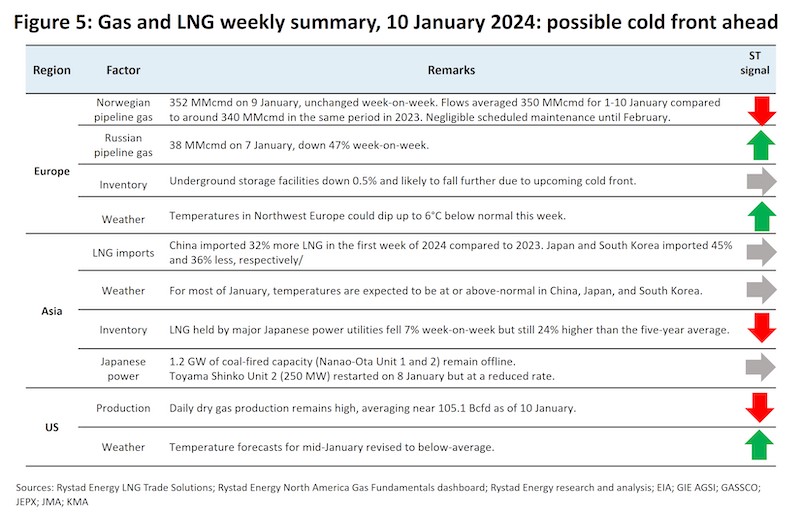

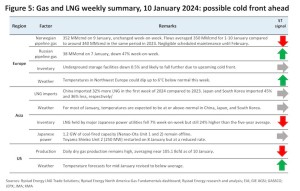

The latest developments in the global gas and LNG market indicate a drop in Asian spot LNG prices for February 2024 delivery.

As of 9 January, prices were down to approximately $9.8 per million British thermal units (MMBtu), dropping below $10 per MMBtu for the first time since July 2023.

Financial derivatives for March 2024 were down approximately 2.3% week-on-week to $10.3 per MMBtu.

If prices remain below $10 per MMBtu, some Asian importers may have an incentive to buy spot LNG, although current inventory levels may hinder swift procurement.

Asia imported a total of 5.75 million tonnes (Mt) of LNG in the first week of January, compared to 6.08 Mt in 2021, 6.15 Mt in 2022, and 5.75 Mt in 2023.

Japan and South Korea imported 45% and 36% less LNG in the first week of this year compared to 2022.

Meanwhile, China imported approximately 2.4 Mt in week 1 this year, up 32% in the same week in 2023.

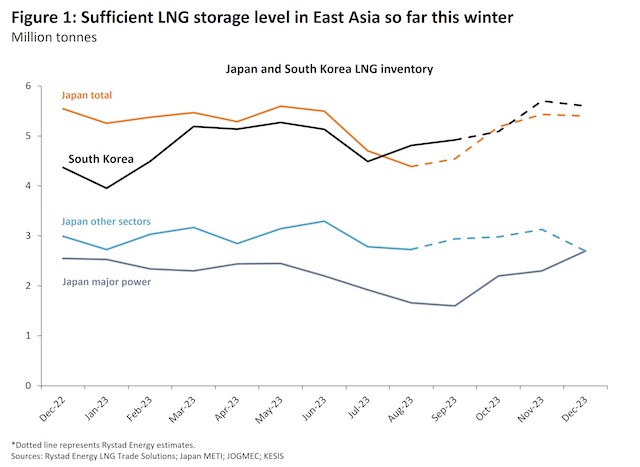

Major Japanese power utilities reported combined gas storage levels of 2.51 Mt on 7 January.

This is down 7% week-on-week but 24% up on the five-year average from 2018-22 for the end of January, and 5% higher than the 2.39 Mt reported at end-December 2022.

Similarly, in South Korea, LNG inventory remains high at 5.6 Mt as of the end of December 2023, according to Rystad Energy's estimates.

This is above storage levels of 4.1 Mt in 2019, 2.9 Mt in 2020, 3.2 Mt in 2021, and 4.4 Mt in 2022 for the same period.

Following the earthquake that struck the northern region of central Japan on 1 January, Hokuriku Electric’s Nanao-Ota coal-fired power plant 500-megawatt (MW) Unit 1 and Unit 2 (700-MW) remain offline as of 10 January.

The two coal-fired units will likely remain offline for at least a few weeks as some damage has been found in the coal unloader and chimney as well as rupture and subsidence in the ground and roads around the power station, according to Hokuriku Electric’s press release on 4 January.

Approximately two LNG shipments per month would be required if gas-fired power generation was to compensate for any prolonged outage.

Meanwhile, Hokuriku Electric’s 250-MW coal-fired power plant Toyama Shinko Unit 2 resumed operations on 8 January, although at a reduced rate, according to a filing with the Japan Electric Power Exchange.

Hokuriku Electric’s nuclear power plant units 1 and 2 have been offline since 2011.

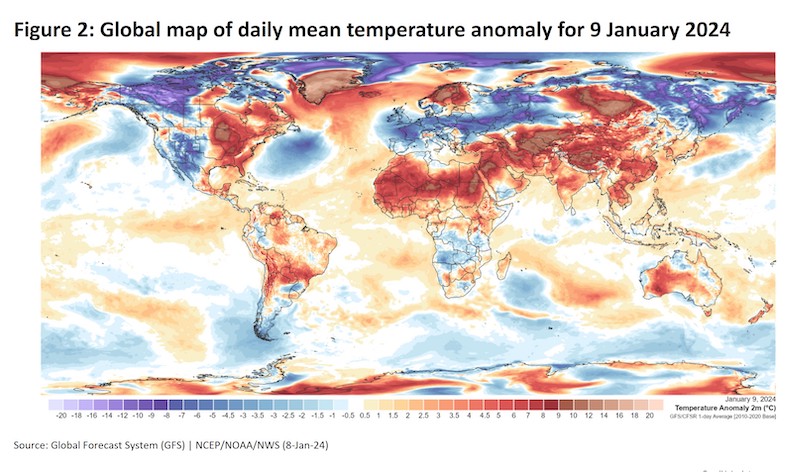

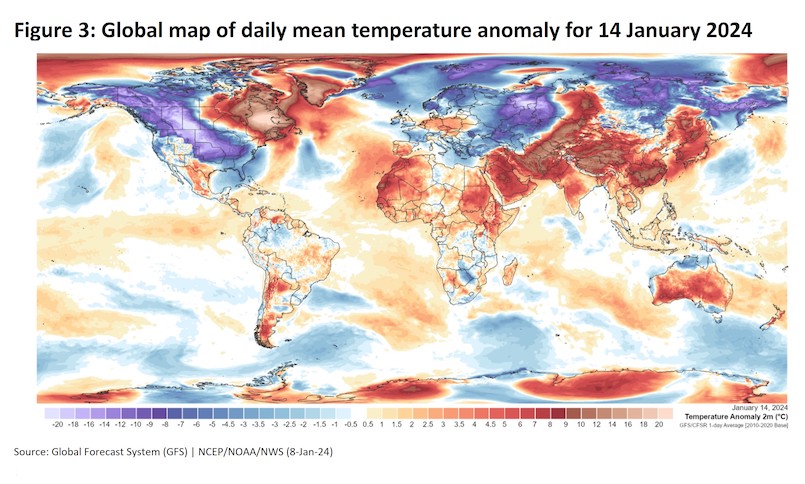

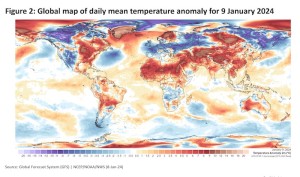

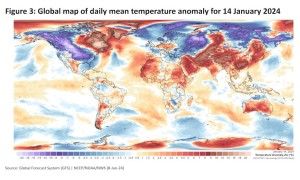

In terms of weather, low-pressure systems are set to deepen eastwards in the northwest Pacific region, meaning that east and central Asia will face warmer-than-average weather this month.

Japan will likely face above-average temperatures throughout January except for 16 January, with South Korea forecasting above-average temperatures until 23 January except for 15 January.

Meanwhile, China’s capital city Beijing is expected to see above-average temperatures until 24 January, with Shanghai also likely to experience above-average temperatures until 22 January.

Europe

Our research strongly suggests a significant temperature drop across Europe in the coming days, as extensive areas of low air pressure will deepen during the second half of week 2.

This could strengthen both downstream gas demand as temperatures in Northwest Europe are expected to hit -4°C, up to 6°C below normal for this time of year.

This may also cause European pipeline gas prices to rebound, after falling 8.6% and 3% on 8 and 9 January, respectively.

Underground storage facilities in Europe are down 0.5% to approximately 96.97 billion cubic meters (Bcm) or 84.4% full, with the February 2024 Title Transfer Facility (TTF) price down 0.2% week-on-week to $9.79 per MMBtu on 9 January.

LNG for delivery into Europe was approximately $9.1 per MMBtu on 9 January, 1.7% higher on the week but 60% lower compared to this time a year ago.

In Norway, process problems led to Dvalin reducing output by around 4.5 million cubic meters per day (MMcmd) from 4-5 January and Aasta Hansteen reducing output by 2.5 MMcmd from 4-5 January.

As of 9 January, total pipeline flows from Norway into Europe were at 351.9 MMcmd, largely unchanged from 352 MMcmd a week earlier.

Meanwhile, flows from Russia were down 47% week-on-week to approximately 38 MMcmd as of 7 January.

US

Henry Hub prices have increased 24% on the week from approximately $2.6 per MMBtu on 2 January to $3.2 per MMBtu on 9 January on colder weather forecasts.

Rystad Energy believes that North America will see a dramatic decrease in temperatures on 13 January, particularly in the central part of the US which could see temperatures drop 10°C to 15°C drop below the long-term average. Warmer temperatures are expected to return in late-January.

Daily US dry gas production remains high, averaging near 105.1 billion cubic feet per day (Bcfd) as of 10 January, down compared to the 30-day moving average of 108.2 Bcfd.

We anticipate supply will average 104.4 Bcfd in January.

Approximately 13.2 Bcfd of feedgas was supplied to US LNG terminals on 7 January, up 9.4% compared to 12.1 Bcfd a year ago.

Cove Point LNG has experienced lower feedgas supply in recent days, although the cause is uncertain.

The facility’s feedgas levels are approximately 811 MMcfd, down from around 900 MMcfd in the final few days of December.

Still, total US feedgas is robust, averaging 14.6 Bcfd so far in January, up 1.1% compared to December 2023 when total exports reached 13.2 Bcfd.

We should expect similar trends this month, assuming no disruptions in feedgas supplies due to maintenance or weather impacts.

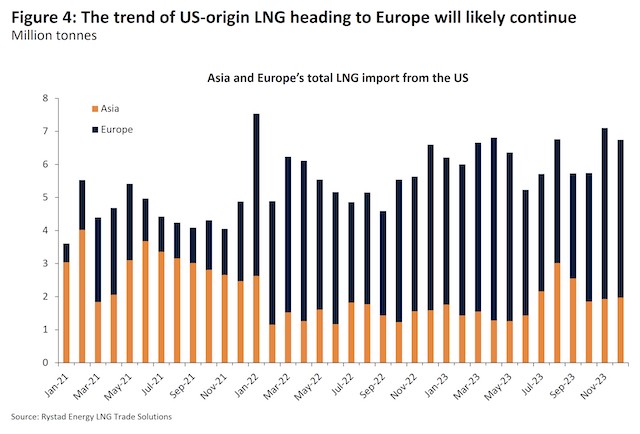

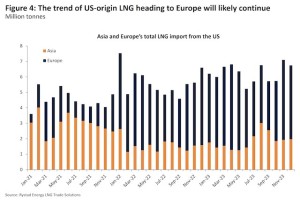

The US exported approximately 1.8 Mt of LNG in the first week of 2024, compared to 1.7 Mt in 2021, 1.8 Mt in 2022, and 1.6 Mt in 2023.

Most US LNG cargoes will likely continue heading to Europe instead of Asia as the arbitrage to Asia for US-origin LNG remains closed.

_-_28de80_-_58820516bd428ab3fd376933932d068c43db9a4a_lqip.jpg)