IBA, the leading aviation market intelligence and consulting company, has today published its latest monthly Aviation Carbon Emissions Index in association with KPMG. This month’s index also includes a spotlight on lessors in the Asia Pacific region.

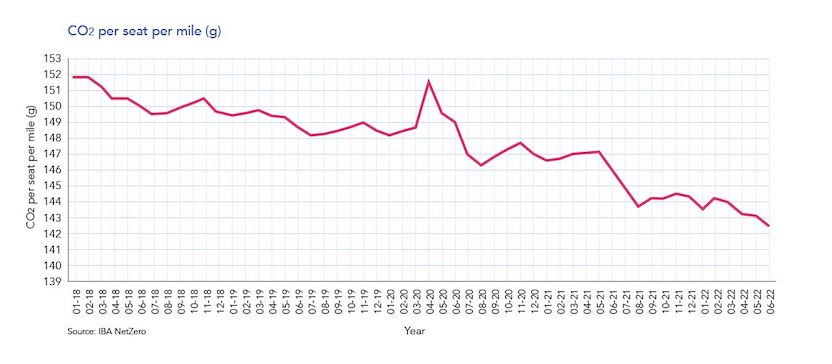

Aviation carbon emissions intelligence from IBA NetZero has revealed that CO2 emissions from commercial aviation averaged 143.1 grams of CO2 per-seat per-mile in June 2022, with overall carbon intensity per-seat decreasing by 0.4% compared to May 2022. This represents a 2.4% reduction in CO2 intensity per-seat per-mile year-on-year - another record low for the industry.

June 2022 saw additional international and domestic growth as the summer season got into full swing, with a 4% increase in global traffic month-on-month. Global flight volumes increased across the board, except for the Latin American market, which saw a 3% reduction in flight volumes.

The Asia Pacific region continues to grow, with an 11% increase in domestic and a 6% growth in international flights. Flight volumes have been steadily increasing in the North American domestic traffic market in the months leading up to June. However, the market has stagnated somewhat compared to the previous months, bringing traffic growth broadly in line with the European and Asian domestic markets.

Surprisingly, the largest growth in flight volumes within Europe and CIS is being driven by Russian operators. S7 Airlines, Rossiya and Aeroflot have each seen a 30%, 12% and 27% increase in flight volumes respectively. This equates to an additional 7,000 flights, making up 18% of all the growth within the Europe & CIS region in June 2022.

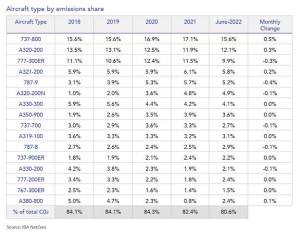

Aircraft Efficiency Spotlight

The global share of emissions in June 2022 did not change significantly, though IBA did observe a slight shift towards the Boeing 737-800, which saw an increase of 0.5%. The Boeing 777-300ER saw a decrease in monthly share of 0.3%.

Airline Efficiency Spotlight

French BEE remained at the top of IBA’s ranking of the most efficient airlines in June 2022, largely thanks to their fleet of high-density Airbus A350 aircraft. Sunwing Airlines re-enters the ranking this month with an all 737 family fleet of six Boeing 737 MAX 8 aircraft and five 737-800s, six of which are owned by Air Lease Corporation and three by Aviation Capital Group all in a high density 189 seat configuration.

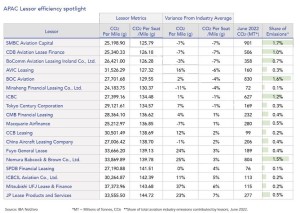

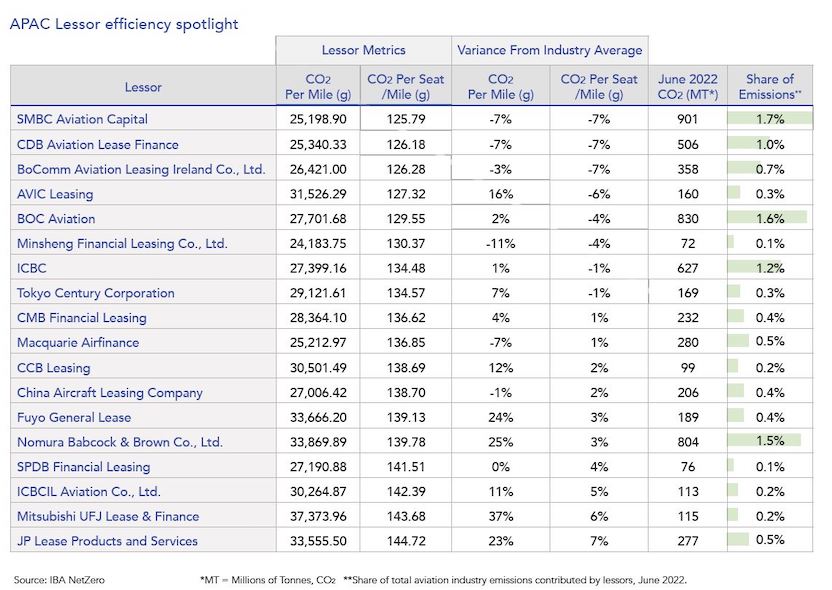

Monthly Spotlight: Lessors in the Asia Pacific region

This month, IBA shines their spotlight on aircraft lessors in the Asia Pacific region. This was last reviewed in December 2021.

SMBC Aviation Capital ranks as the most efficient lessor in the region on a per-seat per-mile basis. IBA Insight reveals the lessor manages around 430 aircraft, and that their overall CO2 efficiency per-seat per-mile has reduced by approximately 1 gram per-seat per-mile.

IBA suggests that this has largely been driven by the Japanese lessor taking delivery of 8 Boeing 737 MAX and 5 Airbus A321-200neo aircraft. SMBC’s fleet is comparatively young, with an average age of 6 years old compared to the industry average of 13.5 years. IBA anticipates the fleet age will continue to reduce thanks to SMBC’s sizeable order book of almost 200 next generation narrowbodies.

Chinese lessor AVIC also performs well in IBA’s ranking, with an extremely diverse portfolio of aircraft. The most numerous in-service type is the Airbus A350-900, with 17 aircraft leased to Air China, Ethiopian Airlines, Turkish Airlines and Vietnam Airlines. IBA Insight reveals that 56% of AVIC’s portfolio comprises narrowbody aircraft. Of these, 65% are A320 family aircraft (mostly neo) and 35% are of the 737 family. Whilst AVIC has 15 Comac C919 aircraft on order at present, IBA does not anticipate any meaningful change to their CO2 output in the near future.

Tokyo Century Corporation holds a portfolio exclusively comprising of narrowbody assets, which are 8.5 years old on average. Of the 70 aircraft within their current fleet, only five aircraft are new generation Airbus A321-200neo aircraft. The remainder are of the 737 NG series and A320ceo family. IBA Insight shows no new aircraft orders as of June 2022, and IBA anticipates little change to their ranking unless more new generation aircraft are introduced to the portfolio.

Chris Brown, Head of Strategy at KPMG, said: “Governments play a key role in promoting and developing carbon alternatives. Yet because of the international nature of aviation, scope for domestic action is more limited to the likes of airport initiatives and domestic flights. It needs greater international alignment. Only recently, IATA has called for governments to urgently put in place large-scale incentives to rapidly expand the use and production of sustainable aviation fuels (SAF). ICAO’s 57th Conference of Directors General of Civil Aviation for Asia and Pacific Regions made several similar recommendations.

“Industry led examples can be seen by the recent announcement from Qantas and Airbus - announcing a AUD$200 million ($140m) five-year partnership to expedite the production of SAF in Australia by investing in local fuel and feedstock initiatives. The airline has also revealed “encouraging discussions” with the country’s newly-elected federal government to support a transition of the aviation industry to low carbon fuels. But let’s not kid ourselves - even if every planned SAF plant comes online as intended, there will remain a significant supply shortage, in turn driving a price delta between it and Jet-A1. Some in air finance will watch this dance from afar, others are actively exploring how they can profitably co-invest in scaling SAF production."