Energy

Energy industry news - solar, wind, hydroelectric, natural gas, petroleum.

New England Aqua Ventus will launch first US floating offshore wind turbine In 2023/24

In 2020, US coal production fell to its lowest level since 1965

| July 14, 2021 | Energy

U.S. coal production totaled 535 million short tons (MMst) in 2020, a 24% decrease from the 706 MMst mined in 2019 and the lowest level of coal production in the United States in any year since 1965.

The seven elements of the EU green deal you should care about

| July 14, 2021 | Energy | Alternative

World’s top carbon market to get bigger with EU climate plan

| July 14, 2021 | Energy | Alternative

Uganda moves to end monopoly on Kenyan route for oil shipments

| July 14, 2021 | Energy

Trump’s former energy chief to push gas exports for Sempra

| July 13, 2021 | Energy

U.K. vows to end sales of new petrol and diesel HGVs by 2040

| July 13, 2021 | Energy

US oil consumption surging with industry firing at full blast

| July 13, 2021 | Energy

Atlantic Towing selects Vard Electro for implementation of battery technology to reduce green house gas emissions

| July 13, 2021 | Energy | Alternative | Maritime | Technology

Vard Electro has announced the award of the contract for an innovative hybrid battery power system with Atlantic Towing to be integrated on their vessel Atlantic Shrike. Atlantic Towing is the first company to implement this multiple mode application of battery technologies on a single vessel in the Canadian Offshore Oil and Gas Industry.

KR signs MOU with Hyundai Motors and Hyundai Global Services

| July 13, 2021 | Energy | Alternative | Maritime | Technology

Air France KLM Martinair Cargo welcomes five Chinese partners to its SAF program

| July 13, 2021 | Air Cargo | Freighters | Energy

AWOT, CTS, Jobmate, Sinotrans and SuperTrans have joined the Sustainable Aviation Fuel Program (SAF Program) of Air France KLM Martinair Cargo (AFKLMP Cargo), offering greener cargo services on routes connecting China with Europe and South America.

US crude oil production efficiency increased only in the Bakken region in 2020

| July 13, 2021 | Energy

In 2020, U.S. initial crude oil production per well, or well production efficiency, increased significantly in the Bakken region, according to our Drilling Productivity Report (DPR), which we update monthly. Productivity in other drilling regions remained largely steady or decreased slightly, DPR data shows.

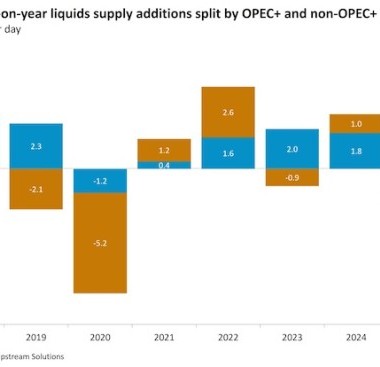

World’s recoverable oil now seen 9% slimmer; commercial volumes can keep global warming below 1.8˚C

| July 13, 2021 | Energy

Every year and following the publication of the BP Statistical Review, Rystad Energy releases its own assessment to provide an independent, solid and clear comparison of how the world’s energy landscape changed last year.

World’s biggest green energy hub proposed for Western Australia

| July 13, 2021 | Energy | Alternative

The world’s largest renewables project has been proposed in Western Australia, covering an area half the size of Belgium.

Kuwait looks to gas imports as Gulf states aim to burn less oil

| July 13, 2021 | Energy

Reliance considers bid for India’s solar incentives in green push

| July 13, 2021 | Energy | Alternative

China’s crude imports climb as refiners emerge from maintenance

| July 13, 2021 | Energy

Orkim tankers take to water with COMPAC

| July 12, 2021 | Energy

China’s Fujian Southeast Shipyard has delivered four in a series of five new product tankers ordered by Malaysia’s Orkim Sdn Bhd.

US airlines May 2021 fuel use up 9.4% from April

| July 12, 2021 | Air Cargo | Airlines | Energy

The Department of Transportation’s Bureau of Transportation Statistics (BTS) today released U.S. airlines’ May Fuel Cost and Consumption numbers.

EIA product highlight: Southern California Daily Energy Report

| July 12, 2021 | Energy

We provide daily information on the Southern California energy market in our Southern California Daily Energy Report, which uses several of our data sources as well as third-party information from sources such as the Southern California Gas Company (SoCalGas), the California Independent System Operator (CAISO), and the National Oceanic and Atmospheric Administration.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved