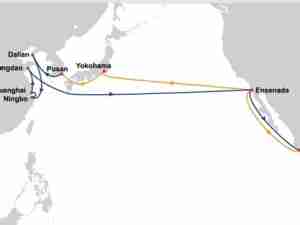

The forward contracts are based on shipping rates for the China-Western America route and the China-Europe route, it said on its website.

The contracts have began trading with the most active Europe route contract opening at $886 per 20-foot equivalent unit, and the U.S. route opening at $1,658 per 40-foot equivalent unit.

The SSEFC said each route will have maturing periods beginning from July until December. Trading margins were set at 10 percent.

"We are positive towards the volume being concluded and we hope that liquidity will improve over time," said a freight trader.

The Shanghai freight index is based on quotations from shipping companies as well as cargo brokerage firms on 15 major routes leaving Shanghai, home to the world's largest container port.

Freight derivatives or FFAs allow a buyer to take a position on where freight rates will stand at a point in the future. Container contracts offer the same hedging principle as those traded for dry bulk and tanker markets.

Singapore Exchange and LCH.Clearnet last year launched clearing services for over-the-counter container freight derivatives to enable companies to hedge against volatile freight rates.

Maersk Line and other leading shipping companies have opposed the expansion of the container freight swap agreement market, saying it creates more uncertainty and does not accurately reflect rates.

"We, as Maersk Line, have no need for the derivative market," Eivind Kolding, chief executive of Maersk Line, told a news conference in Singapore.

"It is really the wrong direction for this industry. If our customer has a need for more security, we would be very happy to engage with that customer and we can make a long term contract for them." (Reuters)