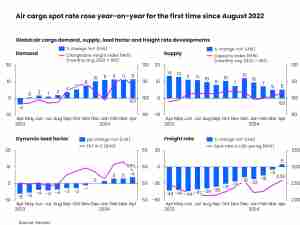

One silver lining is cargo operations, which have cushioned the massive losses in passenger revenue thanks to robust demand for everything from laptops to vaccines during lockdowns. Airfreight helped Indian budget carrier SpiceJet Ltd.—which featured on the list of possible bankruptcies in 2020 but has since improved its position—to a profit in the three months ended Dec. 31.

Hardest Hit

Since early 2020, when the pandemic essentially halted global air travel, at least 68 airlines have either entered or exited bankruptcy, or were liquidated, consultancy firm Ascend by Cirium, which maintains a database on aviation, said in September.

Z-score analysis is based on historical data, usually the most recent financial results, so some airlines on the list may now be in a healthier position after receiving financial support or emerging from insolvency. Norwegian Air Shuttle ASA said its cash and cash equivalents rose to 7.7 billion Norwegian kroner ($866 million) at the end of 2021, after it restructured debt in court-supervised insolvency proceedings.

“We now have a strong financial position with low interest-bearing debt and a right-sized and flexible aircraft fleet and organization,” Norwegian Air spokesman Esben Tuman said in an email.

Meanwhile, Thai Airways International Pcl needs about $750 million in funding to keep flying and hopes to get a loan within six weeks as it restructures at least 170 billion baht ($5.3 billion) of debt.

Pakistan International Airlines Corp.’s position isn’t as perilous as its -8.3 Z-score suggests because the carrier’s debt is backed by sovereign guarantees, said Abdullah Hafeez Khan, a spokesman for the airline. A plan is in the works to shift about $3 billion in debt from its balance sheet, he said.

“The world is opening and travel restrictions are going away gradually, but it is not yet over,” Khan said.

AirAsia X Bhd., the long-haul unit of Malaysian tycoon Tony Fernandes’s recently rebranded Capital A Bhd., has the lowest Z-score in the latest analysis. Once touted as a potentially revolutionary model for budget international travel, AirAsia X’s commercial passenger operations have been grounded since March 2020 and it is restructuring debt after offering to pay creditors just 0.5% of more than $8 billion owed and terminate existing contracts.

The airline’s business model, which is dependent on low-cost international travel, came to a halt when lockdowns were imposed and long-haul flying suddenly became a thing of the past.

AirAsia X this week said it plans a smaller fundraising than previously approved and that it expects to have seven aircraft operational by the end of the quarter. The company’s chief financial officer also said the airline would be alright for the next couple of years even if borders don’t reopen. An AirAsia X spokesperson declined to comment on Bloomberg’s analysis.

Thai Airways, Nok Airlines Pcl and Gol Linhas Aereas Inteligentes SA didn’t respond to requests for comment.

Philippine Airlines Inc. said its prospects are brighter following a restructuring. The carrier, whose parent PAL Holdings Inc. has a Z-score of -1.68, won court approval in December for a reorganization to exit bankruptcy, which included cutting $2 billion in debt.

“Philippine Airlines emerged last Dec. 31 from a successful restructuring process through which we acquired fresh capital, lowered our debt and streamlined our fleet, thus shoring up our financial position,” Chief Financial Officer Nilo Thaddeus Rodriguez said in an emailed statement.

Azul spokesman Danilo Alves said while the company was familiar with the Z-score indicator, most investors tend to focus on future performance rather than backward-looking analysis.

Colombia’s Avianca Holdings SA emerged from a “very successful” restructuring process on Dec. 1 with much lower debt and over $1 billion in liquidity, spokeswoman Lina Guevara wrote in an email. “Demand has been strong and we have been operating very high load factors on our flights for the last several months.”

In Indonesia, creditors of PT Garuda Indonesia submitted about 198 trillion rupiah ($13.9 billion) in claims as part of a debt restructuring. Garuda has a score of -2.05.

“Garuda is technically bankrupt from financial point of view,” Kartika Wirjoatmodjo, a deputy at Indonesia’s Ministry of State-Owned Enterprises, wrote in a text message on Feb. 17. “That’s why we have to go through the court-supervised restructuring process to get debt reduction.”

Green Shoots

Passenger revenue for global airlines dropped $372 billion in 2020 from the previous year, according to the United Nations’s International Civil Aviation Organization. Last year wasn’t much better, with revenue $324 billion lower than in 2019. The figure is forecast, however, to be some $227 billion below pre-pandemic levels this year.

While new virus variants and restrictions could still crop up, underlying demand remains strong and international travel will recover as curbs are lifted, International Air Transport Association Director General Willie Walsh said last month.

“The rebound also has to be smart,” said consultant Martin. “Everybody starts the race from point zero—it’s now about how fast you can run to capture the market, maintain your network and sustain your operations.”