Transitions. Often the chassis, like the equipment itself, is the piece in the story left behind when talking about trucking, particularly intermodal trucking. Yet the chassis has been as much the story over the past 24 months as any other feature of the trucking business — maybe even more.

Consider in February, the Federal Maritime Commission (FMC) ruled on ocean carrier chassis practices — providing an answer to a long standing disagreement between trucking groups and some specific chassis providers. Also, there is the evolution of the chassis pools themselves with the launch of South Atlantic Chassis Pool 3.0 (SACP 3.0). In short, there is a lot of interest in the chassis business beyond the headlines.

But to understand how the chassis business grew and where it might be going, it’s worth taking a look backwards at how it evolved. Mike Wilson, CEO of Consolidated Chassis Management (CCM) in an article (see AJOT.com Jan. 26, 2023) entitled “The evolution of container provisioning in the US” described the early version of the chassis business model, “In this straightforward model, ocean carriers owned and/or leased their chassis. A motor carrier would pick up ocean carrier “A’s” box and would use ocean carrier “A’s” corresponding chassis, which was provided free of charge for the container move as part of the line’s service offering.”

But this, “ocean-centric” business model, as Wilson dubbed it, became a lot more complicated as the ocean carriers exited the business, “For the first 40-plus years of containerization, up until the early 2000’s, it was ocean-carrier centric. To some carriers, providing chassis to customers was viewed as a competitive advantage, while others wanted to exit the chassis business because it was not a core part of their expertise. Moreover, given the line had minimal physical control over the use of their chassis, they believed it would be more efficient for others to operate them.”

The Complex Business of Chassis Pools

In the 1990s a solution to the ocean carriers’ chassis dilemma emerged: pooling.

The basic idea behind the chassis pool was that ocean carriers would “contribute” chassis to a “pool” whose operation would be shared among the contributing lines. The pool concept fit in well with the box carriers own movement toward carrier alliances with many of the same goals — improved equipment utilization, increased velocity, and reduced costs.

But as Wilson explains the pool system evolved, “Over the next 15 years, those pooling arrangements began to take off in several different forms, including port terminal pools, carrier alliance pools and cooperative gray pools.

Almost immediately it was clear that this piecemeal approach to pooling wasn’t quite the panacea the carriers’ expected. In 2005, the ocean carriers under the Ocean Carrier Equipment Management Association (OCEMA) decided to create the Consolidated Chassis Management (CCM) to administer their cooperative gray pools.

But the ocean carriers got an unexpected jolt in 2008 with the Great Recession and began divesting themselves of their chassis business, opening the door for chassis leasing companies to become the major contributors to the chassis pools.

The chassis leasing companies took over the role of providing chassis to the trucking companies, BCOs (beneficial cargo owners) and other stake holders involved in the shipping process. This in turn led to the leasing companies themselves creating their own proprietary pools as opposed to the cooperative pools that had emerged from the ocean carrier involvement.

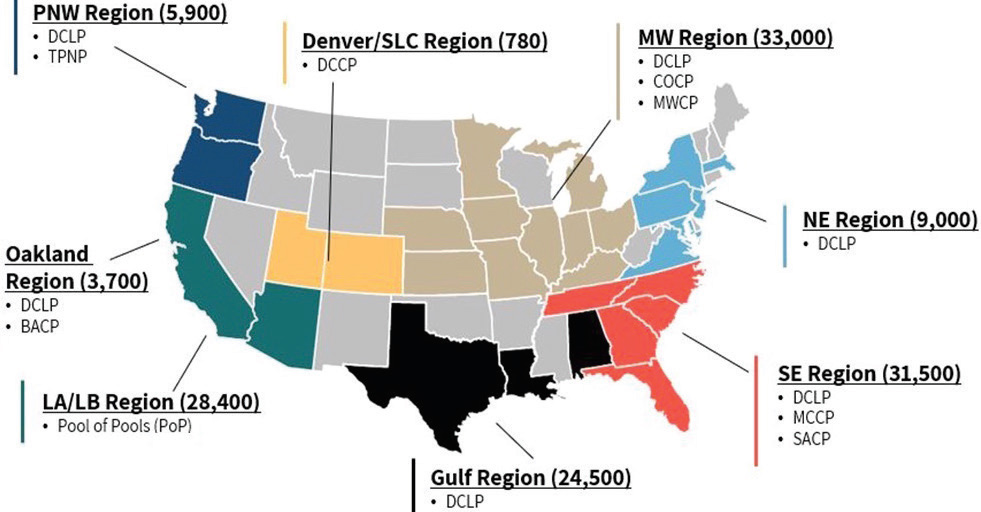

Currently, the chassis industry now falls into two basic business models: Cooperative or Gray pools and Neutral, Dedicated or “Proprietary” pools.

A cooperative or gray pool means that chassis in the pool, regardless of ownership, or name “brand” on the side of the chassis, all are “gray” — in other words “brandless” — and a trucker can use that chassis for any box and return it to any location within that regional network. Conversely, a neutral, dedicated, or proprietary” pool operates as a single independent equipment provider where all aspects including price, network, and operational rules for pool access and usage are controlled by this single entity or group. The pool can be neutral or dedicated (to a single user). A dedicated pool is usually established by the chassis leasing company for a specific customer’s use.

Although they rarely take up much ink, the chassis pools are vital to the ocean carriers and port operations. For example, it was recently announced CMA CGM (including affiliates APL and ANL) joined the FlexiVan Los Angeles Basin Chassis Pool (FLBP). FLBP is a participating pool member and intermodal equipment provider in the Pool of Pools within the LA/LB Ports complex.

One new or more accurately reconfigured chassis pool that has attracted a lot of interest is the South Atlantic Chassis Pool 3.0 that will officially start in October of this year.

SACP 3.0 Launch

In November of 2022 the FMC gave its regulatory nod to the proposed South Atlantic Multiport Chassis Pool Agreement which was the last major hurtle to launching SACP 3.0.

The concept behind SACP 3.0’s development was to combine the best qualities of existing pool models with a unique public-private cooperation between port authorities and ocean carriers. The key feature of the pool is placing the responsibility for the chassis procurement under a single provider, CCM. With the responsibility of the chassis under a sole provider, replacement, maintenance, and other matters related to chassis quality control will rest with one party with one set of operational parameters as opposed to individual contributing parties.

Mike Wilson said, “The SACP 3.0 represents the next logical step in the evolution of interoperable pools in the U.S. The new pool represents a leap forward in terms of supply chain efficiency and resilience.”

SACP 3.0 will be owned by a subsidiary of OCEMA and managed by CCM, but subject to forward looking operating parameters agreed with the ports. Chassis rates will be made available to pool users through a publicly available tariff.

In June SACP 3.0 initiated its soft launch and in August CCM as the pool manager announced the official opening of its onboarding portal. The onboarding portal enables motor carriers to register so that they can access CCM’s new and like-new refurbished chassis over the network of 75 locations throughout the South Atlantic region. In its entirety, the SACP 3.0, interoperable chassis pool in the South Atlantic, will be comprised of 50,000 modernized chassis servicing locations based in North and South Carolina, Alabama, Florida, and Georgia.

The FMC Ruling on Chassis Practices

In a decision that came down in February, the FMC ruled that the Shipping Act prohibits ocean carriers from designating an exclusive chassis provider for its containers when the carrier is not responsible for moving the container off terminal. In a case brought by the Intermodal Motor Carriers Conference (IMCC) of the American Trucking Associations (ATA) against the Ocean Carrier Equipment Management Association (OCEMA), Consolidated Chassis Management (CCM), and 11 shipping lines (the respondents), the FMC ruled that such a practice is unreasonable and therefore unlawful.

Peter Buxbaum, in an article (See April AJOT issue #752 page 6) wrote, “The claims in the case were several and the facts complex, but they boil down to this: the respondent carriers required shippers and truckers to use the carriers’ designated chassis providers even when it was the cargo owners’ responsibility to deliver the cargo to its ultimate destination. That practice, the FMC concluded, is unreasonable.”

Motor carriers considered the FMC ruling a victory. From their perspective the dispute revolved around the agreements shippers make with intermodal equipment providers at ports. As the ruling pointed out, these were agreements in which IMCC truckers had no control, even though they are bound to use the providers’ equipment. The IMCC’s view was that this put their carriers at a disadvantage. Although the two sides negotiated for months eventually it landed with the FMC.

It’s unlikely that the FMC ruling is the end of the matter as there is the prospect of appeal as well as the very practical matter that the two sides are inextricably tied together in providing the intermodal service.