Indonesia, the world’s biggest palm oil producer, will ban all exports of cooking oil and its raw materials amid a local shortage.

The shipment halt will start from April 28 and last until the government deems the shortage resolved, said President Joko Widodo in a Friday briefing. Most of the country’s cooking oil is made of palm oil products.

“I will continue to watch and evaluate the implementation of this policy so that the domestic supply of cooking oil is abundant and the price is affordable,” said Jokowi, as the president is known.

Indonesia’s move adds to a raft of crop protectionism around the world since the war erupted in Ukraine, as governments seek to ensure local food supplies with agriculture prices surging. Argentina, another major vegetable oil shipper, raised export taxes on soybean oil. The United Nations has urged countries to keep trade open, saying the moves will only further drive up global prices.

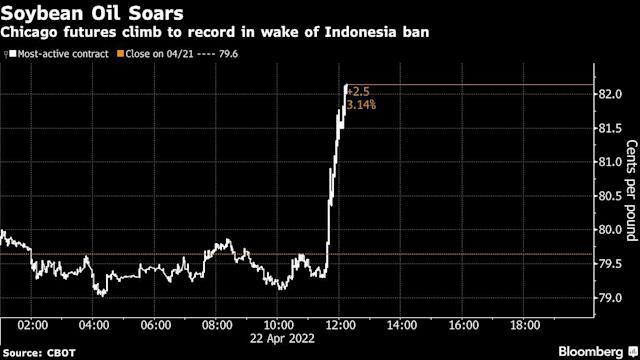

Soybean oil, palm’s closest substitute for food and fuel, soared to a fresh record on Indonesia’s ban, rising as much as 3.5% in Chicago. Palm oil in Kuala Lumpur was up 0.7% earlier to close at 6,355 ringgit ($1,469) a ton. Rapeseed in Paris and canola futures in North America also gained.

“The news will certainly create a mayhem,” said Paramalingam Supramaniam, director at Selangor-based broker Pelindung Bestari. “We have the largest producer banning the exports of palm products which will add more uncertainty to the already tight availability of vegetable oil worldwide.”

When asked for details about the ban, Veri Anggrijono, acting director-general for foreign trade at the trade ministry, said officials will hold meetings to follow up with the president.

The local shortage of edible oil has roiled the country, leading to street protests over high food prices and the detention of a trade official in a corruption case. The government has rolled out cash subsidies and deployed police surveillance to safeguard nationwide distribution to temper prices and ensure ample supply.

Managing food prices is a key priority for Jokowi, especially as the country that’s home to the world’s largest Muslim population heads into the Eid al-Fitr holiday, usually marked with feasts and celebration.

A lot of exports could still take place until the April 28 effective date, said Gnanasekar Thiagarajan, head of trading and hedging strategies at Kaleesuwari Intercontinental.

“It’s a short-term measure and not likely to last for long,” Thiagarajan said. “I don’t see a continued tightness in the market on the back of it. But, in the near term, it is likely to result in a sharp jump in prices.”