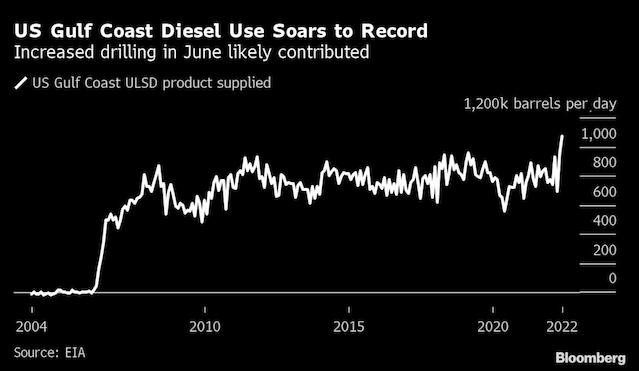

June was an unexpected blockbuster for diesel demand in the US but economic headwinds threaten to cut trucker consumption going forward.

US diesel supplied -- a proxy for demand -- hit a seasonal record in June, according to monthly estimates from the US Energy Information Administration this week. On the Gulf Coast, June diesel use surged to an all-time high, the data show.

Bullish diesel demand coincided with increased drilling activity as soaring oil prices prompted explorers to deploy more rigs powered with the fuel, and a broader rebound in employment saw more workers jumping behind the wheel.

Truck tonnage crisscrossing US highways rose by 2.7% in June from the prior month, suggesting the goods economy “wasn’t as bad as feared,” said Bob Costello, chief economist at the the American Trucking Association, which calculates the index.

The record diesel number was 4.2% higher than the EIA’s weekly estimate, which has raised eyebrows among traders and economists in recent months. Bigger-than-normal diesel exports out of the Gulf Coast could have skewed demand calculations, traders and analysts said. The EIA’s demand number measures the amount of fuel that disappeared from the primary supply chain, which some say is not an accurate representation of retail consumption.

Retailers knew they had a big June, as diesel sales for the month rose by 3% compared with a year earlier, according to data from the National Association of Convenience Stores. Along the Gulf Coast, retail diesel sales rose by as much as 5.5% year-on-year, NACS data show.

“Even though our Petroleum Supply Monthly is realistically the ‘final’ and best answer for demand in that month, the uncertainties surrounding something like demand are higher than other variables,” said EIA spokesperson Chris Higginbotham in an email.

The strong June number does not appear to be indicative of a trend, said John Auers, manging director at RBN Energy, adding that the data may be overstated. Diesel demand is closely tied to economic activity, and recessionary forces indicate trucking use of the fuel will be less robust this winter, Auers said in a phone interview.

In a colder-than-normal winter, heating demand could send diesel use significantly higher in the US Northeast, said Mark Finley, a energy fellow at Rice University’s Baker Institute for Public Policy in Houston. This could potentially offset any slowdown in diesel demand coming from a weakening economy.

_-_28de80_-_939128c573a41e7660e286f3686f2a6e25686350_yes.jpg)