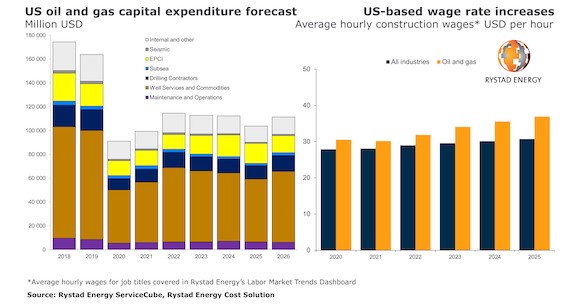

Supply chain costs are set to increase for oil and gas projects in the US in coming years, with the engineering, procurement, construction and installation (EPCI) segment being the first to record a double-digit percentage hike in costs, a Rystad Energy report forecasts. EPCI costs, mostly driven by climbing wages and material costs, are set to gain about 10% in 2023 from current levels.

As a result, US capital expenditure on EPCI in 2023 is expected to end at $15.5 billion, some $1.4 billion higher than where it would be under the current cost status quo. Higher expected construction wages account for about $1 billion of that extra cost, with the remaining $400 million coming mostly from the rising cost of bulk materials in addition to engineering labor.

This year’s EPCI capex is estimated at $12.6 billion, which means the segment is poised for a significant spending increase in 2023, irrespective of the cost rise – and the figure will climb even further in 2024 to $18.0 billion.

Other supply segments will also see higher costs in 2023, albeit not at the rate of EPCI. Subsea supply costs are expected to rise by 8% from 2021, maintenance and operations by 7%, drilling contractors by 6% and seismic by 5%.

Overall, our projections indicate that US oil and gas capital expenditure will rebound from a Covid-19-induced low of $91.0 billion in 2020 and an expected $99.3 billion this year to over $112.7 billion in 2023 and 2024. Concurrently, EPCI expenditure is expected to experience robust growth, peaking at $18 billion in 2024, up 50% from last year’s $12 billion.

Although the current trend of high oil prices indicates a more favorable economic outlook, the growth of EPCI costs is a cause for concern in the near term. Costs are expected to rise even further after 2023, with drilling contractor and subsea cost increases becoming the prime headache for oil and gas operators.

_-_28de80_-_939128c573a41e7660e286f3686f2a6e25686350_yes.jpg)