- Global sawlogs prices fell again in the 3Q/16 after a temporary increase in the 2Q/16, following an almost two year-long downward trend. The Global Sawlog Price Index (GSPI) has fallen by 14.3% in two years and currently is almost 12% below the ten-year average.

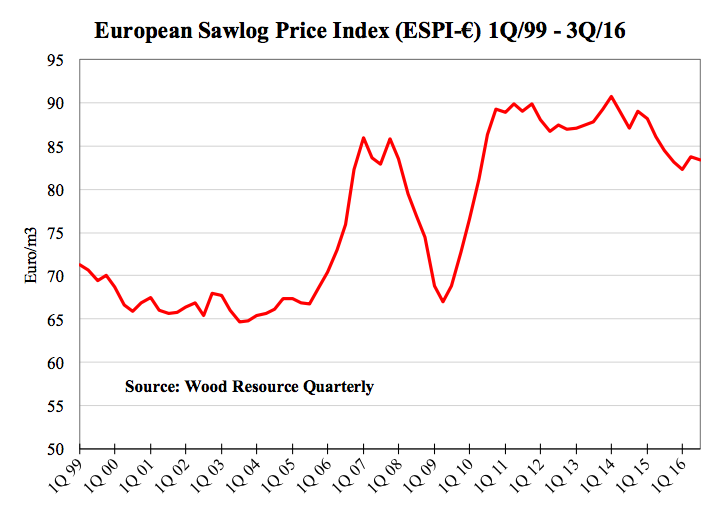

- In the 3Q/16, the European Sawlog Price Index (ESPI-€) fell by 0.5% from the previous quarter to €83.40/m3. The Index has trended downward for the past few years, and in 2016, was at its lowest level since 2010. Much of the recent decline has been the result of reduced demand for lumber in some markets and generally lower lumber prices in both domestic and export markets.

- The two Global Wood Fiber Price Indices were close to parity at US$88.46/odmt in the 3Q/16. The Hardwood Wood Fiber Price Index (HFPI) has rebounded by 5.6% from the 1Q/16 when it reached an 11-year low. The biggest price increases this year have been in Brazil, Indonesia, Australia and Chile where prices have gone up despite the strengthening of the local currencies. However, hardwood fiber prices have not gone up in all markets this year. Hardwood pulplog prices were lower throughout Europe, Eastern Canada and the US South.

- Softwood chip and pulplog prices fell in the local currencies in most of Europe and North America which, together with a stronger US dollar against the Canadian dollar and the Euro, resulted in a decline of the Softwood Wood Fiber Price Index (SFPI) in the 3Q/16.

- Global production of market pulp continues to go up and was 3.5% higher during the first eight months of this year than it was during the same period in 2015.

- On the demand side, China has shown the biggest change from earlier in 2016 by increasing importation in the 3Q/16 by 11% from the previous quarter. Softwood pulp prices have remained steady during most of 2016 in both Europe and North America.

- Softwood pulp prices have remained steady during most of 2016 in both Europe and North America. Prices for hardwood pulp have trended downward from late 2015 to October of this year

- The World Trade Organization (WTO) reported in September that overall world trade will expand by only 1.7% in 2016, a downward revision from earlier this year and the slowest pace since the global financial crisis in 2009. This gloomy forecast however, is not true regards the global trade of softwood lumber. In contrast to general world trade, global demand for lumber increased in 2015 and 2016, resulting in a rise in trade by 10.2% in 2015, and WRI estimates that the increase will be as much as 13.6% in 2016.

- The slow and steady improvements in the US housing market in 2016 have resulted in both higher production domestically and an increase in lumber imports.

- During the summer and fall, China has seen strong demand for imported softwood lumber with the import volumes for the 2Q/16 and the 3Q/16 reaching their highest level on record.

- Russian export prices have been fairly stable so far this year with only slight increases during the fall. In US dollar terms, prices continue to be at their lowest levels in over ten years, thanks to the weak Russian Rouble.

- Residential pellet prices in Europe have moved slightly upward this fall but still have a way to go before reaching the same levels as last fall. Import volumes of pellets to South Korea have increased rapidly and the country was the second largest importer of pellets in the 3Q/16.

- Import volumes of pellets to South Korea have increased rapidly and the country was the second largest importer of pellets in the 3Q/16. The major suppliers in 2016 have been Vietnam and Malaysia, together supplying 84% of the total import volumes.