Maersk Line operates about 100 of its 550-vessel fleet in African trades and has a bigger slice of the market there than its 15 percent share of global boxship capacity.

"I'll be surprised if Africa does not continue to outpace non-emerging markets, though it's coming off a very low starting point," Anders Boenaes, Maersk Line's vice-president for Africa trades, told Reuters in an interview in Copenhagen.

Containerised imports, driven by consumer goods and machinery, continue to top exports by three to one, he said.

Boxed goods imports to Africa are largely funded by Africans wiring money back from Europe, the Middle East and elsewhere, which has helped sustain demand in the past despite the many armed conflicts that have ravaged the continent.

Improved political stability and rule of law are helping boost container imports after several armed conflicts in Africa ended in recent years, Boenaes said, adding political unrest continues to have a dramatic impact on demand. "We still see the biggest slump in volumes prior to elections. Nobody wants to have a large stock of something that may be looted if events turn into unrest," Boenaes said.

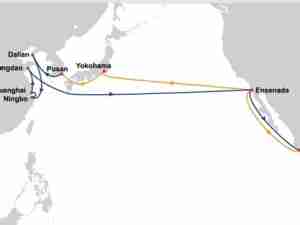

Regional Routes

The Danish shipper and South African subsidiary Safmarine want to retain their historically strong market share in Sub-Saharan Africa, though annual African container trade volume barely matches the weekly throughput on the world's biggest trade routes between Asia and Europe.

The Maersk group's port arm, APM Terminals, this month said it signed a deal to run the port of Monrovia in Liberia for 25 years, which it said reflected its positive view of the region's potential in freight

And Maersk Line's chief executive said last month that it was looking increasingly to serve Africa and Latin America with ships sailing directly from Asia.

Boenaes said Maersk Line needed smaller vessels to serve African ports which are shallower than those in Asia and Europe. Maersk will take delivery of 22 small and mid-size container ships to replace time charters before 2013.

"Growth in African exports is in the hands of international, particularly Asian, hunger for commodities," Boenaes said.

Maersk expects boxship exports from Africa to continue to lag imports until value-boosting processing industries emerge in Sub-Saharan Africa outside South Africa and Kenya.

"We don't expect that to happen until the longer term," Boenaes said. (Reuters)