The first all-new order for Airbus SE’s mainstay A320 jet of this week’s Farnborough International Airshow was distinctly lacking in the hoopla that usually accompanies deals unveiled at the world’s leading aviation expo.

The $2 billion transaction from Latam Airlines Group SA of Chile was communicated by email at 8 a.m. in the UK, when most show delegates were still at their hotels.

Airbus’s slim order haul and publicity restraint contrasts with previous shows, where the European manufacturer made a big splash with commercial announcements to a packed audience, often in rapid succession. Management relished the closing press conference, where executives needled the US competition and touted their wins before heading back to Toulouse with a bulging order book.

This time round, Airbus Chief Executive Officer Guillaume Faury and his sales chief, Christian Scherer, had left the event even before the final day and Airbus confirmed Thursday that it would hold no formal closing media conference. The duo’s early exit came amid a dearth of orders for the European planemaker and as rival Boeing Co. trotted out a raft of deals including three-figure sales for its 737 Max narrowbody, which competes with the A320neo.

Agency Partners analyst Nick Cunningham said that, overall, the order haul from an event so keenly anticipated after a long-time absence of such gatherings due to the coronavirus crisis has been “pretty modest” by historical standards. Boeing “did a little better than expected,” he said, even as it grapples with glitches with the 787 Dreamliner and years of delays to the 777X.

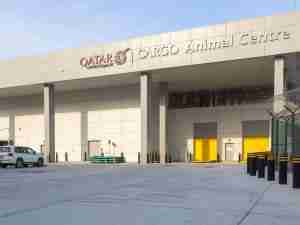

The US company continued to announce new business late into the expo, with 25 orders for the Max 10 model from Qatar Airways and a commitment from Cargolux Airlines International SA for 777-8F freighters.

Ihssane Mounir, senior vice president of commercial sales, said Boeing has had “a very gratifying week” in terms of its order success but understands that it needs to do more to turn the corner on its production issues.

“We are incredibly thrilled and very humbled by our customers,” he said. “It’s a journey.”

Latam’s Airbus order is for 17 A321neos, the largest variant in the planemaker’s single-aisle family, according to the emailed release. South America’s biggest airline has also “confirmed to bring in” the long-range A321XLR, though the statement didn’t specify if that model is part of the order.

Airbus’s relatively poor showing was partly expected, with its order backlog already swollen by the early sales success of the A320neo, a re-engined version of an older plane that was launched before the similarly upgraded Max, which it comprehensively outsold.

The A320 consolidated its dominance when the Max was grounded after two fatal crashes. But with the waiting time for the Airbus model now stretching beyond five years for most airlines and the Max cleared to fly again, Boeing is making up for lost time.

Airbus did announce another chunky A320 deal at Farnborough, with British discounter EasyJet Plc, but the order for 56 planes had already been telegraphed last month and was awaiting shareholder signoff.

Airbus also snagged a top-up deal from Delta Air Lines Inc. for 12 A220-300s, the former C-Series model that the manufacturer acquired from Bombardier Inc. as the Canadian company slimmed down its business.

That order however was overshadowed by a Delta purchase of 100 Max 10s that provided a boost for the largest member of Boeing’s revamped 737 family as it grapples with regulatory issues.

The European firm is unlikely to be too despondent with its Farnborough showing, after announcing what may prove to be the blockbuster deal of the year just weeks prior to the expo, securing the sale of 292 airliners worth more than $37 billion to China.

“They came into Farnborough on the back of a massive order and while this show does give an opportunity to capture the zeitgeist, Airbus isn’t the scrappy underdog anymore,” said Cunningham. “They’ve become the biggest manufacturer with close to 70% share.”

All the same, the low tallies for the A320neo in particular point to the challenges facing Airbus as it seeks to accelerate monthly build rates on its narrow-body production lines both to meet existing demand and create room for new orders.

Supply-chain pressures as component makers struggle to step up output following Covid are holding back those plans, with staffing shortages creating a dearth of parts from computer chips to engines.

An absence of the latter has even forced Airbus to produce so-called gliders -- fully built aircraft sitting on the ground minus their turbines. The planemaker now has 26 planes without engines, six more than at the end of May, Faury said at the show.