Volumes this year remain relatively healthy, in historical terms, while comparisons with last year are skewed by exceptionally strong volumes from North Asia in 2021. But the trend into the summer is not favorable, WorldACD analysis highlights.

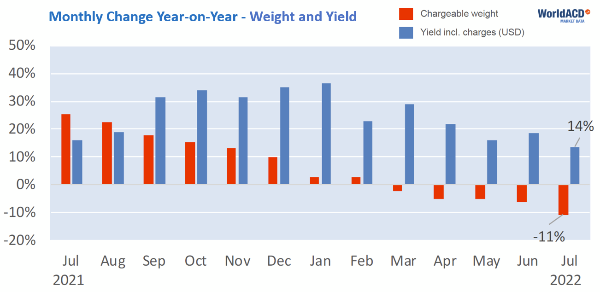

Year-on-year (YoY) global air cargo volume changes for the last 13 months seem to paint a less than rosy picture, as shown in the chart below. But behind the apparent recent decline in worldwide flown tonnages and yields there is a more complex and nuanced picture that reflects some exceptional characteristics of the market last year and of North Asian volume patterns, rather than simply a general worldwide weakening this year.

Since last March, our monthly figures have shown negative YoY growth rates for the worldwide air cargo business. July 2022 was even lower, with a double-digit percentage decline in volumes compared to July 2021 (-11%). For the period Jan-July, the YoY comparison stood at -4%. With average USD-yields up +22%, the industry’s overall air cargo revenue increased, YoY, by a significant +18%, including elevated fuel surcharge levels compared with last year.

This month, we specifically focus our analysis on weight trends, as a yardstick of the industry’s performance. When it comes to weight, is it all that bad around the world, or is there reason to be more optimistic? We zoomed in on the underlying details, to get a better understanding of the trends.

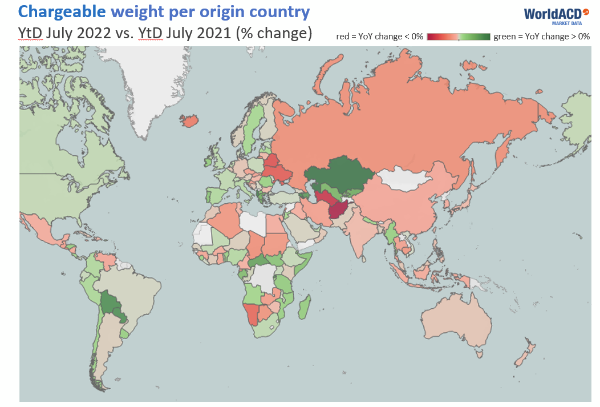

Looking at the performance of all 157 countries for which we publish individual data, we observe that half of the countries still experienced positive outbound growth in the first 7 months of 2022. See world map below:

This is somewhat surprising considering the overall worldwide YoY growth stood at

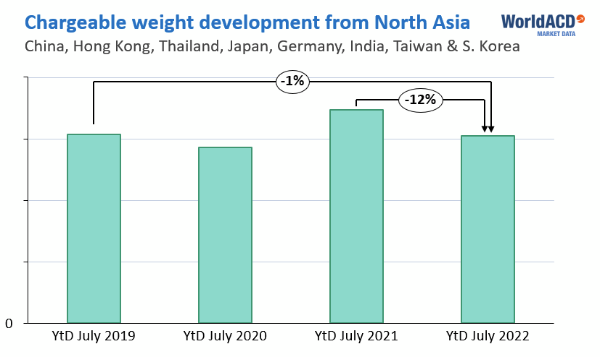

-4%, so there must be something else at play. This something else has to do with the adverse performance of a small group of important air cargo countries. It appears that 8 countries are responsible for 80% of the YoY decline this year (in order of importance): China, Hong Kong, Thailand, Japan, Germany, India, Taiwan and South Korea.

Given this list of countries, it is fair to say that it is predominantly a result of developments in North Asia. The YoY volume slide from North Asia stood at -12%. However, it is important to mention that 2022 for North Asia is not very different from the pre-covid year 2019, with volumes being only 1% lower. Let’s not forget that 2021 was a good year for cargo.

More specifically, the strong figures for worldwide air cargo volumes last year were buoyed by extraordinarily high levels of North Asia chargeable weight in 2021: WorldACD analysis indicates that North Asia volumes in the first 7 months of 2021 were +9% higher than in 2019, the last pre-Covid equivalent period. For the rest of the world, the total air cargo business in 2022 was at the same level as in 2021 (Year-on-Year change of 0%). However, the trend in 2022 is not a positive one: the first 4 months were up 3% compared with 2021, and the last 3 months were down -5%. Our weekly figures for the first 3 weeks of August also do not see this trend changing.

Zooming out to other regions, and comparing 2022 with 2019, we see strong growth from Central & South America (+10%) and North America (+9%), while Africa (-9%) and Middle East & South Asia (-20%) show the largest declines.

Besides the exceptional volume performance from North Asia last year, other reasons for the relative decline this year in North Asia volumes include Covid-related shutdowns in parts of China this year, disruptions and sanctions related to Russia’s invasion of Ukraine, a relative easing of ocean freight congestion, and some softening of consumer and business confidence. Nevertheless, as one logistics company recently observed, demand this year is similar to pre-Covid, but the difference is that we are actually experiencing a normal seasonal summer slack period this year, as opposed to the relentless demand and capacity shortfalls of the previous two years.

Despite the challenges that air cargo is faced with in 2022, this nuanced view should help us to think more clearly about how the air cargo industry is performing today. In essence, overall air cargo volumes this year are relatively healthy, in historical terms, but the trend since April and into August is not a favorable one.

Source: WorldACD