Data points to more contract carriage and away from spot market

In mid-2022, the investment advisory service Zack’s touted the benefits of investing in trucking companies. “Upbeat trucking volumes owing to increased freight demand are driving the industry’s growth,” said its report. “Higher trucking rates amid capacity constraints contribute to buoyancy in the trucking industry.”

That report came out just in time to see volumes ebb and spot rates fall. But, as with other aspects of the United States economy, the trucking industry presents a mixed picture.

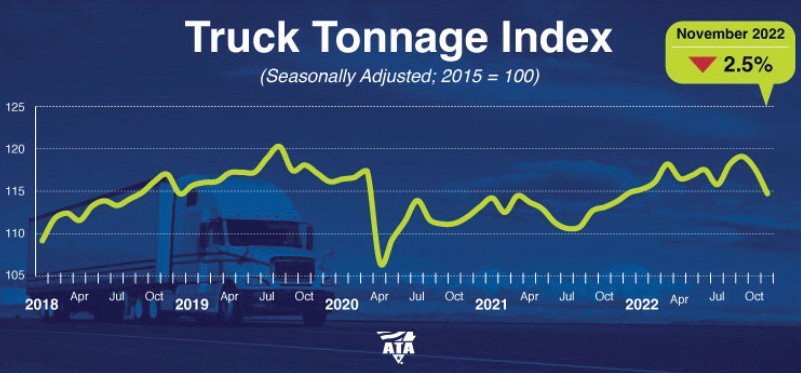

At the time the Zack’s report was released, the American Trucking Associations’ (ATA) seasonally adjusted For-Hire Truck Tonnage Index had gained 7.9% in June year over year and 3.5% in May. A few months later, the index decreased 1.2% in October and 2.5% in November, the latter representing “the largest single monthly decrease since the start of the pandemic,” according to Bob Costello, the ATA’s chief economist.

Those numbers among others fed into the larger perception that the U.S. economy was headed for a recession. But, after taking a breather, truck volume ticked up in December—the Cass Freight Index showing a 1.2% gain on a seasonally-adjusted basis.

Shift in Spot Market

The future direction of the U.S. economy presents a confusing picture as do the prevailing trends in the trucking industry. The possibility that a fundamental industry shift is afoot, in which the spot market has less influence on broader market trends, provides some clarity.

The health of the U.S. economy, and the trucking industry, by extension, is fundamentally dependent upon the level of consumer spending. Consumer spending revolves in part around trends in interest and inflation rates. Higher interest rates make it more expensive to finance purchases and higher prices, on essential commodities like fuel and food, crowd out spending levels for other items. The Federal Reserve aggressively boosted interest rates in 2022, but with price inflation trending lower—6.5% yearly as of mid-January—it’s possible the Fed will ramp down the levels of interest rate hikes in the coming months. On the other hand, the labor market remains red-hot—with unemployment dropping recently to 3.5%—suggesting that wage inflation may still be with us.

“Recent economic data are inconclusive,” said Tim Denoyer, vice president at ACT Research. “The labor market continues to add jobs at a pace that implies too-hot wage inflation pressures.” Research from Convoy, a transportation technology company, recently reported that “real consumer spending remains elevated as both goods and services experienced upticks from previous months.” The U.S. economy grew at a strong 3.2% annual pace from July through September, the federal government reported on December 22.

Denoyer believes that “the bottoming process is beginning” for spot trucking rates. It’s possible that lower spot rates were associated with elevated levels of capacity—Convoy reported that tractor orders in September 2022 represented highest net replacement level since 2018—but they also may be related to a fundamental shift in the trucking market, in which spot rates become less of a factor when considering the trucking industry’s health.

“The industry is shifting towards dedicated capacity to remove variability and seasonality,” said Page Siplon, CEO of TeamOne Logistics, a transportation and logistics workforce expert. That means shippers are “locking in contract rates to have more stability. Shifting volume from the spot market will lower spot rates” because less freight is being made available to that market.

Convoy also reported that “asset carriers now employ a record number of drivers while owner-operators are down 25% from the summer peak.” Siplon maintains that bolsters his view of a move away from the spot market. “As shippers shift more volume toward contracts,” he said, “trucking companies need more employee drivers.”

Trucking in a Balanced Market Place

The trend toward contract carriage and the move to hire more drivers are being driven by the demands of shippers, according to Siplon. “Shippers are willing to entertain a contract, but they require their loads to be picked up on time, every time and the same time every week,” he said. “Shippers are increasingly asking carriers in their RFPs whether they own their own assets and employ their own drivers.” At the same time, opportunities in the trucking employment market, in the form of higher wages and more attractive benefits, provide owner-operators with the incentive to seek employment rather than going it alone.

With consumer spending still proceeding apace, Siplon doesn’t see a recession, or a freight recession, looming. “Why would the trucking industry be spending money on trucks if they think that a freight recession is coming?” he said. “Spending more money on trucks before going into a freight recession just doesn’t add up.”

To Siplon’s point, the quest for more balance and stability means that shippers are “prioritizing the in-full part of the on time-in full equation,” said Claude Pumilia, CEO of DAT Freight & Analytics, a truckload freight marketplace. “Fewer truckloads are needed to move the same amount of consumer spending as during the height of the pandemic.” Maximizing utilization allows carriers to maintain a level of profitability by “reducing empty miles, emphasizing fuel economy, and coordinating with shippers and brokers to reduce dwell times,” said Pumilla.

The other side of this argument is that the current situation resembles the early 1980s, “the last time interest rates and inflation were at similar levels,” according to a report from Anderson Trucking Service, and “unemployment skyrocketed, and a severe recession ensued.

“Though our current situation is similar to the 1980s in many ways,” the report added, “employment levels remain far stronger today.”

With consumers still spending and the employment market roaring, the U.S. economy is not in a recession nor is it facing one, unless the Federal Reserve puts it there by over-aggressively hiking interest rates. “You have to hope they’re not crazy enough to do that,” said Siplon. “I believe they’ll manage interest rates only to the point where it has an impact on inflation.”

“The start of 2023 won’t be gangbusters for trucking,” he added, “but there will be more stability in the market. That’s going to set up a strong second half of 2023 and a great 2024.”