ZIM Integrated Shipping Services Ltd., a global container liner shipping company, announced today that it intends to perform a mandatory excess cash redemption of 100% of its Series 1 and 100% Series 2 unsecured notes due 2023 (together, the “Notes”) at an aggregate amount of $351.6 million, including accrued interest and accumulated PIK interest, in accordance with the terms of the indenture governing the Notes (the “Indenture”).

Eli Glickman, ZIM President & CEO, stated, “We are pleased to redeem the entire $349 million principal amount outstanding on our Series 1 and 2 Notes. ZIM’s success in achieving this important milestone, earlier than expected and earlier than the stated maturity by two whole years, highlights the benefits of our global niche strategy and our continued robust cash flow generation. With significant financial strength and a differentiated, proven approach, we remain in a strong position to capitalize on favorable container liner shipping fundamentals for the benefit of our shareholders.”

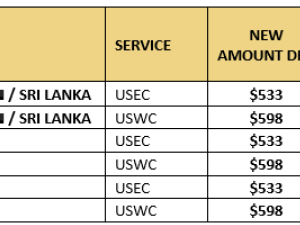

This early redemption constitutes 100% of the outstanding Notes. Pursuant to the Indenture, the redemption date is set for June 21, 2021 (the "Redemption Date"). Below is the outstanding principal to be redeemed and the interest payment in U.S. Dollar amount, and the interest payment as a percentage of the outstanding principal, for each series:

· Series 1A Notes - $215,283,091 outstanding principal and $1,614,623 interest payment (0.75000% on the redeemed outstanding principal).

· Series 1B Notes - $2,152,415 outstanding principal and $16,143 interest payment (0.75000% on the redeemed outstanding principal).

· Series 2A Notes - $94,659,143 outstanding principal and $14,854,111 interest payment including accumulated PIK interest (15.69221% on the redeemed outstanding principal).

· Series 2B Notes - $19,922,812 outstanding principal and $3,126,329 interest payment including accumulated PIK interest (15.69221% on the redeemed outstanding principal).