U.S. exports of liquefied natural gas (LNG) continued to grow in 2020, averaging 6.6 billion cubic feet per day (Bcf/d) on an annual basis and increasing 1.6 Bcf/d (32%) year-on-year, according to U.S. Energy Information Administration’s recently published Natural Gas Monthly, which now includes data through the end of 2020. U.S. LNG exports were at relatively high levels from January through May. In the summer months, they declined to record lows following record declines in international natural gas and LNG prices. By October, U.S. LNG exports started to increase, despite brief interruptions caused by hurricanes Laura and Delta. In November and December 2020, U.S. LNG exports reached an all-time high as spot prices in Asia increased following a period of extremely cold weather and unplanned outages at LNG export facilities in several countries reduced global LNG supply.

U.S. LNG exports increased as new LNG export capacity was added in 2020. The third and final liquefaction units (called trains) at Freeport LNG and Cameron LNG started commercial operations in May and August, respectively. The third train at the Corpus Christi LNG facility in Texas loaded its first cargo in December, six months ahead of schedule, and the remaining small-scale moveable modular liquefaction system units at Elba Island entered commercial service by August.

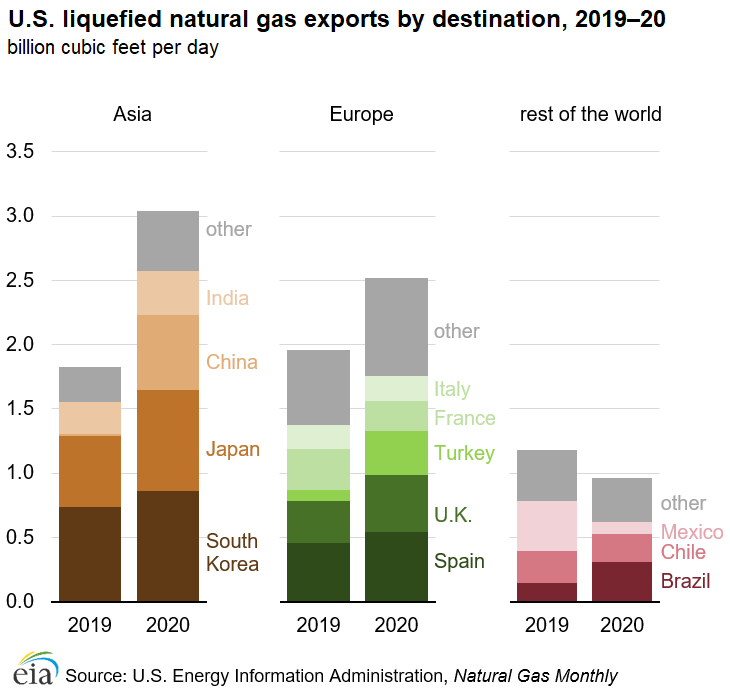

Asia overtook Europe to become the main destination for U.S. LNG exports in 2020, accounting for 47% (3.1 Bcf/d) of total exports, an increase of 1.2 Bcf/d (67%) compared to 2019. The largest increase in U.S. LNG exports was to China, which grew to 0.6 Bcf/d in 2020 after China lowered tariffs on imports of LNG from the United States from 25% to 10%. In comparison, in 2019, when tariffs were at 25%, only two LNG cargoes from the United States were shipped to China. India also increased imports of LNG from the United States by 0.1 Bcf/d year-on-year, particularly in the spring and summer months of 2020, when LNG prices were at record lows. U.S. LNG exports to Japan grew by 0.2 Bcf/d year-on-year, primarily in the fourth quarter of 2020 with the start of the new long-term contracts and increased seasonal winter demand.

U.S. LNG exports to Europe also increased in 2020, averaging 2.5 Bcf/d, an increase of 0.6 Bcf/d from the prior year. Europe was the main destination for U.S. LNG exports in 2019, accounting for 39% of total exports as warm winter weather in Asia and declining price differentials between spot natural gas prices in Europe and Asia led to increased volumes of U.S. LNG exports delivered to Europe. In 2020, compared to the prior year, U.S. LNG exports increased primarily to Turkey (by 0.3 Bcf/d), United Kingdom, Spain, Greece, and Lithuania (by about 0.1 Bcf/d to each country).

U.S. LNG exports to several countries in the Americas (including Colombia, Chile, Argentina, Mexico) and the Middle East (Jordan and the U.A.E.) declined by a combined 0.5 Bcf/d in 2020 compared to 2019. U.S. LNG exports to Mexico declined by 0.3 Bcf/d compared to 2019 as a result of COVID-19 mitigation efforts that reduced demand for natural gas in the first half of the year and as growing U.S. exports by pipeline continued to displace LNG imports. In contrast, Brazil more than doubled its LNG imports from the United States (an increase of 0.2 Bcf/d over the prior year) as drought conditions limited hydroelectric power generation, which increased demand for electricity generated by natural gas-fired power plants.

_-_28de80_-_58820516bd428ab3fd376933932d068c43db9a4a_lqip.jpg)