Gas prices on the Netherlands-based Title Transfer Facility (TTF) fell 14% to around $9.4/MMBtu as of 11 July due to weak demand and healthy supply.

In Asia, spot LNG prices are fluctuating around $11/MMBtu for August delivery as of 11 July, with the monthly average expected to settle at $12/MMBtu or slightly below.

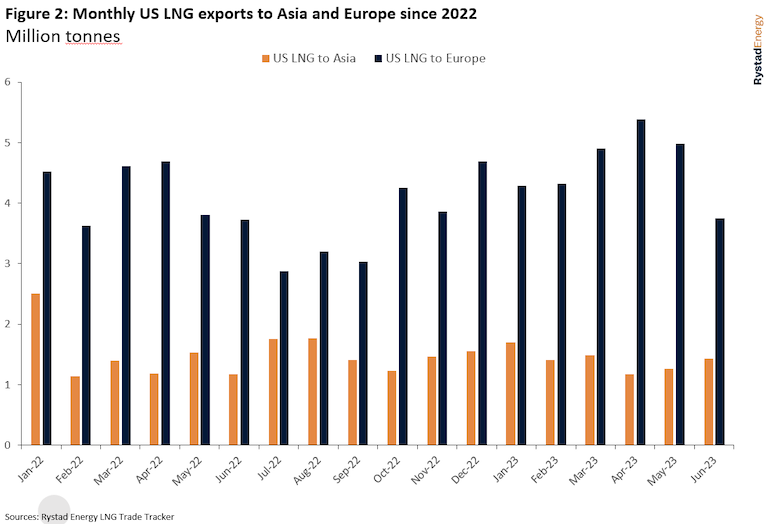

This has incentivized some players with US free-on-board LNG cargoes to direct their LNG towards Asia rather than Europe.

However, finding Asian importers may be difficult as some countries still face high inventory, subject to demand fluctuation during summer.

Supply from the US remains robust, though some decline in LNG exports may be expected due to possible issues at Sabine Pass Train 3.

Europe

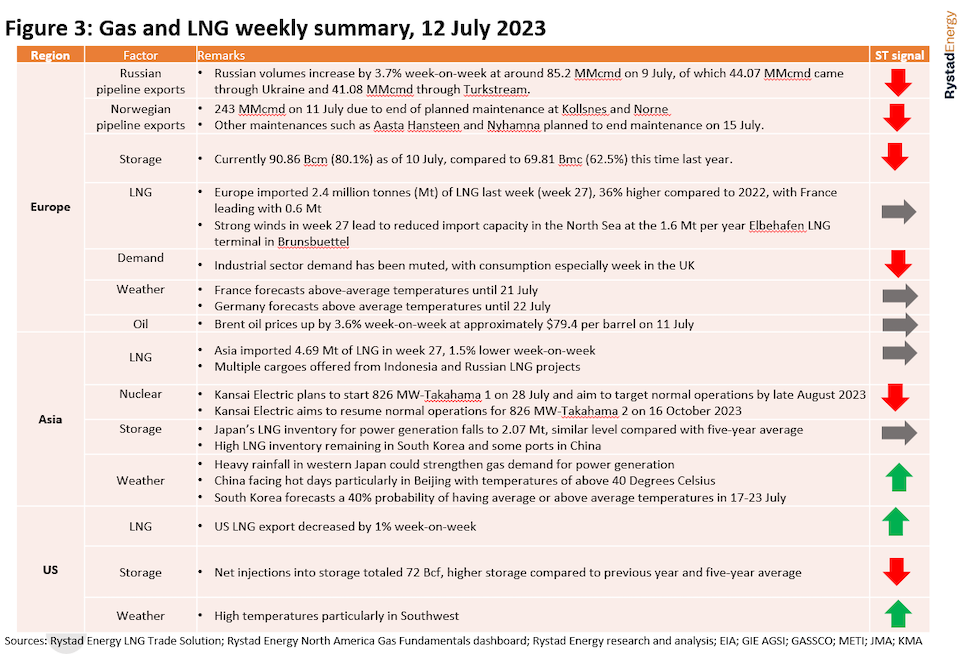

Spot LNG prices for northwest Europe delivery were about $8.9 per MMBtu on 11 July, 18% lower on the week.

High inventory, muted demand and weak economic growth globally weigh heavily on prices, although there is still a risk of higher prices due to political uncertainty.

Europe continues to inject gas into storage, with storage levels well above 2021 and 2022 for this time of the year.

Storage facilities are currently 80.1% full at roughly 90.9 Bcm, well positioned to reach the 90% target before November.

The withdrawal rate is currently around 29.8 MMcmd at an injection rate of 279 MMcmd.

At the country level, UK storage is 56% full, with France at 66% and Germany at 83%.

Europe imported 2.4 million tonnes (Mt) of LNG last week (week 27), 36% higher than the same week of 2022, with France leading with 0.6 Mt.

However, high winds in week 27 reduced import capacity in the North Sea, as some equipment was damaged at the 1.6 Mt per year Elbehafen LNG terminal in Brunsbuettel.

Gas consumption fell 10% in major countries such as Germany, France, and the UK last week compared to late June.

On the gas supply side, Norwegian flows have recovered to 243 million cubic meters per day (MMcmd) on 11 July with the return of fields, including Norne and the Kollsnes onshore facility, from planned maintenance.

The Aasta Hansteen field and the Nyhamna processing plant are planned to end maintenance on 15 July, while the Troll field is due to end maintenance on 13 July.

Meanwhile, Russian flows were around 85.2 MMcmd compared to 82.1 MMcmd a week earlier.

Regarding weather, France is likely to face above-average temperatures until 21 July, while Germany is predicted to see above-average temperatures until 22 July.

Asia

In the Asian spot LNG market, several sell tenders emerged from Indonesia’s Bontang LNG for September and October delivery, with deadlines on 11 July.

Russia’s Novatek offered LNG for 1-4 September delivery into Asia on a delivered ex-ship (DES) basis.

Russia’s Sakhalin Energy also sold two August and two September delivery cargoes to a major Chinese importer.

On the buy side, pockets of demand emerged from South Asia, while buying interest from East Asian importers remained limited despite strengthening downstream demand in some countries.

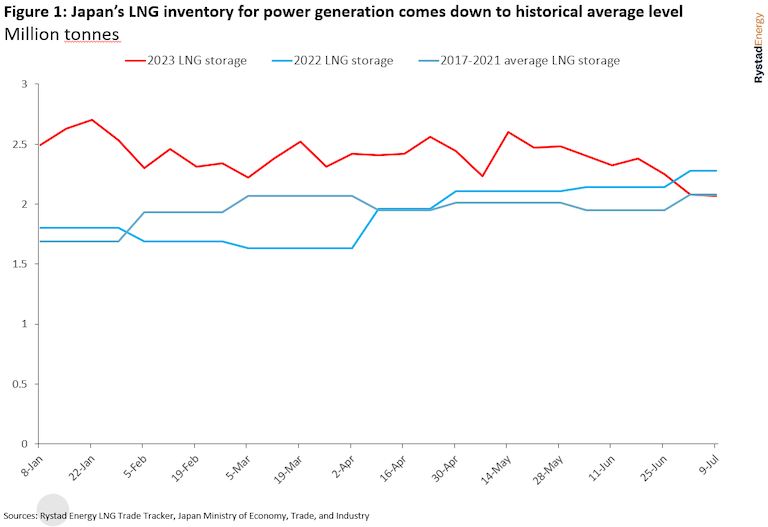

On 12 July, the Japan Ministry of Economy, Trade, and Industry reported major Japanese power utilities’ combined storage levels of 2.07 million tonnes (Mt) of LNG as of 9 July, some 9% lower than the 2.28 Mt reported in the same period last year, and 21% higher than the five-year average of 1.95 Mt.

This is lower than the inventory held at the end of July 2022 at 2.28 Mt and similar to the average LNG stored between 2017 and 2021 at the end of July at 2.08 Mt.

A combination of high humidity during the rainy season leading to more demand for power and less power generation from renewable sources such as solar have contributed to more robust downstream demand.

Meanwhile, LNG consumption for city gas production remains muted at around 1.8 Mt for April, down 12% year-on-year, according to data released by Japan’s Ministry of Energy, Trade, and Industry on 29 June.

LNG inventory held by the city gas sector was around 2.6 Mt at the end of April, 32% higher than the previous year.

China and South Korea’s LNG inventories also stay high, prompting some importers to delay the delivery of cargoes.

Higher-than-normal inventory levels in East Asia could dissuade major purchasers in Northeast Asia from spot market purchases.

Some ports in China face high inventory, causing importers to request delays in LNG deliveries.

At the time of writing on 12 July, players with US-origin LNG cargoes are likely to bring their volumes to Asia rather than Europe as the arbitrage is open for September and October delivery, even when considering total shipping cost.

Consequently, we will likely see more US-origin LNG in Asia in the coming months.

US – Ade Allen, Senior Gas Markets Analyst (New York)

Dry gas production has averaged 102 Bcfd for July, a robust production level that could risk destabilizing domestic balances as the market moves further into injection season.

US LNG exports averaged 1.75 Mt last week and could be reduced this week due to potential issues at Sabine Pass Train 3.

We expect exports to average close to 13 Bcfd in July, barring unforeseen circumstances.

Robust exports will be necessary to keep the market balanced, especially since production remains resilient.

Gas-for-power demand is tightening domestic balances as a nationwide heat wave means that gas bears the bulk of the load for power generation.

Power demand peaked last week at 47.95 Bcfd on 6 July.

If temperatures remain higher than average, we can expect higher peaks, and the pace of injections will slow as the market tightens.

Last week (week 27), the US lower 48 states injected 72 Bcf into storage.

4 Bcf was reclassed as base storage, so net-net 68 Bcf was injected. Henry Hub prices declined to end the week at $2.58 MMBtu (7.7% lower on the week), with storage remaining elevated, especially in the producing regions.

However, even with potential upside movement due to tighter balances, we expect prices to remain below $3/MMBtu.

_-_28de80_-_58820516bd428ab3fd376933932d068c43db9a4a_lqip.jpg)