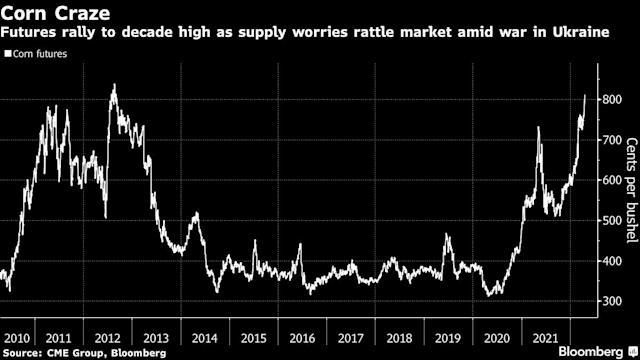

Chicago corn steadied at a decade high, and Paris wheat approached a record as the war in Ukraine curtails its grain sales and weather hampers crops elsewhere.

Ukraine’s president said Russian forces had begun a new campaign to conquer the Donbas region in the east. The crisis has obstructed shipments from the Black Sea region, a major hub of corn and wheat exports.

That’s heightened attention over the status of other exporters’ crops, which are being sown or in the midst of their growing season. Early U.S. corn plantings are trailing the average pace, and wheat conditions are waning as drought grips the Plains. Plus, parts of Brazil’s winter-corn region are adversely dry.

“It is as much the logistical flows as the balance sheets that are currently driving the markets,” Paris-based adviser Agritel said in a note.

Corn futures on the Chicago Board of Trade rose as much as 0.9% to $8.14 a bushel, their highest since September 2012, before paring gains to trade slightly lower.

Ukraine is ramping up crop shipments by rail given that most of its seaports are closed. Still, cars are facing multiweek logjams at the border as the infrastructure isn’t sufficient for the increase in traffic, according to analyst UkrAgroConsult.

Moreover, a third of the country’s farmland could go unharvested or unsown this year amid the war, the United Nations estimates.

Wheat futures on the Chicago exchange also eased near a recent peak, while the Paris contract climbed 1.1% to 406.50 euros ($438.76) per ton. That’s near its all-time high set in early March.

Wintry conditions in Canada threaten to slow wheat plantings, and the condition of the U.S. crop has worsened. The share of its winter wheat in good or excellent shape slipped to 30% in the week to April 17, the worst for this time of year in at least two decades.

“Weather forecasters offer little scope for that crop decline to be arrested,” said Tobin Gorey, a strategist at the Commonwealth Bank of Australia.