Grain markets catapulted even higher as Russia’s attack on Ukraine put a vital source of global supplies at risk.

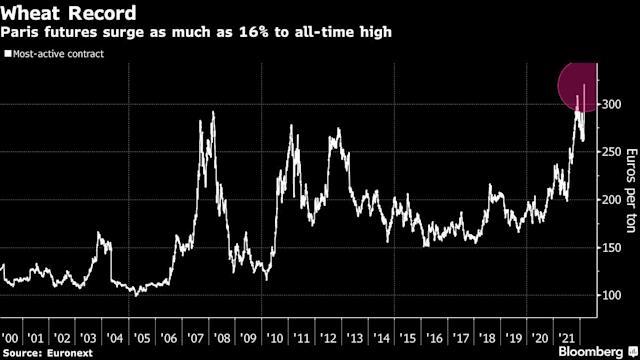

Wheat surged by the maximum allowed by the exchange, and corn earlier did the same before paring gains. Milling wheat traded in Paris soared as much as 16% to a record, heightening concerns of a further acceleration in global food inflation.

Russia launched a barrage of missile, artillery and air attacks early Thursday, triggering the worst security crisis Europe has witnessed in decades. Ukrainian sea ports closed, according to the presidential office, throwing commodity exports into chaos. Top wheat buyer Egypt, which mostly gets supplies from the Black Sea area, was forced to cancel its latest tender to import the grain.

“This is your stereotypical black swan event that we never expect,” said Karl Setzer, an analyst at AgriVisor LLC. “You don’t think of military action impacting the U.S. markets, but this shows just how volatile trade has become.”

The conflict leaves major crop importers particularly vulnerable, with Ukraine and Russia supplying a vast array of countries spanning Asia to the Middle East to Africa. On Thursday, Egypt canceled its wheat tender after drawing a lone offer—of French grain. It had been flooded with participants in another tender just a week earlier.

The world’s biggest crop traders are shutting down in the region. Bunge Ltd. suspended operations at two oilseed processing facilities in Ukraine and closed its local offices due to military action in the country, according to an emailed statement. Archer-Daniels-Midland Co. closed an oilseed crushing plant in Chornomorsk, a grain terminal in the port of Odessa, six silos and its trading office in Kyiv.

Ukraine still has about 6 million tons of wheat and 15 million tons of corn left to ship this season, said Michael Magdovitz, senior analyst at Rabobank in London. While buyers can turn to other origins like the U.S. and European Union, its role in the market is “irreplaceable,” he said.

In addition to the crisis, drought in South America has dimmed the outlook for soybean supplies, sending futures to a nine-year high. Palm oil, which is used in thousands of products from cookies to shampoo, is on a record-breaking run as a labor shortage crimps output in major producer Malaysia.

That could feed through to higher prices at grocery stores as everything from pasta to chocolate becomes more expensive to produce, further squeezing household budgets. A measure of global food costs calculated by the United Nations approached a record in January.

Ukraine and Russia account for more than a quarter of the global trade in wheat and about a fifth of corn sales and 80% of sunflower oil exports.

Benchmark soft red winter wheat in Chicago settled up 5.7% at the exchange’s limit to $9.3475 a bushel. Prices are at a nine-year high. Hard red winter wheat touched the highest price since April 2011. Corn closed up 1.3% to $6.9025, after rising as much as 5.1%, touching the highest price since May. Soybeans and soybean meal fell. The pullback was driven in part by China’s confirmation that it will allow wheat imports from all of Russia Thursday, cutting into projected demand for U.S. product, said Setzer.

Exacerbating the inflation outlook is the surging cost of fertilizer. The market is already feeling the pinch due to reduced potash supplies from Belarus after U.S. sanctions, and any reduction of crop-nutrient exports from Russia will fuel the squeeze. Farmers scaling back use of the minerals may trigger lower crop yields, adding to supply concerns.

There are signs that China, the world’s top importer of agricultural products, is concerned about the rally. Beijing announced this week that it would sell edible oil and soybeans from state reserves to boost supply on the domestic market. The Dalian exchange will also raise margin requirements for some corn and soybean meal futures contracts in a bid to cool speculation.

“Thursday’s rally in agricultural commodities is purely triggered by the Russia-Ukraine conflict,” said Gnanasekar Thiagarajan, head of trading and hedging strategies at Kaleesuwari Intercontinental. “Prices could jump further before witnessing a sharp correction in the coming weeks.”