Here is Rystad Energy’s gas and LNG market update from senior analyst Lu Ming Pang

The Dutch Title Transfer Facility (TTF) gas price hit $14.10 per million British thermal units (MMBtu) on 15 June, following a rally in the past two weeks from $7.90 on 31 May, in what has been an otherwise quiet summer.

This is likely due to an unexpected extension to maintenance work affecting Norwegian pipeline flows into Europe. Asian Spot LNG prices for July remained near constant at $9.40 per MMBtu as of 15 June, while prices for August increased to $12.59 per MMBtu, so far resisting a stronger rally on relatively weak demand in Asia.

The Henry Hub price remains at $2.41 as of 15 June, staying relatively insulated from price changes in Europe.

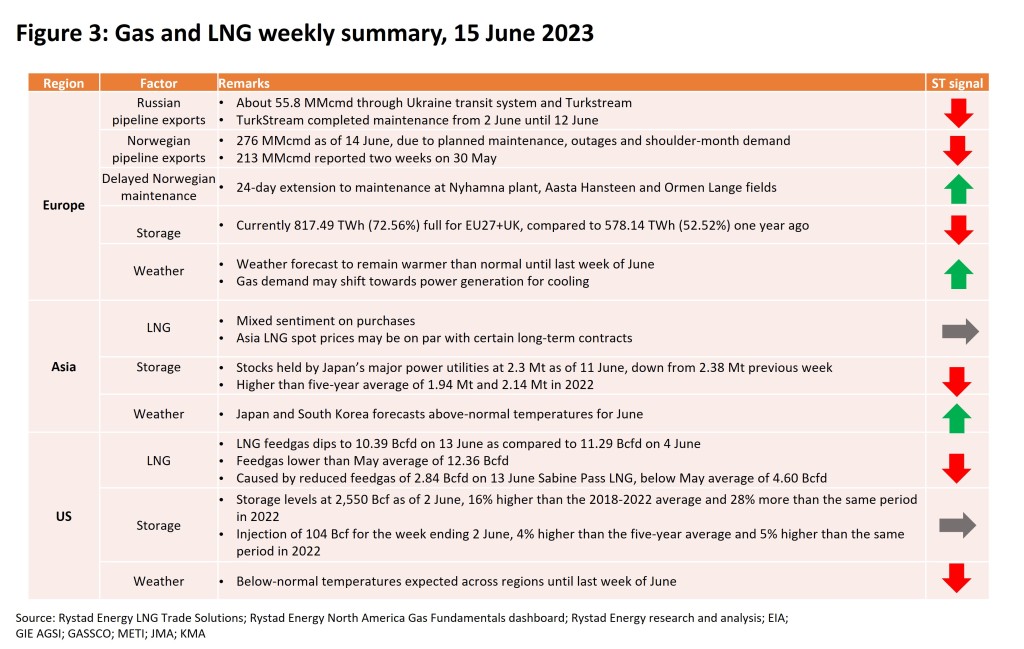

Europe

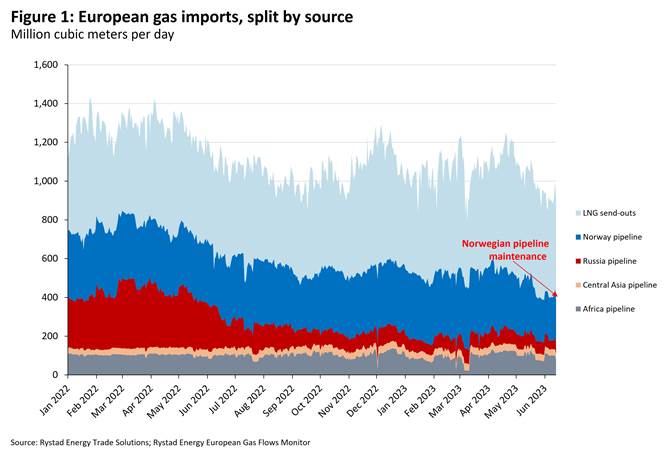

The TTF price of $14.10 per MMBtu is far above the $8.43 reported on 6 June. This is on the back of extended maintenance affecting Norwegian pipeline flows, which were originally expected to conclude on 21 June.

Norwegian maintenance at the Nyhamna, Ormen Lange, Oseberg, and Asta Hansteen facilities, amongst others, have kept flows lower in the past weeks.

Ongoing maintenance at the Nyhamna gas processing plant along with parallel maintenance at its feed gas fields, Aasta Hansteen and Ormen Lange, have all been extended by almost a full month to 15 July instead of the original estimated end date of 21 June.

Nyhamna will have an affected capacity of 78.8 million cubic meters per day (MMcmd), while the Aasta Hansteen and Ormen Lange fields will have an affected capacity of 25.8 MMcmd and 24.2 MMcmd, respectively.

Norwegian flows have now increased to 276 MMcmd as of 14 June, up from the 237 MMcmd reported on 6 June.

This should have been bearish for TTF prices, but the extension of maintenance work means the market will now have to account for the unexpected shortfall despite the return of some supplies.

Although Norwegian flows have increased, they remain lower than the typical flows of 300 MMcmd or higher that were seen in other parts of the year.

Russian flows are now back at 58.8 MMcmd as of 12 June, with 37.3 MMcmd going through the Ukraine transit system and 21.5 MMcmd through the Turkstream facility, which concluded maintenance undertaken from 5 to 12 June.

Of particular note is that storage levels remain high at 817.49 terawatt-hours (TWh) – or 73.57 billion cubic meters (Bcm) – and were 72.56% full as of 12 June. As reported last week, storage levels continue to keep a lid on prices as Europe looks on track to reach its 90% target before 1 December 2023.

Storage levels were at 578.14 TWh – or 52.03 Bcm – and 52.52% full on 13 June 2022 last year.

Regasification send-outs in Europe also recovered to 529 MMcmd on 13 June as compared to 495 MMcmd on 8 June.

This is on the back of Montoir LNG completing part of its maintenance plans that are expected to last until July, with one phase from 3 June to 11 June having seen regasification capacity reduced by 100% during the period.

Assuming 78 MMcmd of affected capacity on Norwegian pipeline flows for an additional 24 days implies that the market would have to make up for the loss of 1.89 Bcm, which is equivalent to about 20 liquefied natural gas (LNG) cargoes.

Assuming regasification terminals in and pipeline flows into Northwest Europe are already running at close to maximum capacity, this would explain why TTF prices have surged in the past two weeks.

The weather, as reported last week, is expected to remain warmer than normal until the end of June.

Barring extraordinary events, prices typically pick up around August and September, as compared to the shoulder summer injection season.

Considering strong storage and supply fundamentals and assuming there are no further supply shocks, this surge in price may be short-lived once Norwegian flows come back online.

Hammerfest LNG is expected to return to service on 14 June, following an extension to an outage that originally started on 31 May.

The 148,000-cubic-meter Artic Princess LNG carrier is currently in the vicinity of the plant.

Asia

Asia spot LNG prices were at a premium to TTF just two weeks ago when the arbitrage between the two hubs was open.

With Asia spot prices for July now at $9.40 per MMBtu at the time of writing on 15 June, the dynamics have switched, with the TTF now holding a premium again over Asia spot LNG prices for July.

The Asia spot price for July has not changed significantly in the past week, holding at $9.26, as reported on 6 June, despite sharp increases in the TTF.

However, prices for the future months have risen to $12.59 per MMBtu for August and $13.04 for September as of the time of writing, which may more accurately reflect market sentiment for the months ahead.

There continues to be slight interest in spot LNG purchases given the relatively low prices compared to what was observed last year, however, the Asian spot price for August has continued to remain behind and has not matched the sharp trajectory in TTF prices, which may reflect relative weakness in market demand.

When the arbitrage was open between Europe and Asia, spot charter rates in the West of Suez and East of Suez increased.

Spot charter rates in the West of Suez increased to $52,000 per day from $30,000 at the start of June, while spot rates in the East of Suez increased to $48,000 from $38,000.

A typical US cargo takes about double the number of days to complete the same laden voyage to Asia instead of Europe, which may have driven up spot charter demand and prices in that period.

High storage levels in Northeast Asia continue to suppress demand, with LNG inventories in major utilities in Japan still holding 2.3 million tonnes of storage as of 11 June.

This is 18% higher than the five-year average, and 7% higher than during the same period last year.

As reported last week, the weather for most regions in Japan is forecast to have at least a 40% probability of above-normal temperatures until the third week of July.

Regions in the north are even forecast to experience a 70% probability of above-normal temperatures during this period. South Korea has forecast a 40% probability of above-normal temperatures nationwide for the last week of June.

This tapers down to 30% probability by the first week of July, before picking back up to 40% probability for the second and third weeks of July.

Once again, compared to the current Brent price of $74 per barrel, assuming a constant of $0.50 per MMBtu, the current Asian spot LNG price gives an implied 11.8% slope, which may be comparable to long-term contracts signed in recent years.

Brunei LNG, which experienced an unplanned outage on 12 June, is reported to have returned to service.

US

The US continues to remain insulated, with Henry Hub prices at $2.41 per MMBtu as of the time of writing on 15 June, as compared to $2.23 per MMBtu on 6 June in our previous report.

Strong storage and supply fundamentals remain at play in the US, continuing to keep prices suppressed.

Storage levels were at 2,550 billion cubic feet (Bcf) as of 2 June, which is 16% higher than the five-year average and 28% higher than during the same period last year.

Injections were at 104 Bcf as of 2 June, which is 4% higher than the five-year average and 5% higher than during the same period last year.

The weather in the US is expected to generally be slightly colder than normal until the last week of June when it is expected to be warmer than normal.

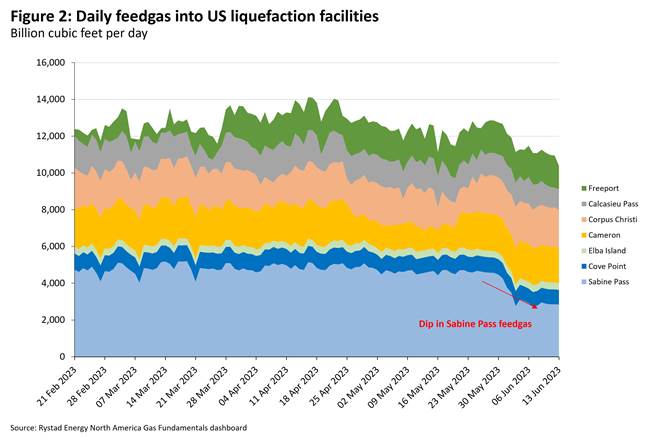

Feedgas into US liquefaction sites dipped to 10.39 billion cubic feet per day (Bcfd) as of 13 June, which is the second consecutive week since feed gas levels dropped below 12 Bcfd for the first time on 2 June. This is on the back of Sabine Pass LNG starting planned maintenance on two out of six trains this month when feed gas was observed to fall below 4 Bcfd mark on 1 June.

Feedgas into Sabine Pass was at 2.84 Bcfd as of 13 June, which is below the May average of 4.6 Bcfd.

With reduced demand for feed gas, high storage levels, and relatively mild weather, fundamentals in the US are not expected to change.

TotalEnergies announced on 14 June that it will purchase a 17.5% stake in NextDecade, which will help enable the latter’s Rio Grande LNG project to proceed to the next stage.

As part of this deal, TotalEnergies will receive 5.4 million tonnes per annum (tpa) of LNG from the first phase of the project in Texas.