China’s military drills after US House Speaker Nancy Pelosi visited Taiwan sparked alarm around the region, although its trade retaliation barely made a dent -- mostly because Beijing doesn’t want to hurt itself.

The value of trade targeted by China’s sanctions contributes a tiny amount of less than 1% to Taiwan’s gross domestic product, according to economists, taking the sting out of China’s announcements. Beijing could ramp up actions by targeting more food products, wood or minerals. But levies on any big-ticket items that would cause real damage to Taipei -- such as semiconductors -- are near-unthinkable, given China’s reliance on the island for cutting-edge technology.

“The chance remains relatively low” for China to target Taiwanese tech, said Ma Tieying, an economist at DBS Group Holdings Ltd. “If you look at Taiwan’s role in global semiconductor supply, it’s very much dominant. It would be very difficult for China to find the alternative supply if it bans the Taiwan-made semiconductors.”

Beijing still has a few tools it could deploy to pressure Taipei. China and Hong Kong account for around 40% of Taiwan’s total exports, though Taipei has made efforts to reduce its economic dependence on China in recent years. More restrictions would be an economic headache for Taiwan, which is already grappling with slowing global demand for electronics and high inflation, cooling its growth outlook.

Here’s a look at what China has already targeted and how likely more measures against Taiwan are:

Trade Sanctions

The trade sanctions Beijing has already inflicted this month are expected to have a marginal impact on Taipei. Food accounts for just 0.4% of cross-strait trade, Goldman Sachs Group Inc. economists wrote in a research note last week. In all, bilateral trade between the two economies reached $328.3 billion last year.

The recent restrictions impacting citrus fruits and some fish exports might have an impact of less than 0.1% on Taiwan’s GDP, the Goldman economists said.

There’s also evidence of other tension, including Chinese customs data that show Beijing has blocked other food imports, though it’s not clear when those suspensions happened.

If China wants to mitigate the fallout of sanctions on its own economy, it could target Taiwanese wood, minerals, shoes or hats. Taiwan’s trade relies significantly more on delivering those items to China than China does on receiving them from the island, according to a DBS report.

China would also have an easier time finding alternative sources for those products, according to DBS. For instance, one-fifth of Taiwanese wood is exported to China, but these comprise only some 0.1% of China’s total wood imports. Other countries where China imports wood from include Russia, the US and Australia.

China could also restrict more of its own exports to Taiwan, as it did with natural sand. There’s some historical precedent for doing so, as Beijing previously halted sand exports in 2007 for about a year, citing environmental concerns. Taiwan, though, has reduced its reliance on China in that area since that ban more than a decade ago, according to economists at JPMorgan Chase & Co., who called the most recent restrictions “mainly symbolic.”

Technological Power

It’s unsurprising that technology is at the heart of trade across the Taiwan Strait, comprising nearly 70% of Taiwan’s total exports to China.

Taiwan is known as the world’s leading supplier of semiconductors, thanks to the outsized dominance of Taiwan Semiconductor Manufacturing Co., which on its own accounts for around half of the global foundry market. It would be very difficult for China to find an alternative supplier if it bars chips imports from Taiwan, particularly for the most advanced 5-nanometer and 7-nanometer chips.

China and other major countries, including the US and Japan, have sought to boost domestic investments in semiconductors and to entice companies like TSMC to build plants in their countries, in part to ease the geopolitical risks of potential disruptions to Taiwan’s supply of chips.

Chinese chip-makers such as Semiconductor Manufacturing International Corp. have also had to contend with US sanctions and tightening export restrictions as Washington tries to curb Beijing’s chip ambitions. While homegrown firms in China have made strides in producing advanced chips, industry experts say they remain several years behind TSMC’s standards, meaning the Taiwanese firm remains a key resource for China.

Investment Ties

There are other ways in which the two economies are intertwined aside from trade across the Taiwan Strait.

Many of Taiwan’s major electronic firms have production bases inside of China, including Hon Hai Precision Industry Co., which is the main iPhone assembler for Apple Inc. The company, also called Foxconn, was at one point known as the largest private employer in China, with ambitions to expand to more than a million workers. The company’s plant in Zhengzhou alone employs some 200,000 workers, according to a report earlier this year in the local Henan Daily newspaper.

That could make moves by Beijing to crack down on Taiwanese firms like Foxconn difficult to pull off without impacting those companies’ contributions to the local economy.

Tourism is another avenue that China could target. The effects might be limited, though, as China had restricted visas for its citizens to travel to Taiwan before the Covid shutdown. Tsai’s government, meanwhile, has policies encouraging tourism and travel from other regions, including Southeast Asia.

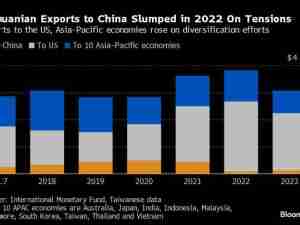

Taiwan has been looking to diminish its dependence on China in recent years, with Tsai exploring ways to bolster trade and investment with Southeast Asia, India, Australia and New Zealand. Taipei last year asked to join Asia-Pacific’s biggest working trade deal, though its application is still pending.

Supply Chains

Actions against Taiwan by China -- such as more military drills -- could also impact supply routes in the Taiwan Strait, which is one of the world’s busiest shipping lanes. Almost half of the global container fleet and 88% of the world’s largest ships by tonnage passed through the waterway this year, according to data compiled by Bloomberg.

More aggressive actions in the strait, though, could have more of an impact on trade routes involving Chinese ports than Taiwanese ones. The recent Chinese military exercises have had limited impact on container shipping in the Taiwan Strait, beyond some divergence of vessels away from specified military exclusion zones, said Tan Hua Joo, a consultant at the container analysis firm Linerlytica. While access to Taiwanese ports is not dependent on passage through the strait, he added, entry to ports in Hong Kong and northern China often are.

“If there’s full-blown military action, that would be a completely different story,” he said. “But given the experience in the last two weeks, I think its quite clear that China has no intention of blocking the trade routes because its own trade volumes would also be affected if there was any vessel transit restrictions.”

Economists also suspect Beijing could take steps to restrict more trade in the second half of 2022, given that President Xi Jinping may want to bolster his power ahead of a Communist Party Congress later this year, when he is expected to secure a historic third term in office. Beijing claims the self-governed island as its own territory, and has made unification a top strategic priority.

“China may broaden the trade restriction measures in the coming months or quarters,” Ma from DBS said. “Given the very busy political calendar going forward, I think it’s possible that the tensions between Beijing and Taipei may escalate gradually going forward.”