Concern, uncertainty grip Gulf port leaders in wake of Trump steel tariff announcement

Hefty tariffs on U.S. imports of steel and aluminum have executives of Gulf ports gripped with wide-ranging concerns and uncertainty.

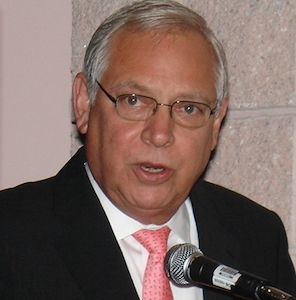

“The impacts could be far-reaching,” Jimmy Lyons, director and chief executive officer of the Alabama State Port Authority, told AJOT in reference to 25 percent and 10 percent tariffs, respectively, on steel and aluminum imports announced by President Donald Trump to go into effect March 23.

U.S. Gulf port leaders sharing in Lyons’ fears include top executives of Port Houston, the Port of New Orleans and Louisiana’s Port of Lake Charles.

Port Houston’s executive director, Roger Guenther, said, “Port Houston is recognized as the leading steel port in North America, and our steel cargo volumes are growing.

“Our history shows that steel cargo immediately declined following a tariff increase,” Guenther continued. “As a result, we are concerned that the proposed 25 percent tariff on steel cargo could decrease cargo volumes, creating a detrimental impact on local jobs and the economy. We urge that the matter continue to be reviewed.”

The Port of New Orleans’ president and chief executive officer, Brandy Christian, said Port NOLA suffered a 46 percent decline in steel imports in the year following President George W. Bush’s 2002 imposition of steel tariffs under a trade law provision – unlike the broader domestic security grounds under which Trump is advancing the latest tariffs.

“Imposing and enforcing tariffs arbitrarily on imported steel and aluminum would negatively impact ports, the larger maritime community, manufacturers throughout the U.S. and other steel-consuming industries,” Christian said.

Port NOLA is particularly sensitive to tariffs on steel and nonferrous metals such as aluminum, according to Christian, who cited the 2.48 million tons of steel – representing 83 percent of her port’s breakbulk tonnage – and more than 665,000 tons of aluminum imported into New Orleans in fiscal 2017.

“Restricting steel imports would cause wide-ranging economic damage, raising prices for U.S. industries such as construction, transportation and mining,” Christian said, adding, honing in on U.S. grain exports, “The reaction of other countries and their desire to retaliate against U.S. exports is a concern for Port NOLA and ports along the Lower Mississippi River.”

Christian said Port NOLA leadership will continue efforts communicating that it is in the best interest of the port and the nation’s economy for the Trump administration to “limit actions related to this matter.”

Bill Rase, executive director of the Port of Lake Charles, told AJOT that he is fearful of the impact of higher steel prices on the several multibillion-dollar liquefied natural gas facility projects being built in and around Lake Charles, as well as pipelines and other infrastructure undertakings that depend upon steel.

“I think it causes concern among those who are buying the steel and those who finance construction, and I’m sure it creates havoc in the financial markets,” Rase said. “The fear that everybody has is the fear of the unknown.”

Another Louisiana port executive, who asked not to be named, said he was uneasy about the impact of higher steel prices on port infrastructure projects.

Noting potential negative impacts upon export flows from the Port of Mobile, the Alabama State Port Authority’s Lyons commented, “One of my big concerns all along is that this triggers a trade war, which can’t be good. It could adversely affect us in a number of different areas.”

The Port of Mobile handles significant volumes of steel coils and related products, including sheet pile, of which Lyons said there is limited U.S. domestic production, as well as a couple hundred thousand tons a year of aluminum imports from Venezuela and Argentina.

Lyons also expressed woes related to inflationary impacts.

“If it does raise the price of steel appreciably, which it certainly could, I’m concerned about its impact upon our manufacturing industry, which is quite large here in Alabama,” Lyons said, citing automotive production in particular.

“There’s a lot of uncertainty,” Lyons said. “We have concerns about decline in trade, just because of tariffs drying up the business or retaliation or trade wars that could erupt that could potentially impact our [export] soybeans, as an example.”

Lyons said one positive note, at least for the time being during North American Free-Trade Agreement renegotiations, is the apparent temporary exclusion from the new tariffs of Mexico, to which nearly 1 million tons a year of steel coil is shipped from Mobile. (Canada, the No. 1 supplier of steel and aluminum to the United States, also appears to be exempt, pending successful NAFTA renegotiation.)

The apprehension among Gulf port executives is reflective of broader trepidation.

The National Retail Federation’s vice president for supply chain and customs policy, Jonathan Gold, said, “We could very quickly have a trade war on our hands.

“The immediate impact,” Gold said, “would be higher prices for American consumers that would throw away the gains of tax reform and put a roadblock in front of economic growth. But, in the long term, we could see a loss in cargo volume and all the jobs that depend on it, from dockworkers on down through the supply chain.”

A policy brief from Trade Partnership Worldwide LLC says the new tariffs could result in addition of more than 33,000 iron, steel and aluminum jobs in the United States but cost more than 179,000 jobs throughout the rest of the U.S. economy, resulting in a net loss of nearly 146,000 U.S. jobs

[Full coverage of Gulf ports and trade is slated to appear in the March 26 print edition of AJOT.]

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved