Every cloud has a silver lining, even in a perfect storm

In my more than twenty years of experience as a lawyer (I started working in Singapore and Jakarta during the Asian financial crisis in 1998), I have never experienced a roller coaster ride like the one we are in right now. The COVID-19 crisis combined with the collapse in the price of oil has created a perfect storm for the oil industry and is causing disruptions to global supply chains, logistics, ports and terminals.

Ports and terminals around the world are experiencing significant decreases in the number of calls of container and other cargo vessels and a significant drop in volumes. The clamour in the US to “decouple” from China, the relocation of labour-intensive manufacturing from China to ASEAN countries and the push to bring supply chains back home is accelerating in many parts of the world.

Oil and gas contractors around the world are affected by the collapsing oil price and it is expected that some may need to restructure and file for chapter 11 or similar bankruptcy protection in other countries.

Many shipyards and contractors are sending or receiving force majeure notices (delaying or cancelling projects on the basis of COVID-19 related disruptions) and it is expected that delivery of more than twenty floating production, storage and offloading (FPSO) vessels currently under construction at shipyards in China, South Korea and here in Singapore, will be delayed. A recurring question for our oil and gas clients is whether a force majeure clause excuses parties from performing their obligations and, if so, whether this is temporary or permanent. It will depend on the terms of the relevant contract whether the COVID-19 outbreak constitutes a force majeure event, potentially entitling the shipyard or contractor to claim an extension of time.

Despite economic pressures, these uncertainties and lower volumes, some governments are pushing ahead with new port concessions and some operators continue to develop greenfield projects. The crisis also presents some operators with acquisition opportunities that might not otherwise be possible, although we expect that some will wait-and-see for a few months. Over the last decade, Chinese operators have invested more than USD 20 billion into foreign ports and terminals. They may look to invest further, but will need to navigate local politics in some countries. Other operators from Asia and the Gulf are in the market as well to acquire gateway terminals and to further integrate their services vertically.

Many upstream companies here in Southeast Asia are re-evaluating business plans, projects and investments and I personally do not think this roller coaster ride will end any time soon unfortunately. The development of various oil and gas projects here in Southeast Asia have been or may be deferred, including for example the Nam Du-U Minh gas project in Vietnam, Limbayong in Malaysia and Kelidang in Brunei. On a positive note, other projects are expected to go ahead this year, including for example Sakakemang in Indonesia and potentially Jerun in Malaysia.

Fully leased out capacity boosts revenue for many tank terminals as a drop in demand has left traders and upstream companies scrambling to find storage. Another bright spot will be the warehousing and logistics sector and some experts predict that this sector will grow by a whopping 35% in 2021. This would make it among the fastest asset classes to recover from the COVID-19 crisis and this also offers opportunities for ports to develop or upgrade adjacent logistics centres.

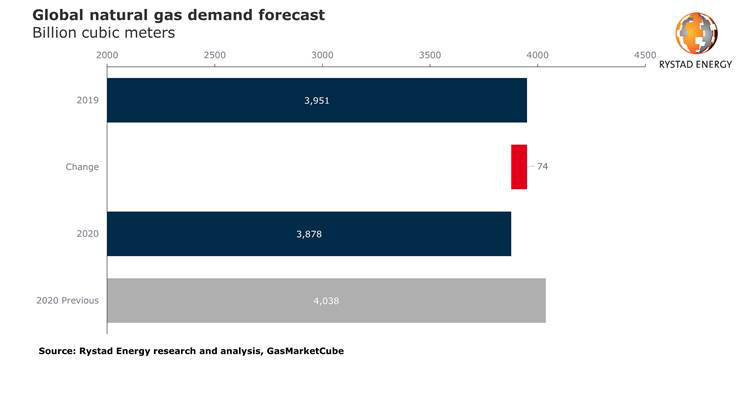

A month after the historic crash (I never thought that oil could ever be a liability, not an asset), the price of oil is recovering somewhat but there is no doubt that the collapsing demand for oil due to COVID-19 and the Saudi Arabia-Russia price war has created a perfect storm.

Some of our clients expect the decline in the demand for oil not to be as severe as initially anticipated as many countries start to relax their lockdowns. Albert Einstein supposedly noted “in the midst of every crisis, lies great opportunity” and for some contractors, investors and upstream companies there may be (distressed) buying opportunities. A perhaps somewhat unexpected silver lining is that lower prices for oil-indexed contracts may accelerate the transition from coal to gas here in Southeast Asia and be a boost for the development of LNG-to-power plants. Every cloud has a silver lining, even in a perfect storm.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved