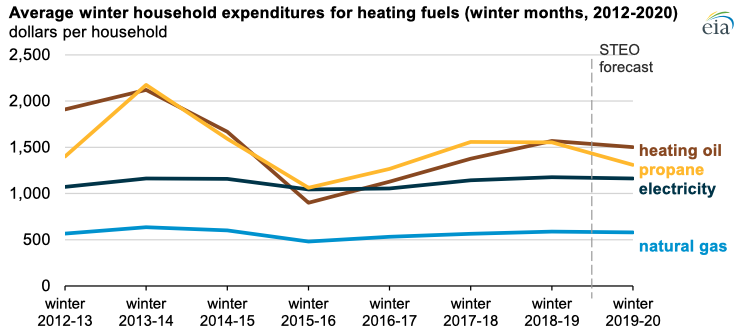

On average across the United States, households can expect heating expenditures this winter (October through March) to be lower than last winter’s, according to the U.S. Energy Information Administration’s (EIA) Winter Fuels Outlook, released at noon today. EIA expects households that primarily use electricity or natural gas as their heating source to spend slightly less than last winter, households that use heating oil to spend 4% less, and households that use propane to spend 16% less. Only natural gas bills in the South are likely to rise significantly, by about 4%, primarily as a result of higher regional natural gas prices. EIA’s forecast of winter heating expenditures are based on fuel price and consumption forecasts from EIA and weather forecasts from the National Oceanic and Atmospheric Administration (NOAA).

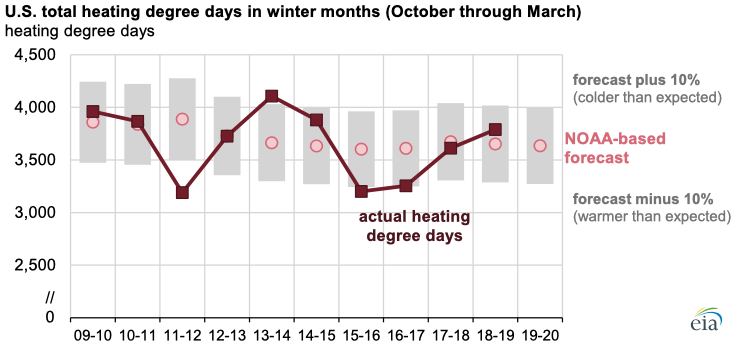

Because U.S. winter heating demand is highly dependent on weather, EIA’s Winter Fuels Outlook includes two additional forecasts, one for colder and one for warmer weather this winter. EIA uses heating degree days to measure colder or warmer winter weather. Heating degree days are daily temperature differences compared with a base temperature of 65 degrees Fahrenheit (about 18 degrees Celsius). For example, a daily average temperature of 45 degrees is equivalent to 20 heating degree days. When added up across a winter, colder temperatures mean more total heating degree days.

To produce regional values over the winter, NOAA weights heating degree days by population and sums them over time. NOAA expects the United States as a whole to experience 3,635 heating degree days this winter, a value slightly lower (warmer) than the average of the previous 10 winters. Seven of the past 10 winters have been within 10% (either warmer or colder) of NOAA’s forecast.

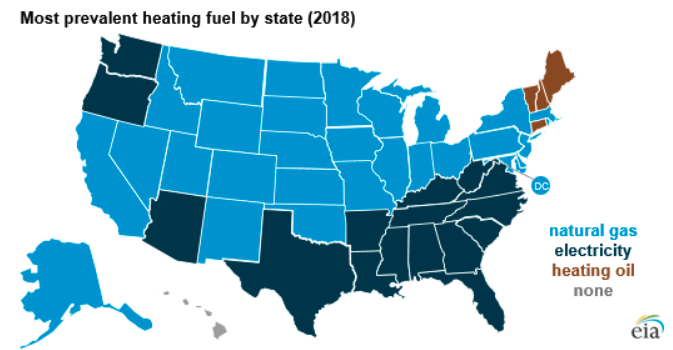

Fuel expenditures in EIA’s Winter Fuels Outlook reflect consumption and the resulting bills for all uses of energy in the household—not just heating. This approach contributes to the differences in expected expenditures across fuels. Natural gas is the most common space heating fuel in 29 states and the District of Columbia. Electricity tends to be more common in southern states.

Heating oil is much more common in the Northeast than in other regions and is the most prevalent primary heating fuel in four Northeastern states. Propane is more common in the Midwest, but it is not the most prevalent heating fuel in any state.

EIA’s Winter Fuels Outlook also considers adequacy of stored energy at the beginning of the winter season. Natural gas storage has seen a significant rebound in the United States over the past year. Working natural gas inventories in the Lower 48 states began the injection season on April 1 almost 30% lower than the previous five-year average. By the end of October, the end of the injection season, EIA expects working gas inventories in the Lower 48 states to be 2% higher than the previous five-year average.

Although the total of all heating oil inventories in the Northeast was 26% lower than the previous five-year average at the end of September, EIA does not expect significant supply disruptions or price fluctuations. Heating oil can be transported to the Northeast by pipeline, coast-wise compliant vessels from other U.S. ports, and imports. In addition, EIA’s forecast of strong distillate margins is likely to encourage refiners to increase refinery runs and maximize production of distillates, including heating oil.

Principal contributor: Stacy MacIntyre