China slashed its fuel export quota by more than half in the first batch of allocations for 2022, highlighting the nation’s strategy of progressively limiting overseas sales.

A total of 13 million tons were issued, including both general trade and tolling issuances, according to refinery officials who have direct knowledge of the matter. That’s 56% less than 29.5 million tons in the same batch for 2021. Last year, the overall fuel export quota was 36% lower than in 2020. The Ministry of Commerce didn’t immediately reply to a fax seeking comment.

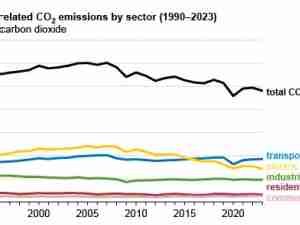

The world’s biggest oil importer has been slow giving out this year’s crude import and fuel export quotas amid a slew of challenges. Complex tax investigations of some refiners, rising competition between private and state-owned firms, and the uncertainty caused by the pandemic caused the delays, according to several traders. Beijing is also thought to be considering limiting both the import and export allowances to cut carbon emissions, they said.

“Looks like this year’s total fuel export quota will keep declining,” said Yuntao Liu, analyst with Energy Aspects Ltd., adding that a smaller issuance may boost competition between state refiners and independents.

Traditional teapots just received a reduction in their crude oil import quota for 2022 last week.

Of the general-trade allocations, Zhejiang Petroleum & Chemical Co. received 1.34 million tons of compared with 2 million tons in the first batch 2021, while Sinopec saw the largest cut, getting 2.71 million tons of general-trade quota versus 9.67 million tons last year. Separately, refiners got 6.5 million tons of low-sulfur bunker fuel export quota, 30% more than the same period in 2021.

There’s speculation that China may eliminate product exports by 2025. Should that happen, Asian fuel exporters—in Northeast Asia, Singapore, Malaysia and Brunei—stand to benefit as regional margins will have to rise to make up for lost Chinese barrels, according to a previous estimate by Energy Aspects.

_-_28de80_-_939128c573a41e7660e286f3686f2a6e25686350_yes.jpg)