China’s exports jumped at the start of the year, offering an early, positive signal for recovering global demand as the world’s second-largest economy contends with trade curbs and geopolitical tensions.

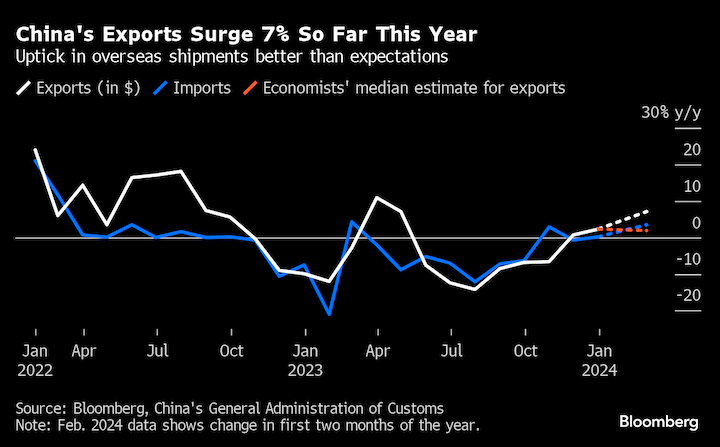

Overseas shipments in US dollar terms rose 7.1% in the January-February period from a year earlier, well above economist forecasts and significantly higher than December’s gain. The trade surplus reached a record $125 billion, while imports grew 3.5%.

“China is moving up the value chain,” said Zhang Zhiwei, president and chief economist at Pinpoint Asset Management, adding that the data “will likely strengthen policymakers’ confidence in China’s economy.”

China is looking for green shoots in 2024 as authorities target economic growth of around 5%. Some economists have expressed skepticism about that ambitious target absent additional policy support, given ongoing challenges from the property crisis and deflation. This week’s national legislative meeting has been fairly scant on detail about more stimulus, though People’s Bank of China Governor Pan Gongsheng did hint Wednesday at a potential boost to liquidity.

“While stronger demand will not offset domestic pressures around a housing sector slowdown, it will not be a drag in 2024” on China, said Carlos Casanova, senior Asia economist at Union Bancaire Privee in Hong Kong.

China’s trade has suffered in the last year because of weak demand from its major economic partners and mounting sanctions and restrictions on its products. That’s turned a once-key pillar of the economy into a pain point — a problem underscored Thursday, when Foreign Minister Wang Yi blasted the US for imposing a “bewildering” level of trade curbs on the Asian nation.

“If the US is obsessed with suppressing China, it will eventually harm itself,” Wang said at a press briefing in Beijing, warning Washington against trying to keep his country at the bottom of the value chain.

What Bloomberg Economics Says ...

“China’s stronger-than-expected exports in the first two months of 2024 point to some support for the economy. But external demand is unlikely to be a reliable crutch for growth, given the slowing global economy and elevated geopolitical risks. Base effects will also turn less favorable in coming months — tugging down export growth.”

— Eric Zhu, economist

Wang’s remarks dampened the mood for investors, with the benchmark CSI 300 Index down 0.5% in afternoon trading after having risen as much as 0.5% in the morning session. WuXi AppTec Co. was the biggest loser in China and Hong Kong, plunging after a US Senate committee advanced a bill targeting Chinese biotech firms.

Reaction elsewhere was muted, with yields on the 10-year note rising one basis point to 2.28%. The onshore and offshore yuan traded steady.

Trade data for the first two months of the year is typically combined to avoid distortions from the Lunar New Year holiday.

The value of Chinese goods has also been dragged down by persistent deflationary pressures, adding to the challenges. An index of export prices in October hit the lowest in data going back to 2006. Last year, the exports posted their first full-year decline since 2016.

The gloomy outlook appeared to cloud any immediate positivity around Thursday’s data. Michelle Lam, Greater China economist at Societe Generale SA, cited concerns about “the diversification of the global supply chains amid heightened geopolitical tensions, which may weigh on China’s export market share.”

At a Wednesday briefing in Beijing on the sidelines of the National People’s Congress, Commerce Minister Wang Wentao told reporters that China still sees “a very grim outlook for trade this year” because of declining demand overseas.

He did stress other positive signals, though, including the value chain improvements.

One factor now helping China’s exports is the strong performance of Chinese carmakers in the global market, according to Zhang. BYD Co. recently toppled Tesla Inc. to become the new No. 1 in electric vehicles after record deliveries in the December quarter, and is looking to expand its reach: The company just launched its third electric car in India.

China’s big annual policy report this week underscored the importance of electric cars and other new growth drivers for the economy, while President Xi Jinping touted the need for “new productive forces” to boost the economy. There are still some headwinds China must navigate, though, with some Western governments pushing back against China’s inroads in their markets.