Australia’s BC Iron shuts iron ore mine as price sinks

By: Reuters | Dec 10 2015 at 10:42 PM | Maritime

SYDNEY - Australian iron ore miner BC Iron Ltd on Friday said it was suspending operations at its Nullagine joint venture, the second company in the country to take such a step this year due to plunging prices for the steelmaking ingredient.

Oversupply and a slowing economy in top consumer China have hit iron ore markets hard, piling pressure on smaller producers such as BC Iron, which owns 75 percent of the Nullagine joint venture in Western Australia. Fellow Australian miner Fortescue Metals Group holds the rest.

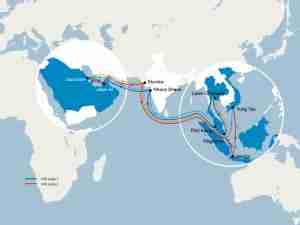

The partners commenced exports in early 2011, using a Fortescue rail line to haul up to 6 million tonnes of ore annually to Port Hedland, where it is shipped to overseas buyers. That volume is a fraction of the amounts churned out by the nation’s top producers Rio Tinto and BHP Billiton .

“BC Iron is a price taker and unfortunately ... the iron ore market is such that we have had to make this decision,” said BC Iron managing director Morgan Ball.

The company and other miners have increasingly relied on a weaker Australian dollar, cheap freight rates and lower costs associated with a drop in oil prices to maintain satisfactory margins.

But a sharper-than-expected decline in ore prices has tested the ability of all but the lowest-cost miners to stay afloat.

Iron ore for immediate delivery to China’s Tianjin port this week stood around $37.50 a tonne <.IO62-CNI=SI>, according to The Steel Index, the lowest level since it began collecting data in 2008.

UBS recently estimated BC Iron’s break-even cost at $52 a tonnes.

BC Iron said it expected its cash balance to stand at A$42-47 million ($64.6 million) at year-end, compared to A$71.8 million on Sept. 30.

The closure comes after Atlas Iron suspended production in April and laid off two-thirds of its employees, resuming only after securing financial backing and selling the bulk of its output forward at fixed prices.

Meanwhile, Fortescue last month put its break-even costs at around $37 a month, dangerously close to current prices. That compares with around $27-$28 a tonne for Rio Tinto and BHP. ($1 = 1.3784 Australian dollars)